- AUD/USD added to Friday’s advance past the 0.6500 barrier on Monday.

- The US Dollar gathered pace following Friday’s comments from Chief Powell.

- Markets’ attention will be on the release of the RBA Minutes early on Tuesday.

The Australian Dollar (AUD) stayed on the positive side on Monday, with AUD/USD building on Friday’s gains and reclaiming the 0.6500 hurdle and beyond in quite an auspicious start to the new trading week.

The pair’s second daily advance in a row came despite the resurgence of the upside impulse in the US Dollar (USD) and the generalised offered bias in the broader risk-associated universe.

Inflation: Cooling, but slowly

Australia’s inflation story is softening, though progress is modest. Second-quarter Consumer Price Index (CPI) rose 0.7% QoQ and 2.1% on a yearly basis, while June’s Monthly CPI Indicator edged down to 1.9%. Prices are easing, but only in small steps.

The economy: Signs of resilience

Other parts of the economy look sturdier. Early August PMIs data showed manufacturing climbing above the 50 threshold to 52.9, services improving to 55.1, and retail sales jumping 1.2% in June. Trade also chipped in, with the surplus widening sharply to A$5.365 billion from A$1.604 billion in May.

The labour market remains tight. July unemployment dipped to 4.2%, with 24.5Kjobs added and participation steady at 67%.

Reserve Bank of Australia: Cautious hands on the wheel

The Reserve Bank of Australia (RBA) cut its Official Cash Rate (OCR) by 25 basis points earlier this month to 3.60%, in line with expectations. It also trimmed its growth outlook for 2025 to 1.7% from 2.1% and nudged its end-2026 cash rate forecast down to 2.9% from 3.2%, citing global headwinds. Projections for unemployment (4.3%) and core inflation (2.6%) at end-2025 were left unchanged.

Governor Michele Bullock resisted calls for a larger half-point cut, stressing that policy is “data-dependent, not data-point dependent.” Markets now see another 25-basis-point move by the November 5 meeting.

Markets have now shifted their focus to the upcoming publication of the RBA Minutes, which could shed further light on the decision.

China: The decisive variable

China’s outlook remains mixed. Q2 GDP came in at 5.2% from a year earlier, industrial output grew 7%, but retail sales once again fell short of the 5% line. Earlier last week, the People’s Bank of China (PboC) kept its one- and five-year Loan Prime Rates (LPR) unchanged at 3.00% and 3.50%, respectively, as widely estimated.

Other data has disappointed: the official manufacturing PMI slipped to 49.3, non-manufacturing eased to 50.1, and Caixin readings painted a similar picture. July trade data showed the surplus narrowing to $98.24 billion, with exports up 7.2% and imports up 4.1%. Inflation barely moved, highlighting lingering deflationary pressure.

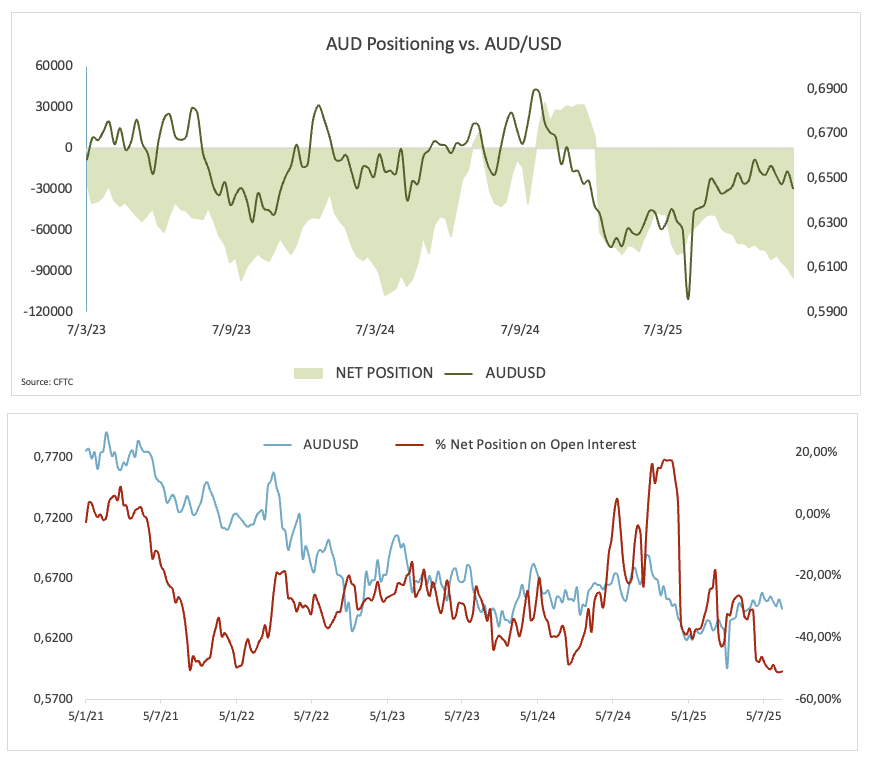

Positioning: Bears in control

Speculators ramped up their bearish bets on the Aussie, with net shorts climbing to nearly 95K contracts, the highest since late April 2024, according to the Commodity Futures Trading Commission (CFTC) data to August 19. Furthermore, open interest also pushed to a two-month peak just under 186K contracts.

Technicals: Range-bound

Initial resistance stands at the 2025 ceiling of 0.6625 (July 24), ahead of the November 2024 high at 0.6687 (November 7). Once the latter is cleared, the psychological 0.7000 mark should return to the radar.

On the other hand, support emerges at the August low of 0.6414 (August 21), preceding the critical 200-day Simple Moving Average (SMA) at 0.6384, and the June trough at 0.6372 (June 23).

Additionally, momentum indicators remain inconclusive: The Relative Strength Index (RSI) has improved to around 51, suggesting potential for extra gains, while the Average Directional Index (ADX) around 17 points to a trend that may be strengthening but still lacks juice.

Outlook: Mired in a range

So far, AUD/USD looks boxed within the 0.6400-0.6600 range. Breaking out of that range will likely need a stronger catalyst in the form of firmer Chinese data, a shift in Federal Reserve (Fed) policy, or new guidance from the RBA.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.