In recent weeks, many observers have been puzzled by the unusual strength of the Thai baht. At first glance, one might assume this is good news after all, a stronger currency is often associated with a strong economy. But the reality is more complicated.

The Dollar–Baht Paradox

At the global level, the US dollar has been showing signs of weakness. Normally, when the dollar softens, currencies like the Thai baht should adjust in a way that reflects real economic conditions. In Thailand’s case, given sluggish exports, weak domestic demand, and slow recovery in tourism, the baht should logically be trading at 35–36 baht per US dollar, rather than the 33–34 range we have seen.

This divergence raises the critical question “Why is the baht strengthening when the fundamentals suggest otherwise?”

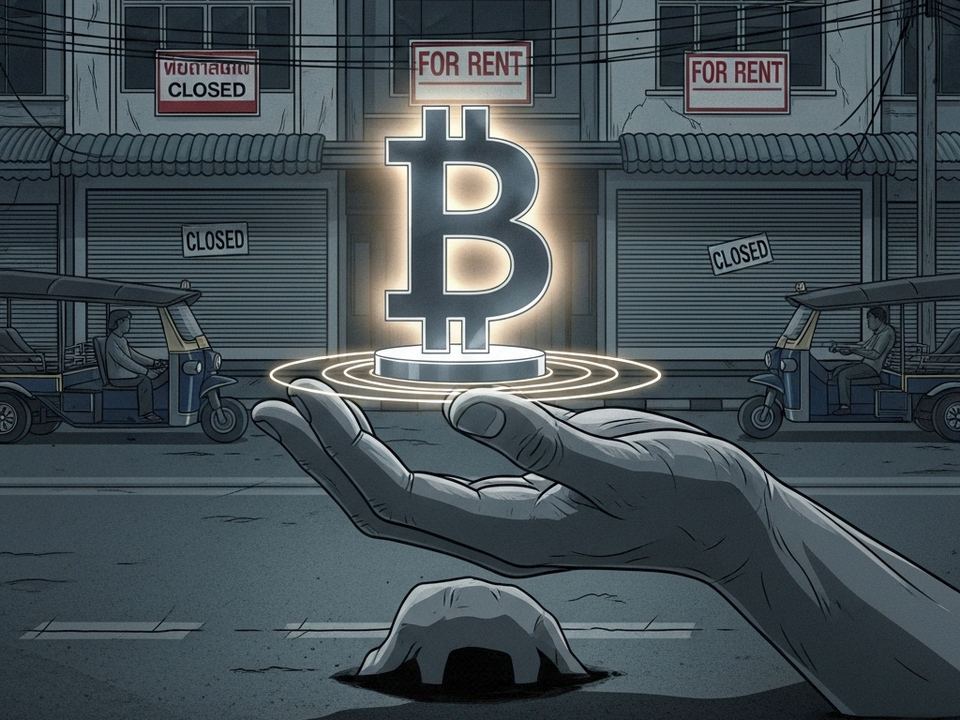

The Role of “Grey Capital”

One explanation gaining traction is the influx of so-called grey money funds of unclear or questionable origin that flow into Thailand through informal channels. The process often works as follows:

▪ Unknown capital flows into Thailand and is converted into baht.

▪ The baht is used to purchase digital assets.

▪ These digital assets are then liquidated back into baht and deposited in Thai bank accounts.

▪ The funds are withdrawn and circulated through consumption or reinvestment.

This cycle creates an artificial demand for baht, boosting its value beyond what the real economy can support. In short, the baht’s strength is less a reflection of economic recovery and more the result of speculative flows.

Why the Bank of Thailand is Concerned

The Bank of Thailand (BoT) has taken notice. In recent years, it has imposed stricter rules on non-resident baht accounts, capped speculative transactions, and prohibited certain derivatives to curb baht speculation. These measures reflect a deeper concern “that Thailand’s currency is being distorted by external capital flows rather than domestic growth.”

Implications for the Economy

Misleading signals: A strong baht does not automatically mean a strong economy. In fact, it may mask persistent weaknesses.

Export competitiveness: When the baht is too strong, Thai exporters struggle to remain competitive in global markets.

Jobs and investment: Overvaluation can eventually dampen foreign investment and put pressure on employment.

Volatility: With inflows driven by grey capital, exchange rate movements become unpredictable, making business planning more difficult.

The Takeaway

The current appreciation of the baht should not be taken at face value. Instead, it is a reminder to look beyond the numbers and ask “What kind of money is driving this strength?”

For policymakers, the challenge is clear to ensure that the baht reflects Thailand’s real economic fundamentals rather than temporary flows of speculative or grey capital. For the public, the message is equally important: a stronger baht does not always mean a stronger economy.

Victor Wong (Peerasan Wongsri)

Victor Wong (Peerasan Wongsri)

Victor Law Pattaya/Finance & Tax Expert

Email: <[email protected]> Tel. 062-8795414