- Most Germans raised privacy concerns over their refusal to adopt the European Central Bank’s (ECB) digital euro.

- A study revealed that most people in Germany still preferred cash for their transactions.

The Germans’ Initial Interest in Digital Euro

In April, Deutsche Bundesbank commissioned forsa to conduct a survey determining public sentiment toward the potential adoption of the digital euro. Half of the 2,012 respondents in the poll were receptive to the idea of using the central bank digital currency (CBDC) for payments.

Even people without prior knowledge of the digital euro expressed interest in the matter. However, more than three-quarters of the participants raised privacy concerns over the use of CBDC.

Fast-forward to the present, trends reveal that most Germans still prefer cash than their digital equivalents.

Cash is Still King in Germany

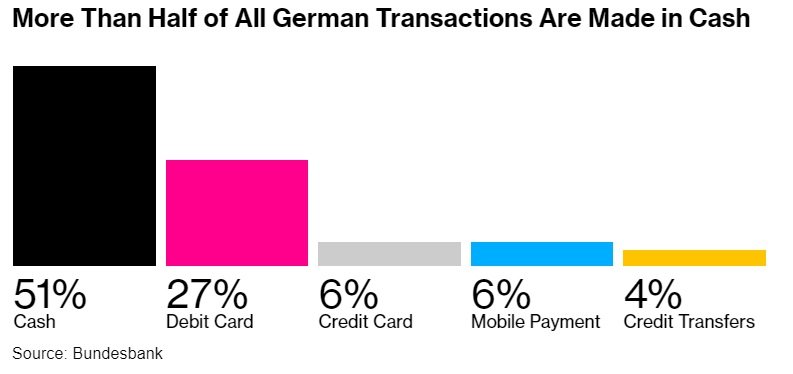

Bloomberg, citing a related Bundesbank study, claimed more than half of Germany’s transactions were still settled in cash. Breaking down the numbers, 51% German respondents reflected the sentiment.

Debit card transactions only made up 27% of the consensus preference, while credit card and mobile payments accounted for 6% each. Meanwhile, only 4% favored credit transfers.

The majority’s apprehension of alternatives to cash payments stemmed from the older demographic’s reluctance to provide their personal data online. A third of respondents above 65 years old primarily brought up concerns over privacy as a reason for their refusal to utilize digital payment platforms.

Nevertheless, Bundesbank President Joachim Nagel has been constantly reminding people that “cash will not disappear” after the rollout of the digital euro. ECB President Christine Lagarde added that the CBDC will only serve as the digital form of cash, and it will coexist together with its physical version.

Opposition in the Bundestag

Within the side of the opposition, Bundestag member Joana Cotar seemed to have established herself as the most vocal critic of a euro-based CBDC. The Bitcoin (BTC) advocate suspected that there’s likely more to the ECB’s digital euro agenda.

Cotar shared the same cautious sentiment as the majority of Bundesbank’s respondents. According to the member of the German Parliament, the digital euro is not just “about another means of payment.” For her, it’s a means to spy and control the populace.

The politician urged her colleagues to study the potential use of Bitcoin as a national reserve instead. She pointed out that such a measure would allow Germany to diversify its treasury assets while reinforcing itself against the negative effects of inflation.