Political risk in emerging markets isn’t just a consideration it’s a fundamental reality that shapes investment decisions daily. For CEEMEA (Central and Eastern Europe, the Middle East, and Africa) emerging markets, this reality operates at an amplified level, encompassing two wars, pandemic disruptions, unorthodox monetary policies, and ongoing geopolitical tensions.

However, rather than being purely destructive, political risk also creates opportunities for astute investors who understand how to navigate volatility while capturing value. Given that much of the liquidity in CEEMEA markets is generated domestically, it is equally important to understand the perspectives and positioning of local investors.

Political risk

CEEMEA emerging markets have faced an unprecedented sequence of challenges. The Russia-Ukraine conflict reshaped regional dynamics overnight, while Turkey’s unconventional monetary policy created significant currency volatility.

The pandemic’s impact varied dramatically across the region, from Gulf countries’ relatively strong fiscal positions to European emerging markets’ more complex recovery paths.

Traditional emerging market investing often involves large benchmark names typically government-related entities heavily influenced by macro headlines, oil prices, dollar movements, and political developments. These companies, while offering liquidity and familiarity, provide direct exposure to the very volatility investors seek to minimise.

The key insight is that moving away from these benchmark-heavy positions doesn’t eliminate political risk it transforms it from a primary driver of returns into a manageable component of the investment process.

Structural winners

The foundation of successful CEEMEA investing lies in identifying structural winners and well-managed companies that have demonstrated resilience through complete business cycles. This isn’t merely investment rhetoric; it requires rigorous analysis of how management teams have navigated previous downturns and crises.

Companies that have successfully weathered at least one full cycle provide valuable data points about their operational resilience, strategic flexibility, and management quality. Their track records offer insight into whether earnings growth and value creation can persist through volatile periods.

Strong management can clearly articulate a corporation’s operational outlook and provide investors with insight into the potential bottlenecks and risks inherent in the company’s growth strategy. When political risk inevitably creates market volatility, transparent and direct communication enables investors to more accurately assess the extent of downside risks, while also presenting opportunities to prioritise quality investments.

This approach doesn’t eliminate exposure to political developments, but it shifts the investment thesis from betting on macro trends to backing proven operators who can create value regardless of headline noise.

Currency

Currency volatility represents one of CEEMEA’s most challenging aspects, particularly with currencies like the Turkish lira.

The key to managing currency risk lies in acknowledging the futility of long-term currency forecasting while maintaining rigorous short-term modelling discipline.

Effective currency risk management involves three complementary approaches. First, detailed revenue and cost modelling for every portfolio company helps quantify currency exposure. Understanding whether companies generate revenues in hard currencies while incurring costs locally, or vice versa, provides crucial insight into the operational sensitivity associated with currency.

Second, realistic time horizon modelling proves essential. While predicting currency levels five years out is futile, developing reasonable expectations for 12-24 month ranges based on current market dynamics, central bank policies, and economic fundamentals provides a workable framework for investment decisions.

Third, risk premium adjustments ensure adequate compensation for currency volatility. If a Turkish company offers 20% local currency returns but the required risk premium exceeds 35%, the investment fails to offer adequate risk-adjusted returns regardless of the company’s operational merits.

Market intelligence

Understanding local market dynamics often proves more valuable than macro forecasting. This means comprehending what fixed income markets are pricing, how local institutional investors are positioned, and where domestic liquidity is flowing.

In Turkey, this might involve understanding banking sector dynamics and capital flow patterns. In Gulf markets, it requires insight into sovereign wealth fund allocation decisions and high-net-worth investment patterns.

This practical approach recognises that currency markets, like commodity markets, are inherently difficult to predict with precision. Success comes from understanding current positioning, identifying when markets have moved to extremes, and positioning for mean reversion rather than attempting to time major directional moves.

Opportunistic positioning

Political risk creates cyclical opportunities alongside structural challenges. When headline risk peaks whether from political tensions, policy uncertainty, or external shocks market dislocations often create attractive entry points for quality companies trading at discounted valuations.

The key is maintaining the analytical framework to distinguish between temporary dislocations and permanent impairment. Companies with strong balance sheets, proven management teams, and resilient business models often emerge stronger from political crisis periods, having gained market share from weaker competitors or benefited from policy responses designed to stabilise economic conditions.

Conclusion

Political and currency volatility in CEEMEA creates an environment where active management can add significant value. ETF investing in the region often results in holding the most problematic parts of benchmarks government-related entities most exposed to macro induced volatility.

Successful active management in CEEMEA requires combining structural company analysis with tactical awareness of political and currency developments. It means building conviction in quality companies while maintaining flexibility to capitalise on crisis-driven opportunities.

Most importantly, it requires accepting that volatility is the price of admission to emerging markets, while building portfolios designed to navigate this volatility rather than predict it.

The goal isn’t to eliminate political risk it’s to ensure adequate compensation for accepting it while building portfolios positioned to capitalise on the opportunities that volatility invariably creates.

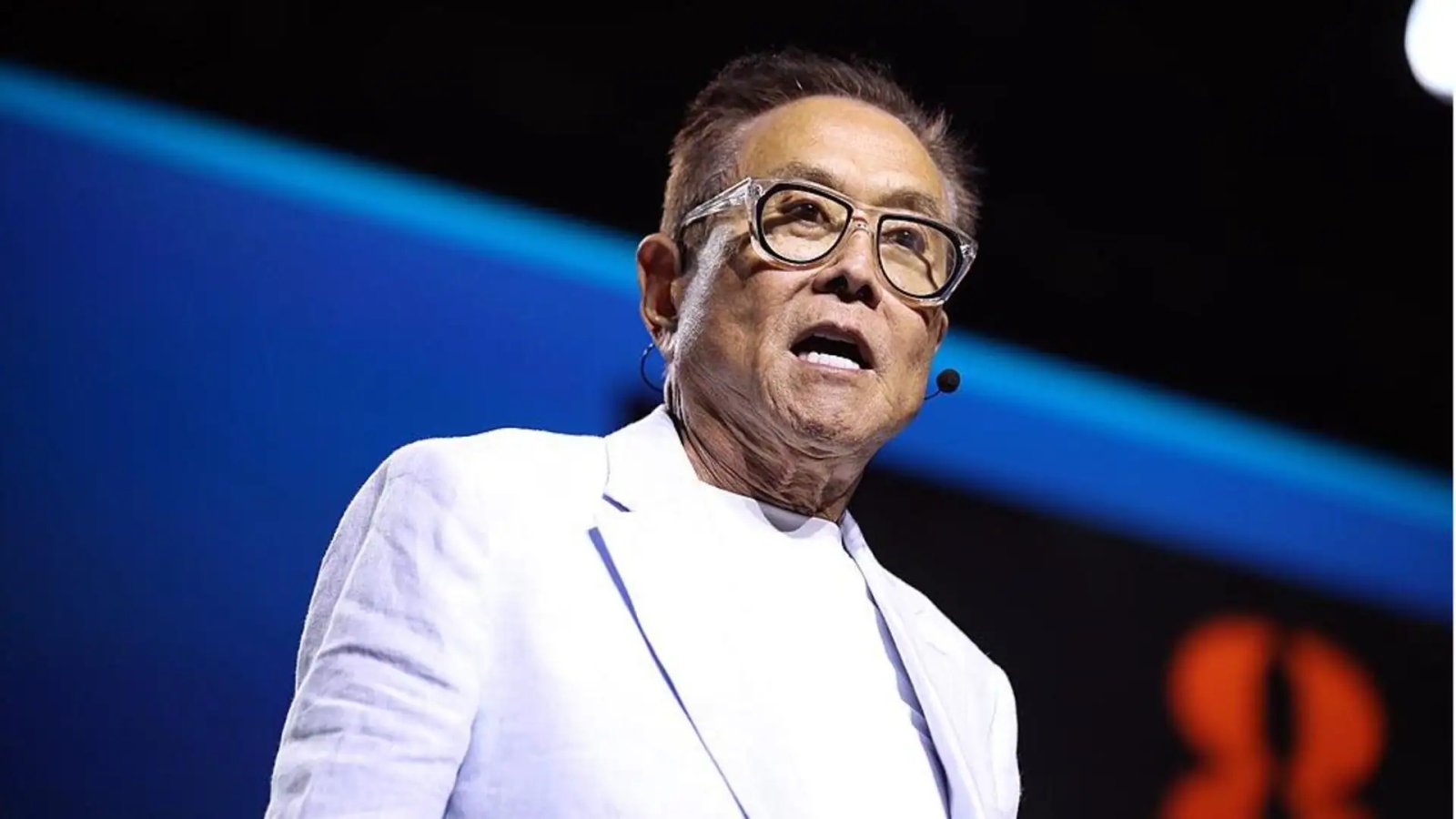

By Adnan El-Araby, Co-Portfolio Manager of Barings Emerging EMEA Opportunities PLC