The GBP/USD pair has staged a recovery, trading above 1.2700 after hitting its lowest level since early July near 1.2670. This rebound is driven by an improving risk mood, which is hindering the US dollar from sustaining its strength and aiding the pair in erasing some of its daily losses. Despite broad-based selling pressure on the US dollar on Monday, GBP/USD pair closed the day negatively and continued to decline towards 1.2700 early Tuesday.

Geopolitical tensions have heightened recently, prompting a significant flight to safety at the week’s start. This broad market selloff heavily impacted the USD, yet the risk-sensitive Pound Sterling struggled to attract demand in this risk-averse environment.

Currently, there are no new developments suggesting a de-escalation of the conflict in the Middle East, but investors seem momentarily relieved. As of the latest updates, US stock index futures are up between 0.4% and 0.8%, while the UK’s FTSE 100 Index remains flat. It is noteworthy that US stock index futures were up over 1% earlier in the session, indicating that risk flows might already be losing momentum.

The economic calendar for the day lacks high-tier data releases that could significantly influence the USD’s valuation. Consequently, market participants will closely monitor shifts in risk perception. With the absence of major economic data, any changes in the geopolitical landscape or broader market sentiment could play a crucial role in the pair’s movement.

As traders navigate these conditions, the focus will be on any signs of stabilization or further risk aversion that could affect the GBP/USD pair’s trajectory.

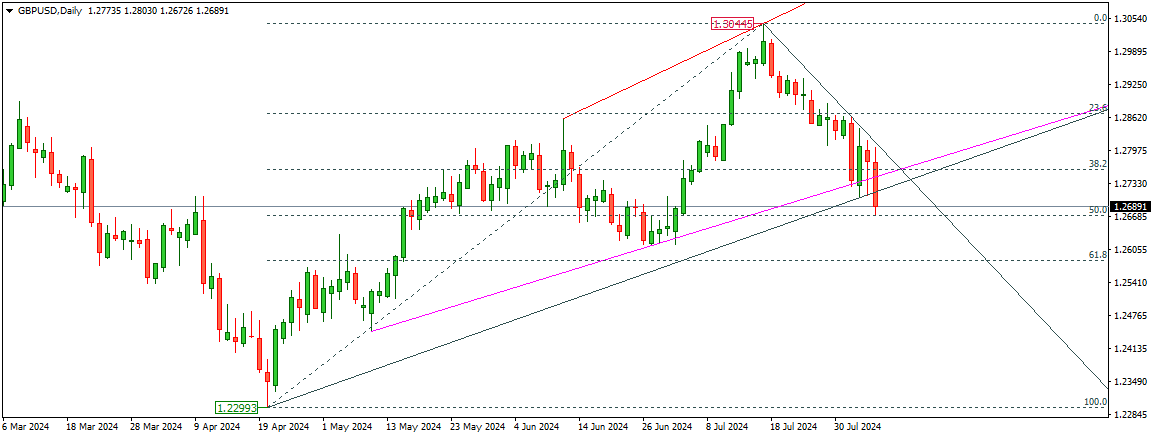

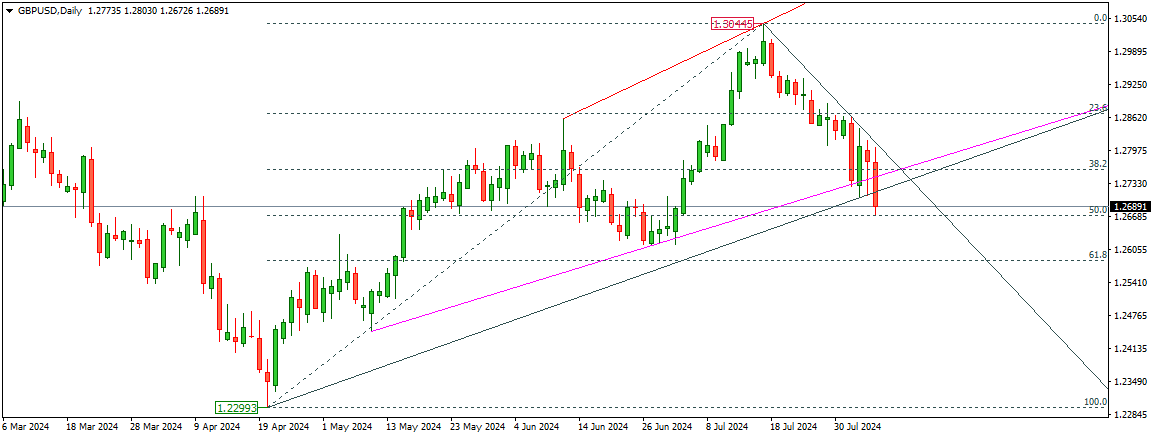

Trade Idea:

Consider buying GBP/USD above 1.2700, targeting 1.2800, with a stop-loss at 1.2650, capitalizing on improved risk sentiment and potential USD weakness.