- EUR/USD faded Friday’s strong rebound and approached 1.1650.

- The US Dollar picked up pace as investors digested Powell’s remarks.

- Germany’s Business Climate unexpectedly improved in August, said IFO.

The Euro (EUR) came under renewed pressure at the beginning of the week, with EUR/USD sliding toward the 1.1650 zone as the US Dollar (USD) staged a marked rebound pari passu with investors’ assessment of Friday’s dovish comments from Chief Jerome Powell at the Jackson Hole Symposium.

Trade tensions cool, but tariffs still bite

Washington and Beijing extended their truce by 90 days in the past, narrowly avoiding fresh tariffs. Indeed, President Trump delayed the hikes until November 10, while China pledged reciprocal steps. Still, tariffs remain steep: 30% on Chinese exports to the US and 10% on US goods heading the other way.

The US and EU also reached a compromise. Washington slapped a 15% tariff on most European imports, while Brussels pledged to remove duties on US industrial goods and give greater access to American farm and seafood products. The US promised to cut its 27.5% tariff on European cars, but only once the EU enacts the needed legislation.

Central banks cautious on the outlook

The Federal Reserve (Fed) kept rates unchanged at its last meeting. Powell’s balanced message contrasted with dovish calls from Governors Christopher Waller and Michelle Bowman, who pushed for cuts but failed to sway the rest of the committee. Policymakers flagged “tough choices” if inflation proved sticky while the labour market weakened.

Still around the Fed and back to Wyoming, Powell left the door open to an interest rate cut as soon as next month’s policy meeting, warning that risks to the job market are increasing even as inflation remains a concern. He also stressed that no decision has been made, putting heavy emphasis on the next set of data. The August NFP report, due September 5, and inflation readings the following week are now seen as critical for shaping the Fed’s path.

At the European Central Bank (ECB), President Christine Lagarde described eurozone growth as “solid, if a little better.” Still, markets expect no rate cut until spring 2026.

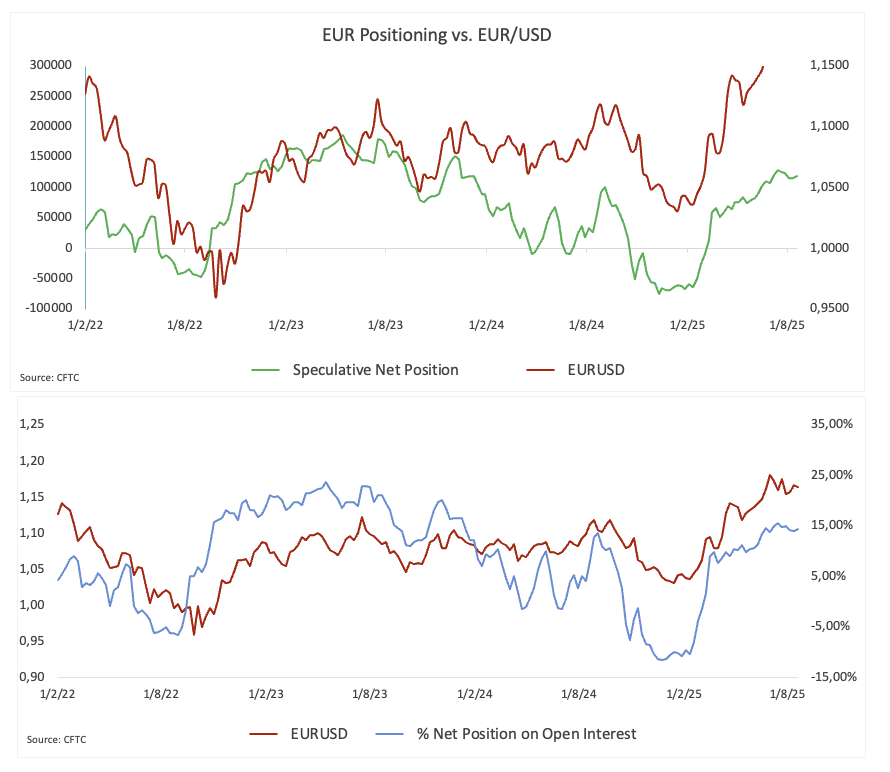

Speculative appetite cools

Euro positioning showed a clear shift last week. Speculative long bets climbed to a three-week high near 118.7K contracts, while institutional players pared back their shorts to a two-week low around 166.4K. in addition, open interest also firmed for a second week in a row, edging up toward 825.2K contracts.

Levels to watch

Resistance lines up at 1.1788 (July 24), prior to the YTD ceiling at 1.1830 (July 1). If the pair clears the latter, it could then embark on a potential visit to the September 2021 high at 1.1909 (September 3), which comes just shy of the 1.2000 threshold.

Southwards, temporary support sits at the 100-day Simple Moving Average (SMA) at 1.1488, followed by the August trough at 1.1391 (August 1) and the May valley at 1.1210 (May 29).

Furthermore, momentum signals remain pale: the Relative Strength Index (RSI) has slipped to nearly 51, pointing to some gains ahead, while the Average Directional Index (ADX) below 11 suggests a directionless trend.

EUR/USD daily chart

Outlook: Dollar keeps the edge

EUR/USD is expected to maintain its range-bound theme for the time being. The next clear driver may come from any shift from the Fed or a fresh change of heart in trade headlines. Until then, the dynamics around the Greenback look set to retain the upper hand.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.