MUMBAI, July 9 (Reuters) – The jump in open interest on rupee/dollar currency futures on the Singapore Exchange indicates that investors are shifting their arbitrage and hedging activity to the city-state after the Indian central bank imposed restrictions on local currency futures, traders said.

WHY IT’S IMPORTANT

The Reserve Bank of India has been seeking to increase the volume of rupee derivatives traded in the local market relative to offshore, which helps them have more control over the currency.

However, in January, the central bank issued revised rules requiring underlying foreign exchange exposure for transacting in exchange-traded rupee derivatives.

This has had the unintended impact of pushing hedging activity to the Singapore Exchange, going against the RBI’s broader objective.

BY THE NUMBERS

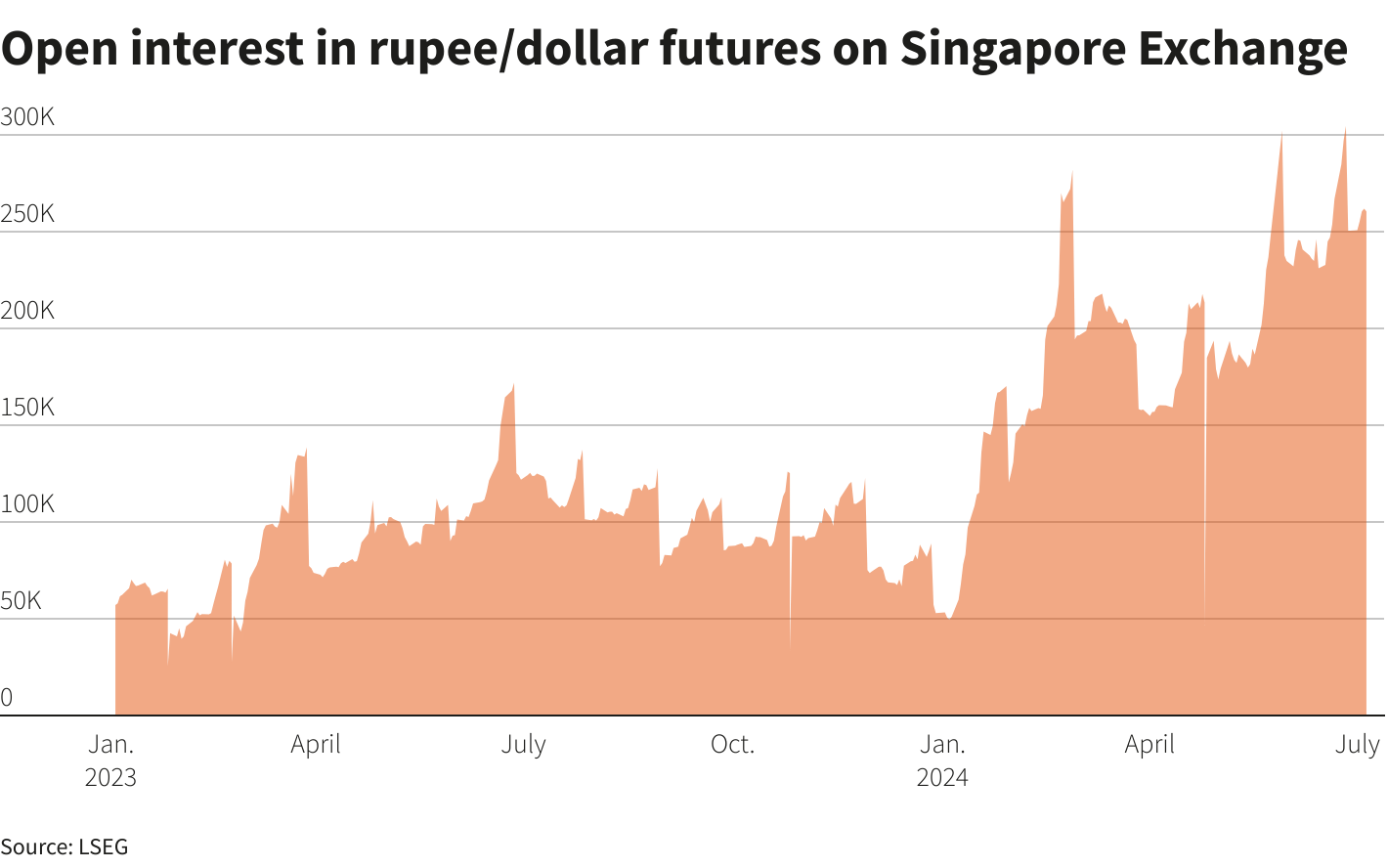

The open interest in rupee/dollar futures on the Singapore Exchange has risen 400% from the start of this year to 268,000 contracts, equivalent to a notional value of nearly $6.5 billion, based on a 7-day average. The average open interest in 2023 was 92,000 contracts.

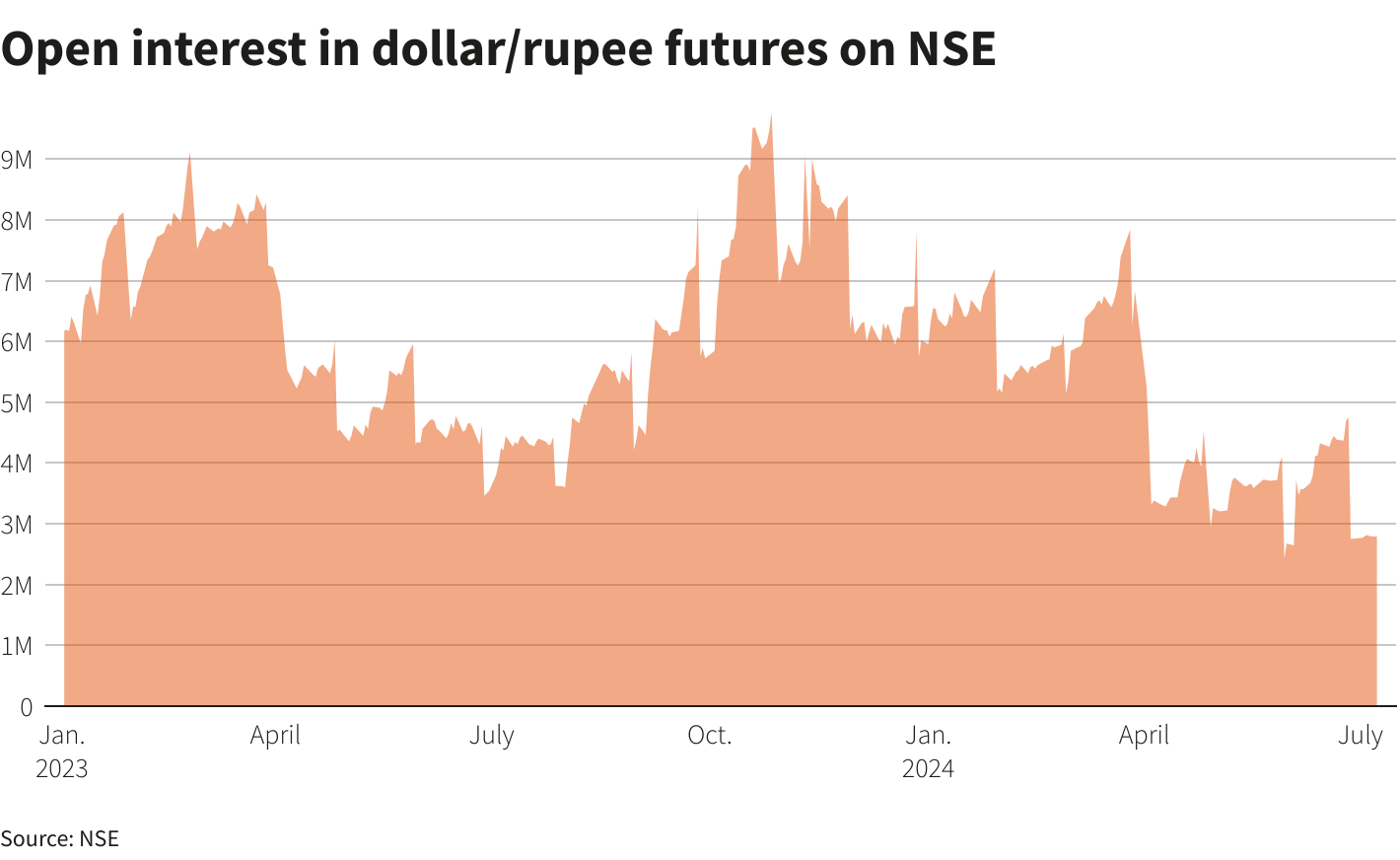

In contrast, open interest on National Stock Exchange of India currency futures has more than halved in the same period to 2.7 million contracts, representing a $2.7 billion notional value.

GRAPHIC

KEY QUOTES

“It’s logical. If you impose conditions on trading in onshore, volumes will move to offshore markets,” Sajal Gupta, executive director and head of forex and commodities at Nuvama Institutional, said.

Foreign portfolio investors, particularly the small-ticket sized ones, will seek alternatives for hedging their currency risk in India while proprietary traders have been completely shut out from the local market, he said.

The RBI’s hedging rule has helped volumes, a Singapore-based hedge fund analyst said, while pointing out that the margin requirements related to an FX over-the-counter platform were responsible for the increased activity from hedge funds.

Sign up here.

Reporting by Nimesh Vora; Editing by Mrigank Dhaniwala

Our Standards: The Thomson Reuters Trust Principles.