In a striking move that could reshape the global financial landscape, China is pushing to end the U.S. dollar’s long-standing dominance. Pan Gongsheng, governor of the People’s Bank of China, has publicly promoted a new world monetary order—one in which the dollar no longer sits at the top.

China’s vision for future

Speaking at the prestigious Lujiazui Forum in Shanghai, Pan outlined a future where several major currencies coexist and keep one another in check. His vision: a more competitive, multipolar currency system that would offer greater checks and balances—and fewer opportunities for any single nation to dominate global trade.

“The global monetary system could evolve into one where several currencies coexist, compete, and mutually restrain each other,” Pan said. He added that such a structure would include both incentives and guardrails for the countries issuing those currencies.

The statement comes amid growing skepticism toward the United States, especially after the financial and trade conflicts triggered by former President Donald Trump. Since then, the dollar has weakened significantly—dropping more than 10% against both the euro and the British pound.

A rising yuan—and waning trust in the dollar

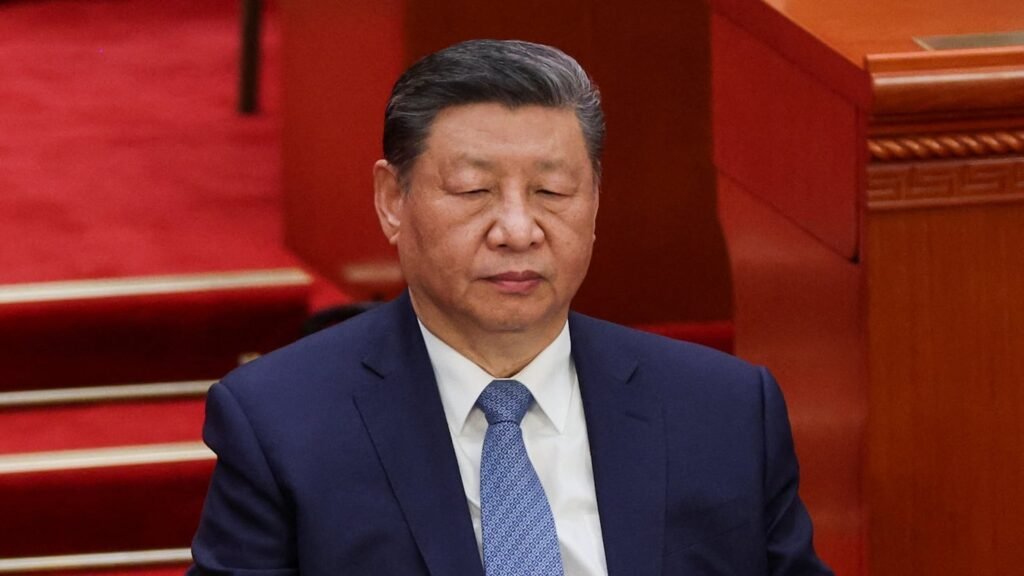

Pan highlighted the rising international stature of China’s yuan, crediting efforts by President Xi Jinping to establish the currency as a stable and reliable pillar of the global economy. While the yuan still lags far behind the dollar in global reserves, China has made major strides in building out the financial infrastructure needed for broader adoption.

The move reflects deeper concerns about overdependence on a single currency. European Central Bank President Christine Lagarde recently underscored the “global moment” of the euro, while some U.S. exporters, according to a US Bancorp official, have begun asking to settle international trades in alternative currencies, including the yuan, to avoid dollar volatility.

China’s central bank, however, has subtly adjusted its approach. After initially supporting the yuan with little hesitation, officials have since grown more cautious, seeking to avoid a rapid appreciation that could destabilize trade flows.

China is diversifying its currency reserves out of the US Dollar:

The share of US Treasury Holdings in total Chinese FX reserves has declined by ~15 percentage points since 2016, to ~22%, near the lowest in at least 15 years.

Over the same period, gold’s share has risen ~5… pic.twitter.com/uFa5bQTucg

— The Kobeissi Letter (@KobeissiLetter) June 26, 2025

Laying the groundwork for a new global system

Analysts at Morgan Stanley say broader international use of the yuan—also known as the renminbi—depends on continued economic growth and greater capital market openness. In line with that, China plans to establish a new operations center for its digital yuan and will promote offshore bond issuance by Chinese firms.

Pan also floated a provocative idea: using IMF Special Drawing Rights (SDRs) as a model for creating a new form of sovereign currency. Former central bank chief Zhou Xiaochuan had previously advocated for SDRs as the basis for a more stable, global monetary framework.

While SDRs are typically used during times of crisis, Pan suggested that broader and more regular issuance could help countries move toward a more balanced financial system—less beholden to the fluctuations of any one currency.

Get your game on! Whether you’re into NFL touchdowns, NBA buzzer-beaters, world-class soccer goals, or MLB home runs, our app has it all.

Dive into live coverage, expert insights, breaking news, exclusive videos, and more – plus, stay updated on the latest in current affairs and entertainment. Download now for all-access coverage, right at your fingertips – anytime, anywhere.