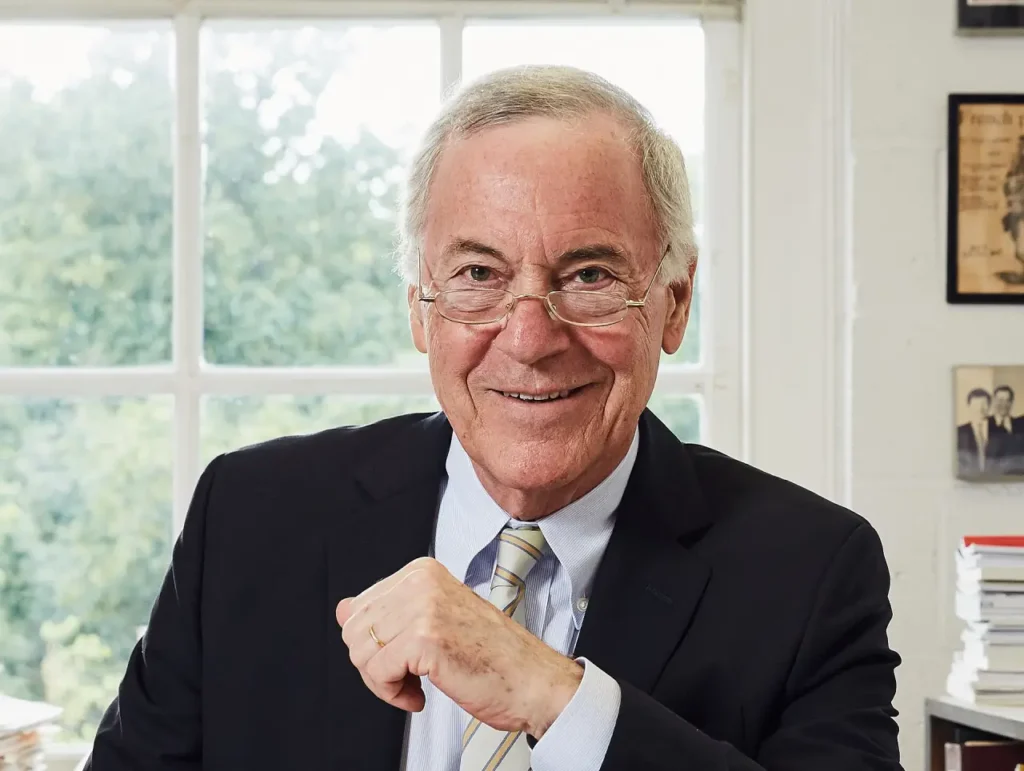

At a time when Zimbabwe is planning a phased transition to a mono-currency system, with the goal of making the Zimbabwe Gold (ZiG) its sole legal tender by 2030, the ZiG has been ranked as one of the world’s worst-performing currencies, according to United States economist Professor Steve Hanke, who placed it sixth on his latest Hanke’s Currency Watchlist.

In an update posted on social media, Hanke said the ZiG has depreciated by 33% against the United States dollar year-on-year, describing the unit with a pun: “The ZiG = A Zag.”

“On this week’s Hanke’s #CurrencyWatchlist, the Zimbabwe ZiG ranks as the WORLD’S 6th WORST currency. The ZiG has depreciated by 33% against the USD YoY,” Professor Hanke stated.

Introduced in April 2024 by the Reserve Bank of Zimbabwe (RBZ), the ZiG is supposed to be a gold-backed “structured currency” designed to stabilise the economy. The move marks Zimbabwe’s sixth attempt at currency reform since 2000.

However, since its launch, the currency has faced persistent pressure from exchange rate volatility, low market confidence, and limited foreign currency reserves, prompting growing skepticism among economic observers.

Professor Hanke, a long-time critic of Zimbabwe’s monetary policy, has consistently questioned the RBZ’s ability to maintain currency stability without full dollarization or the adoption of a currency board system.

While the RBZ has maintained that the ZiG remains stable and backed by growing gold and foreign currency reserves, independent economists have warned that inflationary pressures and a widening gap between the official and parallel market rates could further weaken the unit.

Authorities have urged the public to maintain confidence in the currency, arguing that fiscal discipline, tighter monetary policy, and increased gold reserves will eventually strengthen the ZiG.

Recently, the central bank outlined a roadmap for the country to adopt ZiG as sole legal tender by 2030, marking a gradual phase-out of the US dollar from domestic transactions.

According to the RBZ, the transition will depend on meeting several key economic targets.

These include raising foreign exchange reserves to cover at least three to six months of imports, cutting inflation from the current 94% to single digits by 2026, and narrowing the exchange rate gap between the official and parallel markets to below 30%.

RBZ Governor John Mushayavanhu said at present, Zimbabwe’s reserves can only cover one month of imports.

Under the proposed framework, foreign currency accounts will still be permitted, allowing individuals and businesses to hold and use foreign exchange for international transactions.

However, all local payments will eventually be required to be made in ZiG, while banks will continue to provide foreign currency for imports, travel, and external obligations as the country transitions toward a mono-currency system.

Recently, renowned economist Professor Gift Mugano warned:

“Without strong institutions which eliminate corruption and foster a conducive environment for business; and robust structural policies focused on export growth, import substitution and absorbing people from the informal sector, we must forget the mono currency!”