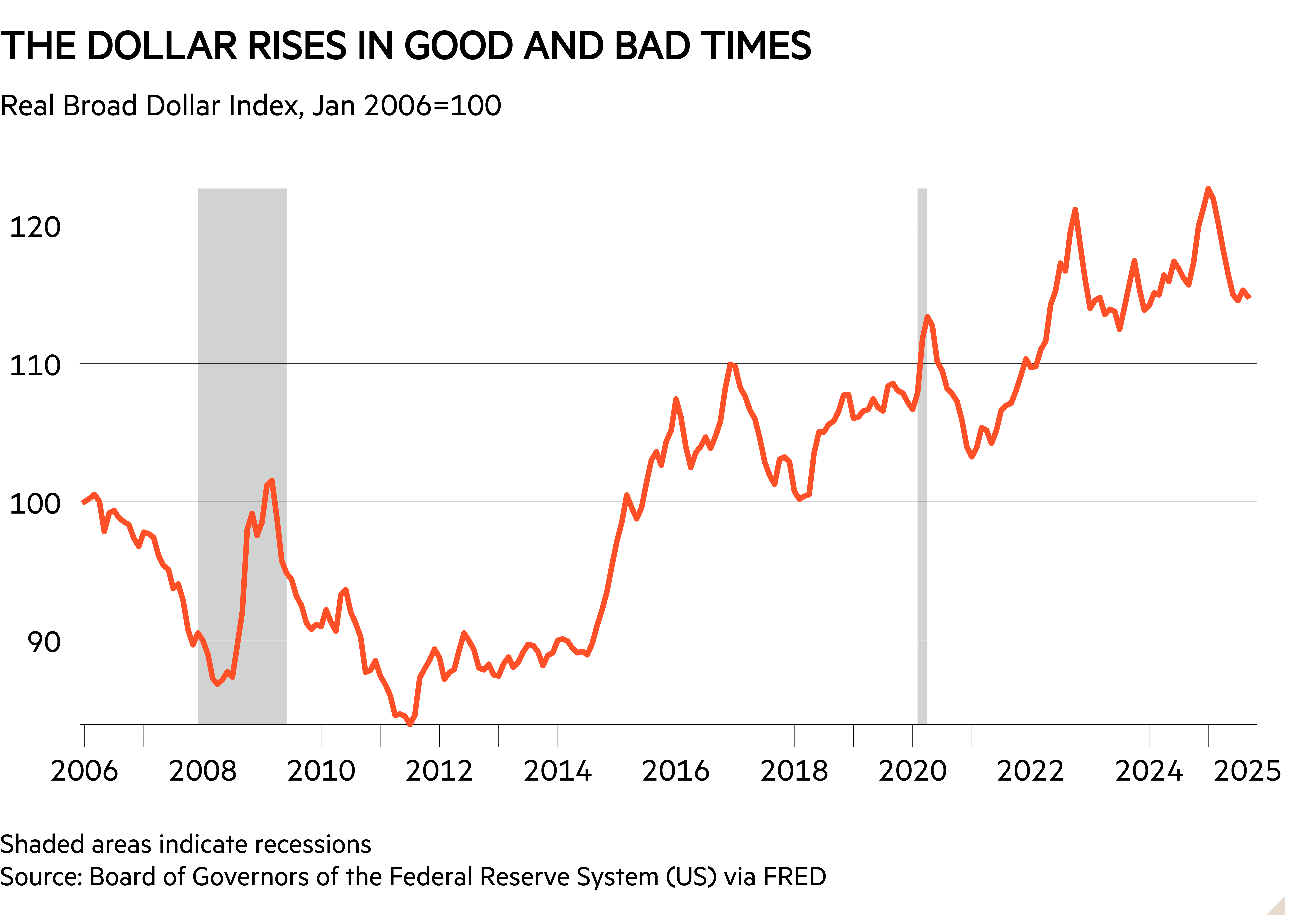

So far, 2025 has been a year of dollar weakness. The greenback has dropped more than 10 per cent against a basket of currencies, while the Real Broad Dollar Index – which also takes inflation into account – has fallen by 6 per cent (see chart below). Analysts at Morgan Stanley warn that the 15-year dollar bull cycle is over. But will the world’s reserve currency keep falling in value as the year comes to a close?

The dollar smile

A 20-year-old theory called the ‘dollar smile’ gives us some useful insight here. It sets out that the dollar rises when the US economy outperforms. This makes sense – high growth attracts capital flows, boosting demand. But the dollar also appreciates when the US economy struggles, thanks to the currency’s unique place in the global financial system. The threat of the world’s largest economy entering recession triggers a flight to safe assets, and investors turn to investments such as US government bonds. Since they need dollars to buy them, the greenback strengthens while the economy flags. The shaded areas in the chart below show recessions, which have coincided with periods of dollar strength.

Even more surprisingly, the theory suggests that the dollar weakens when American economic performance is middling. Investors seek out better returns from elsewhere, and demand for the dollar dries up. This all results in a U-shaped curve: the dollar is strong when US economic performance is very good or very bad, and weakest when it is so-so.

It is a neat theory, and has some empirical backing, too. Analysts at Morgan Stanley looked at data from the past 20 years and found that the smile held. When growth in the US and elsewhere was much weaker than forecast, the dollar rose by an average of 0.8 per cent per month. When the it outperformed expectations, the dollar gained even more – around 1.1 per cent per month. When global growth was synchronised (meaning that the US was not a standout), the dollar tended to weaken by about 0.1 per cent per month.

Read more from Investors’ Chronicle

Turn that smile upside down

Although the smile might have held in the past, analysts fear that US President Donald Trump’s policies have left it looking lopsided today. The theory only holds if investors still treat US assets as a source of safety. Tariffs, central bank meddling and government shutdowns have all given rise to significant uncertainty. It’s less clear how investors will react to a slowing US economy when American policy decisions are the source of the shock.

Recent history is relatively reassuring. In 2018-19, the dollar strengthened as global growth flagged – even though US trade tensions had triggered some of the slowdown. And despite conjecture, the dollar’s unique place in the financial system also remains largely intact. Barclays economists point out that the search for an alternative has so far been “futile”, bolstering the dollar’s resilience.

Where the dollar goes next

According to the CMC FedWatch tool, investors expect the Federal Reserve to cut interest rates to 3 per cent by the end of 2026, down from the current level of 4-4.25 per cent. Morgan Stanley analysts think that the dollar will weaken throughout the year as a slowing economy, lower rates and policy uncertainty weigh on the dollar. If so, we could spend the next few months sitting in the middle section of the dollar smile.

Barclays analysts strike a more optimistic tone, expecting US activity to rebound, supporting risk sentiment and dollar stability. They see scope for a more bullish trajectory, but stop short of forecasting an appreciation to the ‘growth’ side of the smile.

The analysts warn of a “clear and present danger” that a Trump administration could radically reshape the Federal Reserve, potentially triggering an aggressive currency sell-off. The dollar smile might still hold, but a loss of confidence in the Fed would be enough to break it.