Dollar strengthened broadly overnight, propelled by the extended rally in US Treasury yields. 10-year yield soared to its highest level since late July, breaching 4.2% mark during Asian trading session. The move reflects growing market expectations that Fed’s monetary policy easing will proceed more slowly than initially hoped. Importantly, there is an increasing belief that the terminal rate for this cycle will be higher, as the neutral rate is now generally estimated to exceed pre-pandemic levels.

In addition, some speculations are mounting that 10-year yield could advance toward 5% handle, driven by resurging inflation expectations due to Fed’s measured pace in reducing rates, as well as concerns over escalating US fiscal spending and the associated increase in bond issuance.

Technically, 10 year yield’s break of 38.2% retracement of 4.997n to 3.603 at 4.135 is significant, as it reinforces the case that correction from 4.997 has already completed with three waves down to 3.603. Further rally is now expected as long as 3.995 support holds (or in short 4% mark). Next target is 61.8% retracement at 4.464. While it’s still early to draw any conclusions, decisive break of 4.464 would open the path for a retest of 4.997 high or even resumption of the long-term uptrend.

Overall in the currency markets, Japanese Yen is the worst performer, notably breaking its recent negative correlation with Nikkei Index. Yen is now reacting more sensitively to rising US yields rather than domestic risk aversion. Additionally, Japanese officials appear to be refraining from verbal intervention as USD/JPY breaches the critical 150 mark this time.

Euro is the second weakest currency, followed by the British Pound. Sterling is poised for movements pending comments from BoE Andrew Bailey today, particularly regarding whether he will reaffirm the possibility of adopting a more “activist” approach to rate cuts.

Swiss Franc is following behind Dollar as the second strongest currency of the week so far, with Loonie also showing strength. Australian and New Zealand Dollars are positioned in the middle.

In Asia, at the time of writing, Nikkei is down -1.41%. Hong Kong HSI is up 0.36%. China Shanghai SSE is up 0.53%. Singapore Strait Times is down -0.32%. Japan 10-year JGB yield is up 0.018 at 0.980. Overnight, DOW fell -0.80%. S&P 500 fell -0.18%. NASDAQ rose 0.27%. 10-year yield rose 0.109 to 4.182.

Fed’s Kashkari sees modest rate cuts ahead to neutral

Minneapolis Fed President Neel Kashkari stated at an event overnight that he expects “some more modest cuts” in interest rates over the coming quarters, to bring rates closer to a neutral level. However, Kashkari emphasized that the pace and size of future cuts will be heavily dependent on incoming data.

The concept of a “neutral” rate refers to the point where borrowing costs neither accelerate nor hinder economic growth. According to Kashkari, the economy’s current resilience suggests that the neutral rate may be higher than previously estimated.

However, Kashkari also highlighted a key risk that could alter this outlook. If significant weakness were to emerge in the labor market, Fed might need to lower rates faster than currently anticipated.

“If we saw real evidence that the labor market is weakening quickly, that would tell me, as one policymaker, that maybe we ought to bring down our interest rate more quickly than I currently expect,” he explained.

Fed’s Schmid favors gradual rate cuts, avoid outsized moves

Kansas City Fed President Jeffrey Schmid emphasized a measured approach to monetary policy, stating that while he supports reducing the restrictiveness of current rates, his preference is to “avoid outsized moves.”

“Lowering rates in a gradual fashion would provide time to observe the economy’s reaction to our interest rate adjustments and give us the space to assess at what level interest rates are neither restricting nor boosting the economy,” Schmid explained.

He also highlighted that the neutral rate, the level where interest rates neither stimulate nor restrict economic growth, is likely to be “well above” the levels seen during the pre-pandemic period.

Schmid also warned that aggressive rate cuts could foster an expectation of continued rapid cuts, which could amplify financial market volatility. “My belief is that a cautious and gradual approach to policy adjustments would be best suited for this uncertain environment,” he said.

Fed’s Daly: Rate reductions on track, no signs to change course

San Francisco Fed President Mary Daly stated at a conference that she sees no indications that would prompt a halt in the gradual reduction of interest rates. Daly emphasized that the current rate remains “very tight” for an economy steadily progressing toward 2% target, adding that ” I don’t want to see the labor market go further.”

Reflecting on Fed’s September decision to cut rates by 50bps, Daly noted that it was a “close call” between opting for a half-point or quarter-point reduction. However, she stood firmly behind the larger cut.

Although she did not give clear guidance on the pace of future cuts, Daly affirmed that the Fed would “continue to adjust policy to make sure it fits the economy that we have and the one that’s evolving.”

New Zealand’s exports rise 5.2% yoy in Sep, imports fall -0.9% yoy

New Zealand’s trade balance in September 2024 showed a deficit of NZD -2.1B. Goods exports rose by NZD 246m, or 5.2% yoy, reaching NZD 5.0B. Meanwhile, goods imports fell by NZD -67m, or -0.9% yoy, to NZD 7.1B.

Export data showed mixed performance across key trading partners. Exports to China dropped significantly by NZD -109m (-8.8%), and Japan saw a decline of NZD -22m (-8.2%). Exports to Australia also fell NZD -7m or -0.9%. However, exports to the EUR surged by NZD 183m (67%), while exports to the US also increased by NZD 11m (1.9%).

On the import side, the decline was driven by a significant drop in imports from China, down by NZD -158m (-9.8%). Imports from the US surged, rising NZD 330m (51%), while imports from Australia and the EU saw marginal gains of 0.9% and 1.1% respectively. South Korea’s imports fell by NZD -45m (7.3%).

Looking ahead

UK will release public sector net borrowing in European session. Later in the day, Canada will release IPPI and RMPI.

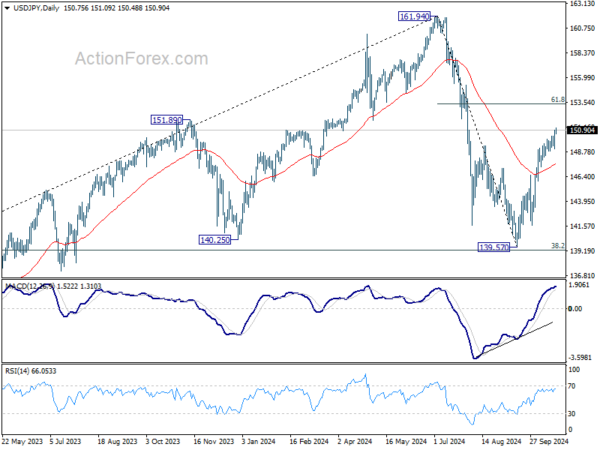

USD/JPY Daily Outlook

Daily Pivots: (S1) 149.66; (P) 150.27; (R1) 151.46; More…

USD/JPY’s rally from 139.57 resumed after brief consolidations, and re-accelerates. Intraday bias is back on the upside for 61.8% retracement of 161.94 to 139.57 at 153.39. On the downside, below 149.08 minor support will turn intraday bias neutral again. But still, further rally is in favor as long as 146.48 resistance turned support holds, in case of retreat.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should now be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.