For years, Nigeria’s foreign exchange market was an arena riddled with opacity, an insider’s game marked by preferential access, backdoor dealings, and a multi-tiered exchange rate regime that often felt more like roulette than responsible policy.

That era, the Central Bank of Nigeria insists, is over.

In February, the CBN turned a new page with the launch of the Nigeria Foreign Exchange Code (FX Code), a bold move to instil transparency, enforce ethical conduct, and rebuild investor trust in the country’s embattled forex system. Today, six months on, analysts and market watchers say the FX Code is not only gaining traction but is gradually stabilising the naira, encouraging compliance, and shoring up foreign reserves.

The local currency appreciated from N1,585/$ in February, when the code was implemented, to N1,530/$ today. The policy has also boosted foreign reserves, reinforced transparency, and improved governance and compliance in Nigeria’s foreign exchange market.

Globally, central banks have long prioritised the development of transparent and efficient FX markets. For Nigeria, the inauguration of the FX Code marked a departure from rhetoric to tangible reforms aimed at fostering accountability and restoring trust in the system.

Read also: Naira rally: CBN FX intervention good for the economy – Rewane

Since the February rollout, the FX Code’s influence has resonated across various market segments, instilling investor confidence and fostering improved operational standards in forex transactions. Analysts and market observers now view the FX Code as a significant regulatory milestone.

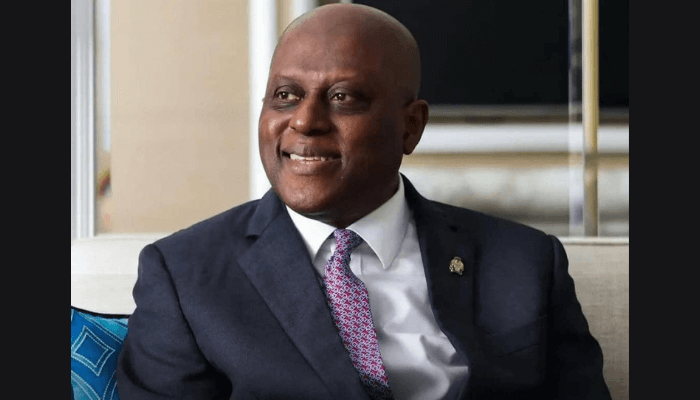

The launch of the Nigerian FX Code signifies a deliberate push to restore integrity, trust, and transparency in Nigeria’s forex market. As part of his broad reform agenda, CBN Governor Olayemi Cardoso introduced the policy to drive accountability in the country’s currency markets.

At the inauguration event held at the CBN headquarters in Abuja, Cardoso declared: “The FX Code marks a new era of compliance and accountability. It is not just a set of recommendations; this is an enforceable framework.”

He stressed that the initiative underscored the CBN’s determination to restore market credibility and set global standards for ethical conduct.

He further explained that the Nigerian FX Code, coming shortly after the launch of the Electronic Foreign Exchange Matching System (EFEMS) in December 2024, offers enforceable standards for market participants, addressing legacy challenges that undermined confidence in Nigeria’s FX operations.

“We must not forget where we are coming from. The era of multiple exchange rates, which created privileges for a select few at the expense of most Nigerians, inflicted significant damage on market integrity,” Cardoso said.

“Practices such as unprecedented ways and means financing contributed to inflation, currency depreciation, and eroded public confidence. These practices must never return.”

He pledged zero tolerance for unethical behaviour and vowed to sanction any breaches of the FX Code: “We will not tolerate any attempts to revert to those practices. Any individual or institution that violates the FX Code will face swift and decisive sanctions.”

Also speaking at the launch, Muhammad Sani, deputy governor of the Economic Policy Directorate, Abdullahi, outlined the six guiding principles and 52 sub-principles of the FX Code.

Meanwhile, Omolara Duke, director of the Financial Markets Department, stated that the Nigerian FX Code was adapted from the Global FX Code launched in May 2017. Nigeria, she said, now joins 54 other central banks in adopting the international standard.

“The true power of the Code lies in its ability to create a legacy. Our goal is to ensure that Nigeria’s foreign exchange market is seen as a beacon of trust and integrity on the global stage,” Duke said.

She also commended Deposit Money Banks (DMBs) for their collaborative role in shaping the Code and urged them to continue upholding its principles.

A boost for the naira and foreign reserves

The FX Code has supported improvements in key indicators like exchange rate stability and foreign inflows. Its effects have been most notable in the appreciation of the naira, which reached its strongest level in over a year, trading at N1,530/$ compared to N1,585/$ at the time of the policy’s launch.

Analysts at Cordros Securities forecast continued naira stability, driven by improved FX liquidity, consistent inflows, and high naira yields that attract investor interest.

Read also: Inflation to drop further as CBN sustains investor confidence with rate hold

Foreign reserves have also risen significantly, hitting $40.11 billion in July, marking the highest level since November 2024. This figure represents about 9.5 months of import cover, reinforcing Nigeria’s external buffer.

Cardoso emphasised that the FX Code is anchored on six core principles: ethics, governance, execution, information sharing, risk management and compliance, and confirmation and settlement processes. These principles align with global standards while addressing the local market’s unique dynamics.

According to Cardoso: “The FX Code represents a decisive step forward, setting clear and enforceable standards for ethical conduct, transparency, and good governance in our foreign exchange market. The era of opaque practices is over. The FX Code marks a new era of compliance and accountability. Under the CBN Act 2007 and BOFIA Act 2020, violations will be met with penalties and administrative actions.”

Industry perspectives

Aminu Gwadabe, president of the Association of Bureaux De Change Operators of Nigeria (ABCON), attributed the naira’s rebound to recent CBN policies, particularly the FX Code.

Gwadabe noted that the policy has helped restore investor confidence while encouraging higher dollar inflows through diaspora remittances.

He echoed the CBN’s position that the FX Code is not exhaustive but serves as a crucial foundation for market discipline.

“The Code authorises the CBN to establish and enforce directives regarding the standards for financial institutions under which FX deals are to be conducted,” Gwadabe said.

He added that the FX Code will continue to entrench accountability and transparency in the market, reinforcing the naira’s strength. He also supported the requirement that all financial institutions submit implementation plans approved by their boards for full compliance.

Stevens Michael, CEO of Countryside Markets Limited, offered a similar view: “For me, the whole idea is just to ensure that there is a lot more sanity in the foreign exchange market because those characters have really created a whole lot of problems over the years in the foreign exchange market.”

He continued: “I think that is what the CBN is trying to do and the more we’re able to sanitise the markets, I think the more stability it will achieve in the foreign exchange market.”

Cardoso also emphasised that FX Code reforms are already producing tangible results. “The year 2024 was marked by structural reforms that sought to return the naira to a freely determined market price and ease volatility as several distortions were removed from the market,” he said.

Read also: One-year T-bill yield slips to 18.86% despite CBN rate hold

Bank participation and compliance mechanism

Commercial banks are key players in the FX Code’s rollout. While the CBN has secured their support, it has also deployed strict compliance monitoring to ensure the institutions, once perceived as weak links in FX policy enforcement, adhere to the new rules.

The formal signing of the FX Code by banks symbolises a collective effort to instill trust and discipline in the market. Yet, stakeholders insist that beyond public commitments, banks must be held accountable through routine oversight.

Backed by the CBN Act (2007) and BOFIA (2020), the FX Code is more than a guideline, it is a legally binding directive for market conduct. All participants are expected to comply fully with its provisions.

By January 31, all institutions operating in the FX market must submit a self-assessment report on their adherence to the FX Code. They must also present a comprehensive implementation plan approved and signed by their boards, with official minutes attached.

Complementary reforms

In addition to the FX Code, the CBN has implemented other policies aimed at stabilising the economy. One major intervention was the aggressive hike in the Monetary Policy Rate (MPR) by 875 basis points to 27.5 percent in 2024, aimed at taming inflation.

At the last Bankers’ Dinner in Lagos, Cardoso remarked: “Our tight monetary policy stance has altered the previous dire trajectory, and we expect a downward trend in 2025. Inflation remains unacceptably high, but the signs are encouraging, particularly given that the full effects of monetary policy typically take 6–9 months to impact the consumer sector. Our commitment is unwavering: we will prioritise price stability until its benefits are felt by every Nigerian.”

The CBN under Cardoso also unified Nigeria’s exchange rate regime, eliminating market distortions and boosting transparency. This move enabled the country to clear outstanding FX obligations, restoring confidence among businesses and investors.

A foundation for long-term growth

Analysts believe that the FX Code and complementary reforms under Cardoso have not only helped stabilise Nigeria’s foreign exchange market but also laid a foundation for sustainable economic growth.

According to Ifeanyi Ubah, head of research at Commercio Partners, the CBN’s decision to retain the MPR at 27.5 percent during its 301st Monetary Policy Committee (MPC) meeting reflects a commitment to macroeconomic stability. “The need to sustain the recent disinflationary trend and keep price pressures under control could be responsible for the rate retention,” Ubah said in an investor note.

Ahead of the meeting, analysts were divided, with some predicting a marginal hike to strengthen the naira and others expecting a hold due to sluggish growth. Ubah insisted that the hold suggests the CBN is focused on steady progress toward price and currency stability.

Read also: Here’re four investment strategies amid CBN rate hold

“The decision suggests that the CBN is prioritising macroeconomic stability while supporting the gradual disinflation trend,” Ubah wrote.

No single policy will fix Nigeria’s foreign exchange crisis overnight. But the FX Code is shaping up to be more than a symbolic gesture. It’s a blueprint, a set of standards backed by legislation (CBN Act 2007, BOFIA 2020), that gives teeth to enforcement and accountability.

“The year 2024 was marked by structural reforms that sought to return the naira to a freely determined market price and ease volatility,” Cardoso noted.

That journey is still unfolding. But for the first time in years, the path forward seems more certain, and better governed.

As the CBN doubles down on market integrity, monetary tightening, and compliance-driven reforms, the message is clear: Nigeria’s forex market is being rebuilt not just for efficiency, but for credibility, and for the long haul.