The Freely Convertible Currency (MLC) is proving resilient, as evidenced by its surprising price increase this Wednesday. The MLC has bounced back to 220 CUP in Cuba’s informal market, regaining the five pesos it lost the previous day. Meanwhile, the US dollar and the euro maintain their trading values from Tuesday, with the dollar at 395 CUP and the euro at 445 CUP, marking record highs for both currencies.

An intriguing aspect of the informal market is the upward trend in the median trading values for both the euro and the dollar. The euro has climbed to 447.5 CUP, while the dollar has also increased, reaching 398 CUP. It remains to be seen whether these increases will hold steady in the coming hours.

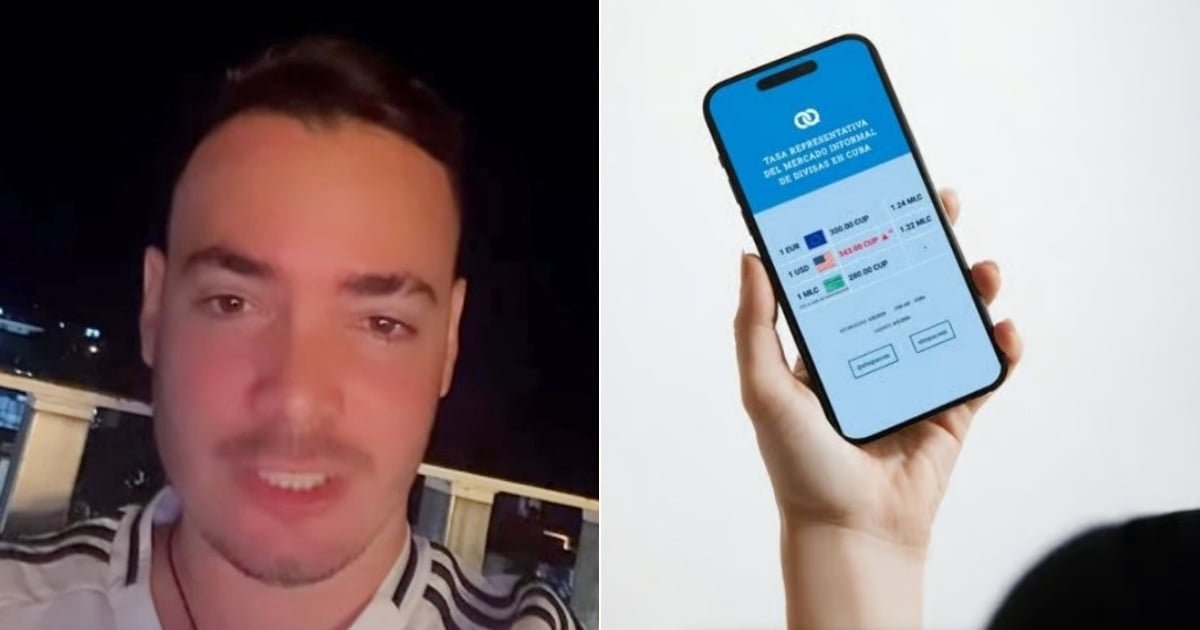

Exchange Rates as of August 6, 2025 – 8:15 a.m. in Cuba:

According to elTOQUE, the exchange rate for the US dollar to CUP is 395, the euro to CUP is 445, and the MLC to CUP is 220.

US Dollar (USD) to Cuban Peso (CUP) Conversion:

- 1 USD = 395 CUP

- 5 USD = 1,975 CUP

- 10 USD = 3,950 CUP

- 20 USD = 7,900 CUP

- 50 USD = 19,750 CUP

- 100 USD = 39,500 CUP

Euro (EUR) to Cuban Peso (CUP) Conversion:

- 1 EUR = 445 CUP

- 5 EUR = 2,225 CUP

- 10 EUR = 4,450 CUP

- 20 EUR = 8,900 CUP

- 50 EUR = 22,250 CUP

- 100 EUR = 44,500 CUP

- 200 EUR = 89,000 CUP

- 500 EUR = 222,500 CUP

In mid-July, Cuban Prime Minister Manuel Marrero Cruz revealed plans to implement a new “currency management, control, and allocation mechanism” in the second half of 2025. This is part of the so-called “Government Program to Correct Distortions and Revitalize the Economy.” The proposed model aims to overhaul the official exchange market, strengthen financing frameworks, and supposedly improve the distribution of foreign currency generated by state enterprises.

In the interim, the informal market continues to lead the way, with the Cuban peso losing value and remittances from emigrants serving as the primary support for millions of households across the nation.

Cuban Currency Market: Key Questions Answered

Why is the MLC gaining value in the informal market?

The MLC’s increase in value suggests a demand for foreign currency amidst economic instability, as people seek to protect their savings from devaluation.

What are the implications of the informal market trends for Cuba’s economy?

The trends highlight the weakening Cuban peso and underline the reliance on remittances, which are crucial for many households as the formal economy struggles.