DXY is bottoming again.

The Australian dollar has been trading a solid up channel. But at the lows it risks breaking.

Lead boots are going nowhere.

Advertisement

Gold is stuck, oil bouncing on Russia risk.

Metals mania is caput.

Big mining bear fully intact.

Advertisement

EM toppy.

Junk is all blue skies.

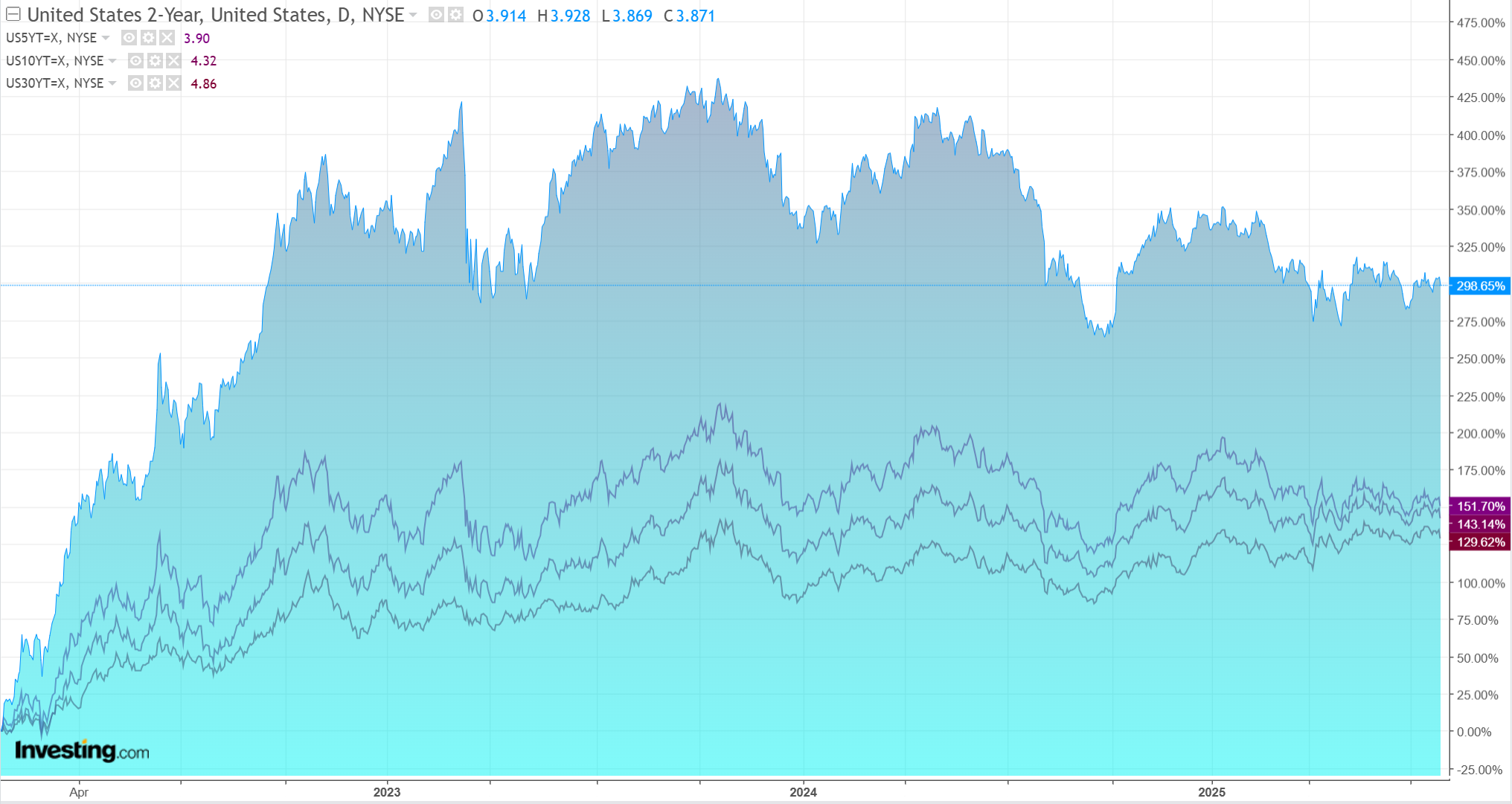

Yields quiescent.

Advertisement

Stocks faded.

There is a lot of event risk this week with China’s Poliburo likely to meet, the Fed meeting, Aussie CPI, Treasury funding and US jobs.

Then we have converging deadlines around trade extensions and Russian peace deals.

Advertisement

Stocks are priced beyond perfection, and we are entering August, volatility season.

It is no wonder that the AUD has turned volatile. Credit Acricole fleshes it out.

While US bilateral trade deals with its major trading partners are starting to fall into place boosting investor sentiment and the AUD, we note that these deals are also a positive for the USD as they reduce US stagflation risk.

Advertisement

This dynamic is weighing onAUD/USD at present.

Another factor that has been supportive of the AUD of late, however, has been the RBA turning less dovish starting with its surprise on-hold decision at its July meeting. RBA Governor Michele Bullock also cautioned recently that a rate cut in August is not a done deal saying that the RBA’s preferred measure of core inflation could remain sticky to the upside and that the market had overreacted to the recent jump in the unemployment rate.

The coming two days will determine whether the RBA cuts in August and the extent of follow-up rate cuts.

Australia’s Q2 reading of inflation on Wednesday will be followed on Thursday by a public appearance by RBA Deputy Governor Andrew Hauser.

As the RBA demonstrated by staying on hold in July, it remains concerned about a resurgence in inflation and wants to see a definitive fall in inflation before cutting rates further.

With the market still heavily priced for rate cuts, the risks for Australian rates and the AUD are skewed more towards a higher print.

The consensus forecast is for headline readings of 0.8% QoQ and 2.2% YoY and trimmed mean readings of 0.7% QoQ and 2.7% YoY, both further modest decelerations and 10bp above the RBA’s May SMP forecasts in YoY terms.

Investors are thinking the central bank will lean more towards its full employment than price stability mandate in the coming months and such outcomes would keep the market priced for a rate cut in July.

I agree with the market that the RBA is likely to ease further.

As for AUD, increasingly, it’s a wait and see.