What’s going on here?

On August 15, 2023, China’s yuan fell 0.25% against the dollar, hitting 7.1577 yuan per dollar as China’s economic metrics continued to disappoint.

What does this mean?

China’s economic wobbles are becoming harder to ignore. The People’s Bank of China (PBOC) pegged the midpoint rate for the yuan at 7.1399 per dollar, stronger than anticipated by Reuters. Despite this, both the onshore and offshore yuan weakened, highlighting the struggle of China’s factory sector, which saw slower-than-expected growth in July. The diminishing factory output adds to a slew of indicators showing the economy’s sluggish pace, even after recent governmental interventions. However, a strategist from DBS noted that easing dollar strength might relieve some pressure on the yuan. With the US Federal Reserve likely contemplating a move in response to easing inflation, market dynamics could see shifts soon.

Why should I care?

For markets: Currency currents shift focus.

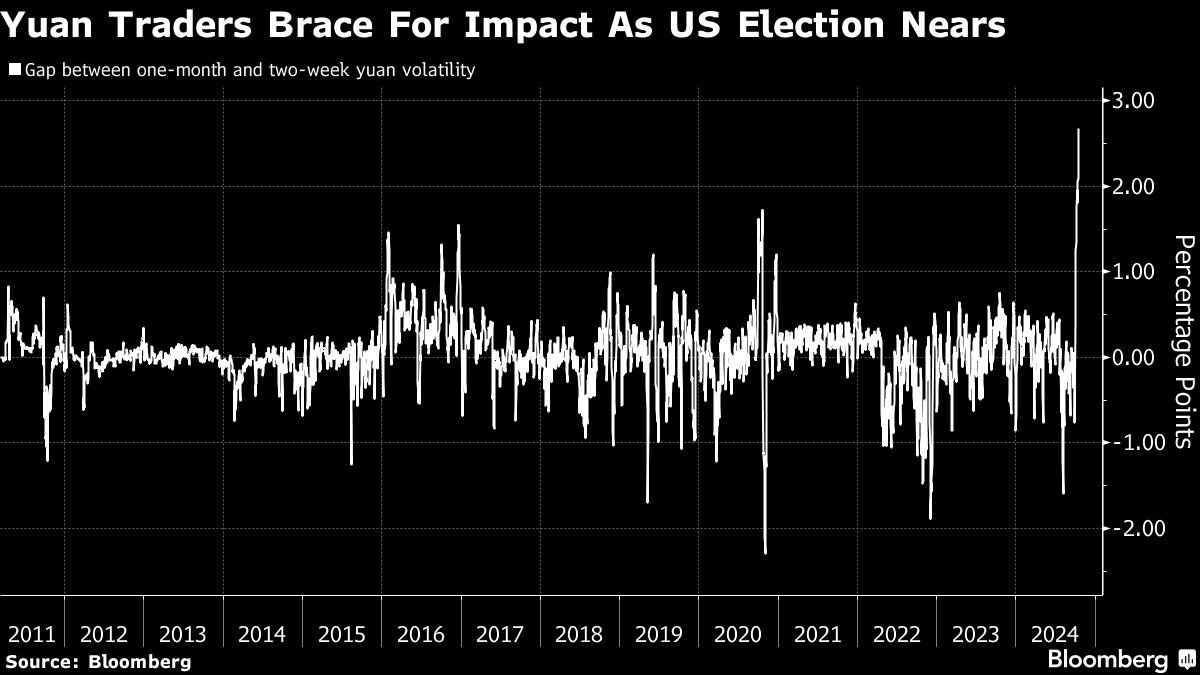

Investors should keep their eyes on currency markets as the US dollar’s recent softness, alongside China’s economic measures, plays a crucial role in the yuan’s volatility. The yuan has had a tumultuous ride this month, peaking at a seven-month high before losing much of its gains. Current trends suggest a potential shift towards a more market-driven yuan, especially with the PBOC subtly guiding depreciation through lower daily fixings.

The bigger picture: A balancing act for global economies.

China’s evolving currency policy and economic status have global ramifications, especially concerning trade and investment flows. The US’s slowing inflation and potential Fed easing, combined with China’s economic struggles, paint a complex picture. Key financial rates like the USD/CNY swap and comparative interbank rates (SHIBOR and HIBOR) underscore the nuanced financial landscape investors must navigate. Watching these dynamics will be critical for understanding broader economic shifts and future policy directions globally.