- The Pound Sterling oscillated in a familiar 150-pip range against the US Dollar.

- The focus shifts to the UK inflation and global PMI data for fresh trading impetus.

- GBP/USD is teasing a falling channel on the daily chart; bullish RSI favors an upward resolution.

The Pound Sterling (GBP) regained its footing against the US Dollar (USD) after the GBP/USD pair exhibited strong two-way price movements within a 150-pip range during the week.

Pound Sterling fought back as USD faltered

Following a painful start to the week, the GBP/USD managed to find its footing as the US Dollar lost its recovery momentum in the latter part, with optimism surrounding the US-China trade truce fading.

On Monday, the pair came under intense selling pressure, hitting a one-month low at 1.3140 after the US Dollar rallied hard following the news of the highly anticipated US-China trade truce. Following the weekend’s trade talks in Geneva, both sides agreed that the US would reduce levies on Chinese imports from 145% to 30% during a 90-day negotiation period, and China would lower duties from 125% to 10%.

Receding recession fears and bets that the US Federal Reserve (Fed) could extend the pause on interest rates bolstered the USD recovery. However, traders quickly moved in on Tuesday to cash in on their USD long positions as the US Consumer Price Index (CPI) cooled slightly in April, reviving dovish Fed expectations and sending Wall Street indices soaring. The Greenback fell in the aftermath of US inflation data release, driving the pair back above the 1.3300 threshold.

The Pound Sterling paid little heed to the mixed UK employment data, which showed that the ILO Unemployment Rate ticked up to 4.5% in the three months to March from 4.4%. During the same period, the Employment Change increased by 112,000, compared to 206,000 previously.

Sellers returned on Wednesday as GBP/USD faced rejection again near the 1.3360 region. The pair hit multi-day highs early Wednesday, drawing support from Bank of England (BoE) policymaker Catherine Mann’s comments. Mann noted: “The UK labor market has been more resilient than expected,” adding, “increasing inflation expectations are worrying.”

Optimism over US-South Korea trade talks and expectations of a US-Iran nuclear deal refuelled the US Dollar’s upside, triggering a brief pullback in the major.

In the second half of the week, the Greenback felt the heat of declining US Treasury bond yields. Downside surprises in US economic data this week reinforced bets for more Fed rate cuts this year, weighing on the US Treasury bond yields and the US Dollar.

Headline Retail Sales rose 0.1% month-over-month in April, slightly above expectations of 0% and well below the 1.5% increase seen in March. Meanwhile, the Producer Price Index (PPI) rose 2.4% on a yearly basis in April, compared to the 2.7% increase recorded in March and below the estimated 2.5% print.

The pair also capitalized on UK growth optimism after the latest data showed that the UK economy grew 0.7% in the three months to March 2025, following a 0.1% increase in the final quarter of 2024. The data beat the expected 0.6% rise in the reported period.

The Greenback remained on the defensive against its currency rivals on increased speculation that Washington could be pushing for a weaker US Dollar as part of trade deals with its Asian trading partners.

A South Korean government official reported on Thursday that South Korea’s Deputy Finance Minister Choi Ji-young met with Assistant Secretary for International Finance at the US Treasury, Robert Kaproth, to discuss the Dollar/Won market on May 5.

On Friday, the data from the US showed that the University of Michigan’s Consumer Sentiment Index declined to 50.8 in May from 52.2 in April. The one-year Consumer Inflation Expectation component of the survey rose to 7.3% from 6.5%, allowing the USD to hold its ground heading into the weekend and causing GBP/USD to stretch lower.

Another data-packed week ahead

Pound Sterling traders brace for another action-packed week, filled with top-tier economic data releases from both sides of the Atlantic.

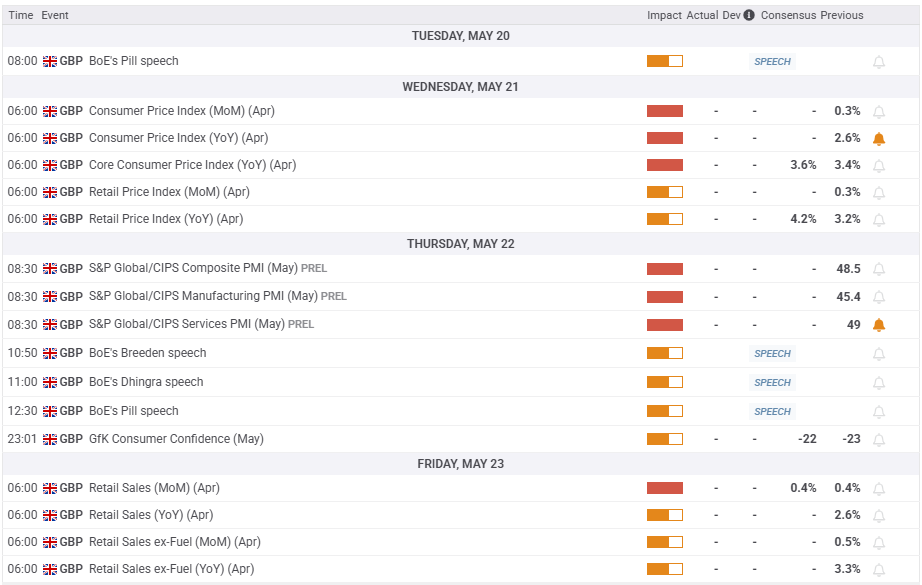

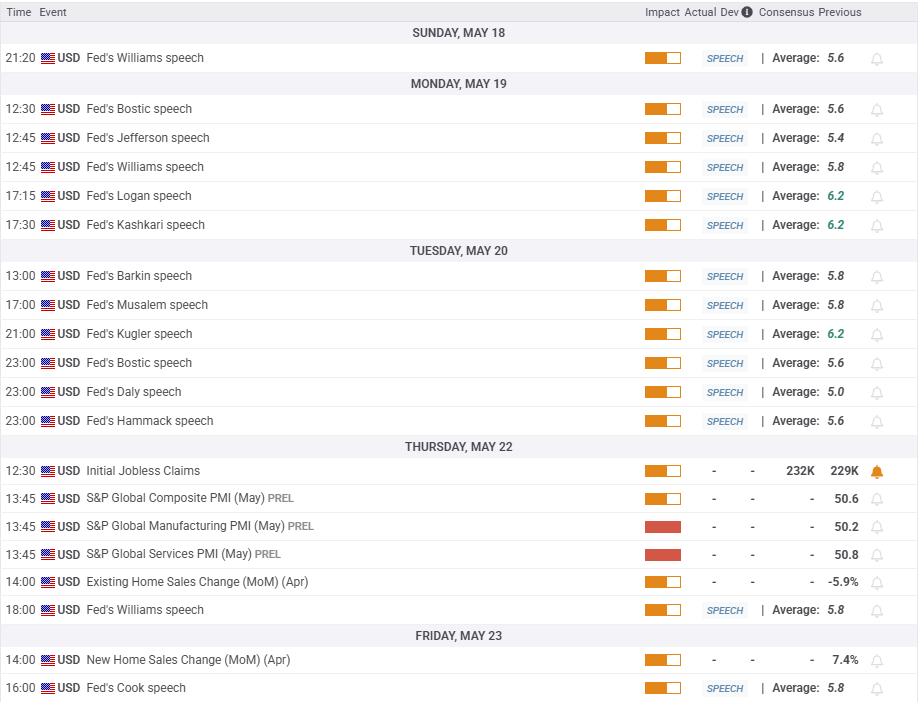

Monday is relatively empty data-wise, but a raft of speeches from the Fed policymakers will make up for it. Tuesday is again light, and hence, attention will remain on BoE Chief Economist Huw Pill’s appearance.

The UK CPI inflation data will stand out on Wednesday, in the absence of high-impact US macro news. Thursday will be the busiest day of the week in terms of data flow, as the S&P Global preliminary Manufacturing and Services PMIS from the UK and the US are due for release.

On Friday, the UK Retail Sales data will be the only relevant data on the cards, while the US New Home Sales will be of interest to American traders.

Other key highlights for the week will likely include trade talks and geopolitical developments surrounding the Israel-Hamas conflict and the Russia-Ukraine situation. Central bank speak will also hold the key in guiding the markets’ pricing of the future rate cuts by the Fed and the BoE.

GBP/USD: Technical Outlook

After reaching a three-year high of 1.3445 on April 28, GBP/USD has been in a steady decline, carving out a falling channel on the daily time frame.

The 14-day Relative Strength Index (RSI) remains above the midline, currently trading near 55, indicating bullish conviction.

If buyers find acceptance above the falling trendline resistance at 1.3390, it will confirm a break to the upside from the channel.

Doors will then open up toward the three-year high of 1.3445. The next topside targets are at the 1.3500 round level and the February 2022 high of 1.3644.

Upon rejection at the aforementioned trendline resistance at 1.3390, the pair could correct toward the May 13 low of 1.3270.

Additional declines will challenge the strong demand area near 1.3115, where the falling trendline support and the 50-day Simple Moving Average (SMA) coincide.

The last line of defense for buyers is aligned at the 1.3050 psychological level.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.