DXY is at critical support and does not look strong:

AUD is melting up:

Positioning is very short for a new Fed cycle:

Advertisement

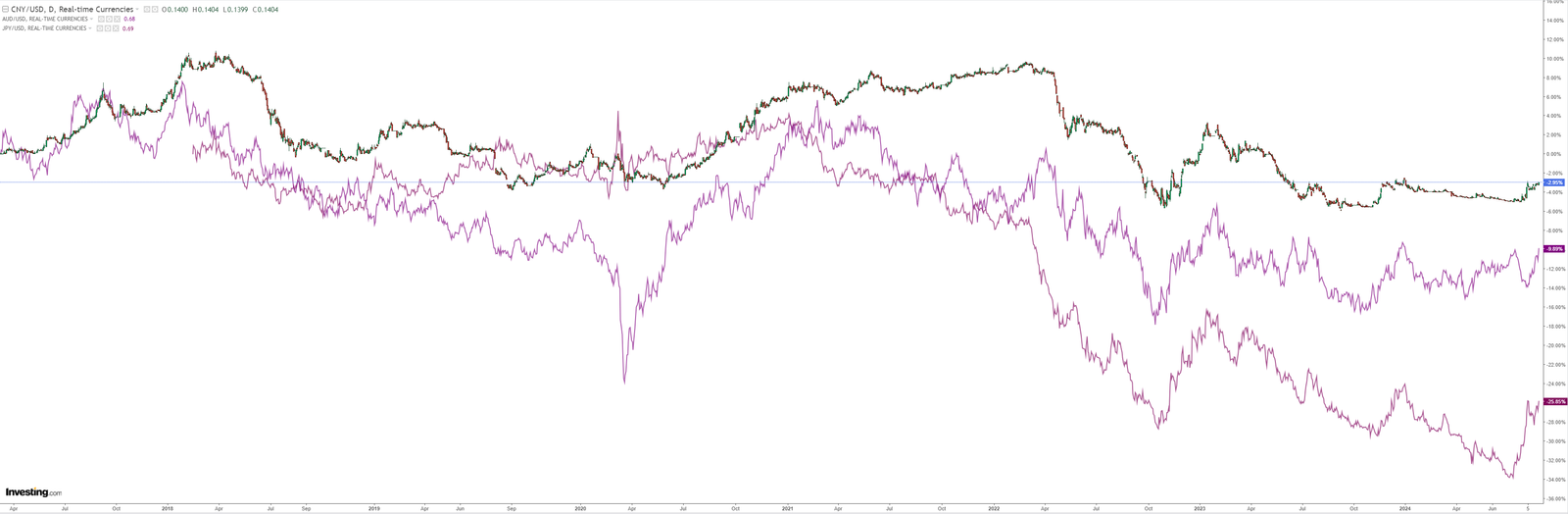

North Asia too:

All commods have entered reflation:

Not miners owing to iron ore:

Advertisement

Risk is bullishly led by junk credit:

Yields were bid but did not break:

Stocks poured higher:

Advertisement

The Fed managed to out-dove the doviest or doves. Jay Powell:

- “The cooling in labor market conditions is unmistakable.”

- “It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon.”

- “We do not seek or welcome further cooling in labor market conditions.”

- “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

- “We will do everything we can to support a strong labor market as we make further progress toward price stability.”

Even though the view accords with my view of the economy, I expected more caution.

Advertisement

So, the Fed will now cut on every weak data release, most notably labour market-related.

Thus, data will have to turn unambiguously recessionary to overthrow a new ‘bad news is good news’ regime, which is not my base case.

Given how short Aussie dollar speculators are, the currency can crush it through 70 cents before we even draw breath.

Advertisement

I don’t think the RBA can resist the tide, and Europe plus China will follow the Fed but, right now, the world’s biggest dove is the FOMC.

The path of least resistance for AUD is up!