The State Council of China is reportedly looking to approve a revolutionary proposal to allow the use of stablecoins backed by the Chinese yuan, a drastic departure from their customary position toward digital assets, which in and of itself is not a recognition of cryptocurrency, as soon as mentioned however, will then allow issuance of a stablecoin like tether to their currency on the national stage. It is a definitive and significant way to create a means of whether we refer to as a plan to bolster the yuan on the global stage and to offer an alternative to the predominance of dollars as the basis for trade. This roadmap is the proposition for approval later this month to unlock the further potential for the yuan, to broaden its use internationally and to use stablecoin as a new method for cross-border trade and payments.

A Major Policy U-Turn

For years, China has maintained one of the world’s most restrictive policies on cryptocurrencies. The historic ban on all forms of crypto trading and mining in September 2021 was a definitive statement that Beijing would not sanction decentralized digital money. Yet, the momentum has shifted – likely realizing that dollar-pegged stablecoins became so widely used in global transactions, especially by Chinese exporters. Seeing that digital currencies will continue to have a place in the modern financial landscape, Chinese authorities are now “onboarding” a controlled, state-sanctioned version so they don’t miss the wave of development. Framing this shift as an accompanying framework to digital currencies shows an understanding that to compete in the new digital economy, you must continue to adjust your tools and remain not only relevant but also central and in control.

The Push for Cross-Border Use

The primary goal of a yuan-backed stablecoin is to facilitate cross-border trade and payments. Unlike traditional banking systems, which can be slow and expensive, stablecoins enable near-instant, low-cost transfers around the clock. China’s motivation is to leverage these technologies in order to facilitate greater trade with its partners–especially those within its sphere of influence. The rollout of the policy is likely to be a key discussion point at the upcoming Shanghai Cooperation Organization (SCO) Summit in Tianjin, and China will probably be looking to engage with other member countries about adopting yuan payments. This policy is also consistent with a possible progression towards a new digital payment corridor, disengaging from the historical dollar-centric financial architecture.

A Global Currency Race

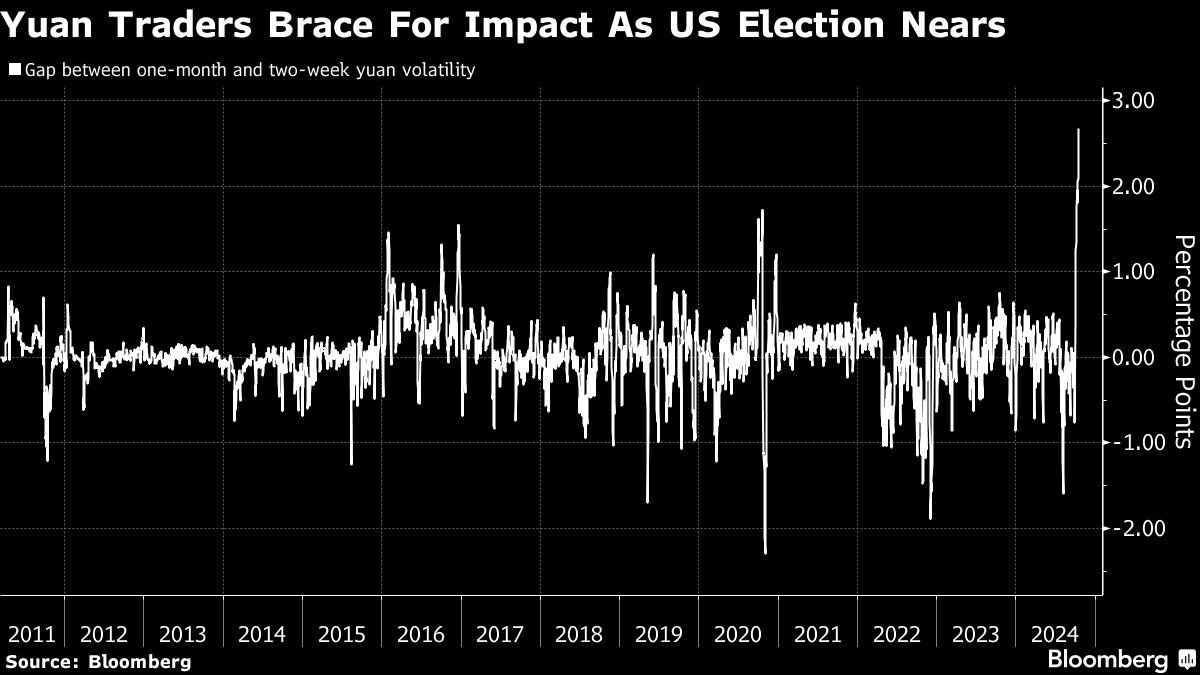

China’s ambition to internationalize the yuan is not new. Despite being the world’s second-largest economy, its currency ranks a distant sixth in global payments, with a mere 2.9% share as of June, according to Swift data. The US dollar, in contrast, dominates with a 47.2% share of global payments and an even more staggering 98% of the stablecoin market. The People’s Bank of China (PBOC) has been outspoken about its goal to lessen what it describes as “excessive reliance on a single sovereign currency.” A yuan stablecoin could be a way to directly address this disparity in global currency values, as well as to address the emergence of dollar-pegged digital assets, now gaining traction with the emergence of new regulatory regimes in the United States and elsewhere.

Pioneering Hubs in Hong Kong and Shanghai

To manage the rollout of this new policy, Beijing has identified Hong Kong and Shanghai as the initial testing grounds. Hong Kong, a global financial hub with a newly established stablecoin regulatory framework as of August 1st, is seen as a perfect location for an offshore yuan stablecoin. Shanghai is already developing a base for the digital yuan to be used internationally, creating a nice natural setting for a new digital base asset. These cities will provide a managed environment to test the stablecoin’s functions and to limit the uncertainty of capital flight if this had been on a larger scale, allowing Chinese regulators to absorb and react before any further rollout.

The Road Ahead: Controlled Innovation

The concept of a yuan-backed stablecoin is appealing but it is clear that China’s strategy will be methodical. Where decentralized cryptocurrencies are troubling, a new digital asset will be under state authority, with the People’s Bank of China as the primary state authority. The plan includes specified rules on preventing risk and monitoring capital flows that highlights that the government of Beijing prefers financial stability to free access. This reassessment includes a shift from adopting a free-spirited, borderless nature of crypto to using this technology to enhance the position of the yuan in an online and digital world at the same time as retaining firm control over the financial system.