- UK Autumn Budget anticipation mounts as markets remain calm, unlike during the ‘Trussonomics’ era.

- GBP/USD faces a critical juncture at the 1.3000 level, with potential for both upside and downside breaks.

- GBP/JPY nears the 200.00 handle, a daily close above could trigger a run towards July highs.

READ MORE: This article follows my previous GBP Price Action Ideas Piece on October 16.

The GBP has steadily gained ground against the majority of G7 counterparts with the exception of the US Dollar and Euro. The British Pound has held steady against the Euro and the USD as markets await more clarity on the rate cycles of the three central banks.

Over the last few weeks there appears to be a growing divergence in the expectations for the Federal Reserve and its counterparts at the Bank of England and the European Central Bank. Markets are starting to price in the possibility of more aggressive rate cuts from the latter two with the Fed seeing a reduction in rate cut expectations.

The change for the US Dollar has come from ongoing data releases which paint a positive picture for the US economy. The British Pound on the other hand has seen a significant drop in its latest services inflation print which came in well below the 5.5% the BoE projected for the end of 2024. This has ramped up rate cut expectations for the BoE and has weighed slightly on the Pound. Now all attention turns to the UK budget due tomorrow.

UK Autumn Budget

Attention now turns to the highly anticipated Autumn Budget in the UK which is also the first under the recently elected Labor Government. There are a host of questions regarding the UK budget with memory still fresh for many regarding the disaster of the ‘Trussonomics mini budget’ in 2022.

However, there are some important differences this time around and it seems markets are calm ahead of the event. There does not appear to be any political risk premium this time around with ING research pointing to a short-term EUR/GBP fair value at 0.834. Remember that in previous instances of political/gilt-related turmoil in the UK, the EUR/GBP risk premium was around 3-5%.

Secondly, CFTC figures from October 22 point to speculators holding a long bias on the British Pound. Traders held the largest net-long positions in GBP among G10 currencies, making up 32% of open interest, and these positions have resisted the shift back to the dollar seen in other major currencies.

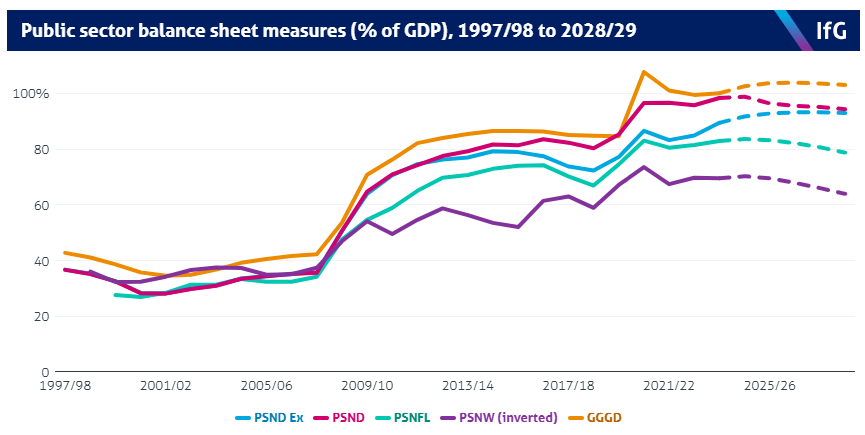

The key issues to pay attention to in the budget tomorrow include tax changes, fiscal rule changes and growth objectives and targets. The Labour manifesto emphasized in particular the importance of striking a “balance between prioritizing investment and the urgent need to rebuild our public finances”. This strikes a particular chord after Rachel Reeves stated last week that the Labor Government would look to redefine public debt in the budget. This has sparked some interest and it will be interesting to see how the Chancellor aims to do this.

This change, according to Reeves, aims to allow for increased borrowing to fund infrastructure and investment projects, potentially unlocking up to £50 billion. Reeves emphasized that this borrowing would be for long-term investments rather than day-to-day spending, aiming to boost economic growth and job creation.

Public Sector Balance Sheet (% of GDP)

Source: IFG

Tax on the wealthy is another sticking point of tomorrow’s budget. Looking back historically however, this would not be the first time the incoming Government has delivered tax hikes. In every fiscal event following an election since 1992, the chancellor has increased taxes.

All in all it promises to be an interesting one, although many would hope not as interesting as the now infamous Trussonomics budget of 2022.

Technical Analysis

GBP/USD

From a technical standpoint, GBP/USD is at a very important level with the 1.3000 psychological level in play. A daily candle close below this level could open up further downside for the pair.

A daily candle close above the 1.3000 level has proved elusive for the better part of a week. This leaves cable vulnerable to further downside with a potential run toward the 1.2800 area growing ever more appealing. Following my previous piece on GBP pairs where I had hoped for further gains above 1.3000, the technicals are beginning to point to the possibility of a break to the downside. .

There are two scenarios that could develop in the day/days ahead. The first one being a break and daily candle close above the 1.3000 handle which could open up further upside.

The second scenario, is a push lower and a break of the ascending trendline, this would open up a run toward support at 1.28060 (200-day MA).

Support

- 1.2950 (100-day MA)

- 1.2900

- 1.2806 (200-day MA)

Resistance

GBP/USD Daily Chart, October 29, 2024

Source: TradingView.com (click to enlarge)

GBP/JPY

GBP/JPY has been inching its way higher since bottoming out on August 5. There was another push down to the mid 180s on September 16 before the move higher began once more.

GBP/JPY broke above the 200-day MA as mentioned in my October 16 article before making a run toward the 200.00 handle. A high today of 199.690 leaves GBP/JPY at a critical junction heading into tomorrow’s budget.

On a daily chart, a daily candle close above the 200.00 handle tomorrow could open up GBP/JPY for a run toward its July highs at 207.57. There may be some resistance around the 203.00 handle which could lead to a pullback as the RSI is currently just shy of overbought territory.

Weakness in the British Pound tomorrow could bring the GBP/JPY toward the 200-day MA resting at the 195.00 handle. There is also another area of support resting at 193.84 before the 190.00 handle comes into focus.

GBP/JPY Daily Chart, October 29, 2024

Source: TradingView.com (click to enlarge)

Support

- 195.16 (200-day MA)

- 193.84

- 190.00

Resistance

EUR/GBP

EUR/GBP remains near the YTD low around the 0.8300 handle. The pair is struggling to gain acceptance above the confluence level of 0.8345 which is a confluence area.

Immediate resistance rests at 0.8342 with the 50 day MA resting at 0.8385 likely to provide some resistance as well. The region between 0.8400-0.8487 plays host to the 100 and 200-day MAs as well as the most recent swing high.

Conversely, should the GBP strengthen in light of the UK budget tomorrow then the YTD lows around 0.8295 will likely be broken before the 2022 lows around 0.8200 comes into focus.

EUR/GBP Daily Chart, October 29, 2024

Source: TradingView.com (click to enlarge)

Support

Resistance

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.