Overnight saw the NASDAQ have its biggest one session fall in over two years, losing nearly 3% all on the back of chip tech companies as they suffered some political handwaving from President Biden. In currency land, Yen came under enormous pressure with some steep buying as the USD also wavered against Euro and other major pairs as talk about a September rate cut by the Fed gained momentum. The Australian dollar remains under pressure however as it nearly breaks below the 67 cent level, nearly giving up its six month high.

US bond markets saw reduced volatility but the yield curve remains sharply negative as 10 year Treasuries yields steady at the 4.1% level. Oil prices are now stabilising with Brent crude getting back above the $85USD per barrel level while gold prices oscillated around the $2460USD per ounce level.

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets were still negative in reaction to the previous GDP print with the Shanghai Composite down more than 0.3% while the Hang Seng Index was flat as it fails to gain momentum, closing at 17749 points.

The Hang Seng Index daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session as it tried to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. Price action looked like turning this falling wedge pattern into something more bullish but is looking like a dead cat bounce instead:

Advertisement

Meanwhile Japanese stock markets were very mixed with the Nikkei 225 closing some 0.4% lower at 41097 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term resistance had been defended with price action now pushing right through resistance at the 39000 point level with momentum very overbought as this breakout gets going, with futures are indicating a strong pullback on the sharply appreciating Yen:

Advertisement

Australian stocks were able to advance the most with the ASX200 pushing further above the 8000 point level, closing 0.7% higher at 8057 points.

SPI futures however are down more than 0.6% on the pullback on Wall Street overnight. The daily chart was showing a potential bearish head and shoulders pattern forming with ATR daily support tentatively broken, taking price action back to the February support levels in mid April. Momentum is now well out of its oversold condition with this breach of the 8000 point level possibly coming up against significant resistance, or a new level to launch higher from:

Advertisement

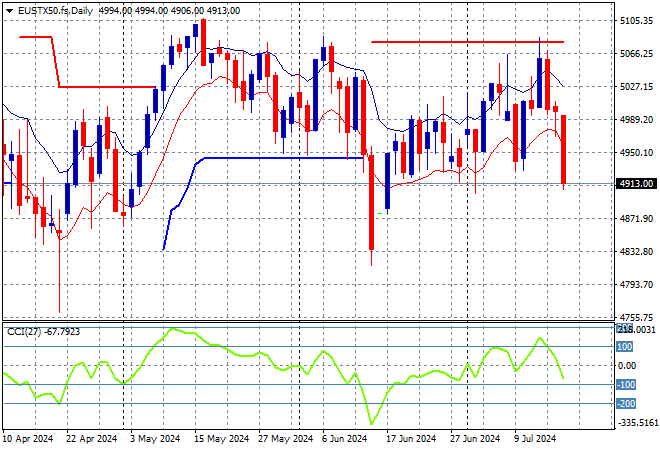

European markets still can’t find a positive mood with solid losses across the continent again due to the higher Euro as the Eurostoxx 50 Index closed more than 1% lower to extend below the 5000 point level, finishing at 4891 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance still looming at the 5000 point barrier. Former ATR support at the 4900 point level looks like the anchor point and so far has held here, but this looks ominous:

Advertisement

Wall Street was sideswiped last night by tech stocks with the NASDAQ falling more than 2% lower while the S&P500 closing down 1.4% at 5588 points.

The four hourly chart showed resistance overhead that had been tested last Friday before an early week slump that has now been tested and broken through, helped alongside a soaring NASDAQ. Momentum was somewhat overbought but has retraced slightly so we could see a continued volatile trading week if further earnings or political machinations get in the way as the markets are betting on Trump 2.0:

Advertisement

Currency markets are pulling back from USD despite a slew of stronger domestic economic prints as macro concerns in Europe and elsewhere are shuffling sentiment around. Euro initially pushed back above the 1.09 handle overnight but couldn’t follow through but remains relatively strong and on trend here.

The union currency had previously bottomed out at the 1.07 level before gapping higher earlier in the week with more momentum now building to the upside with the 1.0750 mid level to act as support going forward, but watch the low moving average here in the short term to come under pressure:

Advertisement

The USDJPY pair is tumbling down a series of steps here with Yen appreciating sharply overnight as the pair fell down to the 156 level after losing momentum and rolling over in the previous session:

This volatility speaks volumes as it once pushed aside the 158 level as longer term resistance, but then was unable to breach the 162 level as it looks like the BOJ intervention finally worked on the ever weakening Yen. Watch out below as this overshoots:

Advertisement

The Australian dollar has been struggling to make further gains after breaking out of its holding pattern with a further failed move overnight despite overall USD weakness and is no longer well supported above the 67 cent handle despite the potential of a rate rise from the RBA.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. This move was looking more convincing with the potential to go higher as speculation of a rate hike in August building, but I’m watching short term support here which has now broken:

Advertisement

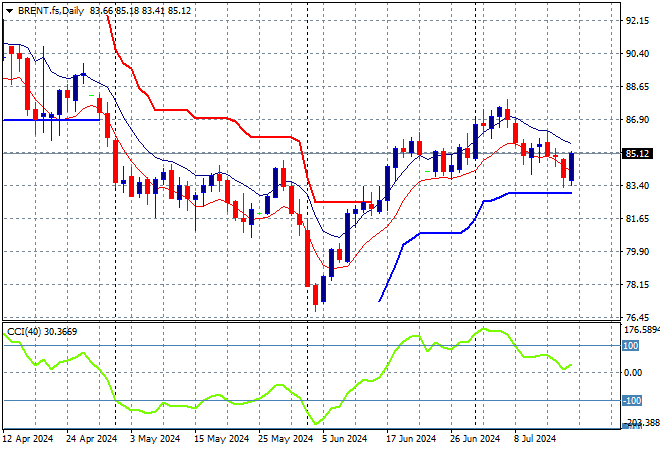

Oil markets are again trying to stabilise after getting out of correction mode with Brent crude bouncing off short term support, finishing back above the $84USD per barrel level overnight.

After breaking out above the $83 level last month, price action has stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Watch daily ATR support here at the $86 level which is still broken and will likely be resistance for sometime with short term momentum now retracing out of overbought mode:

Advertisement

Gold is not just holding on to its breakout from late last week but is exceeding expectations well above the $2400USD per ounce level although overnight it ran out of steam to pull back slightly below the $2460 level.

While it was the biggest casualty of the reaction to the US jobs report, the shiny metal had consistent negative short term momentum that has now turned around with upside resistance at the $2400 level finally broken. The longer term support at the $2300 level was key so this should support further gains if the USD remains weak:

Advertisement

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

Advertisement

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

Advertisement

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!