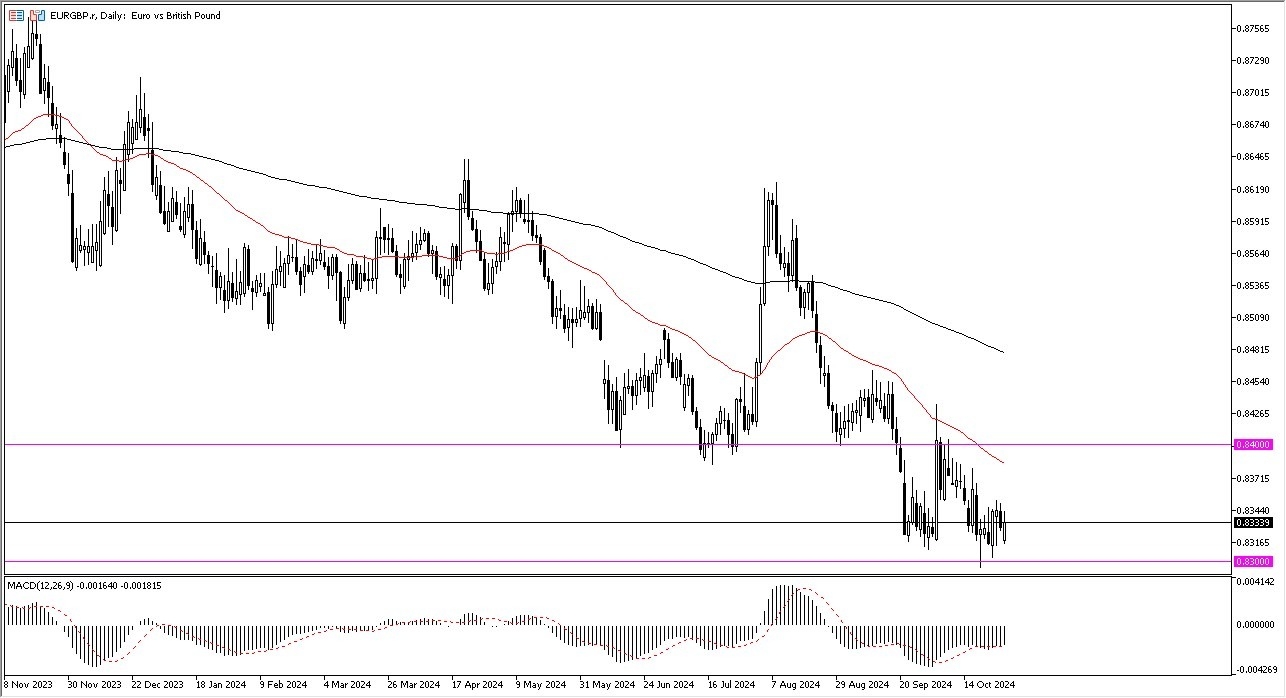

- The Euro has rallied a bit during the course of the trading session on Monday against the British pound.

- As we continue to see a lot of market participants test the 0.83 level for support.

- Ultimately, we did find it. And that of course is a relatively good sign, but we also have to keep in mind that we have been here multiple times in the past and as a result, the market is still currently cutting back and forth between the 0.83 level on the bottom and the 0.84 level on the top.

- The 50 day EMA sits just below the 0.84 level and is offering significant resistance as was support previously.

If We Break Higher

If we could break above the 0.84 level, then the market is likely to go looking to the 200 day EMA, which is closer to the 0.8480 level. If we were to turn around and break down below the 0.83 level, then the market really starts to unwind as it would be a break of the massive support level that’s been important for multiple years and at multiple times.

All things being equal, this is a market that is neutral, but it’s trying to sort out whether or not we are finding some type of floor for the market. I do expect choppiness and noisy behavior, but quite frankly, that’s nothing new for this pair. And ultimately, this is a market that I think given enough time, we’ll have to make a bigger decision. Once we break out of this 100 point range, then it will become increasingly obvious. If we do break out of that area, then the market is likely to continue to go much higher or lower, and the so-called “measured move” of course would be for 100 points. This is a pair that does tend to be very choppy and noisy, so keep that in mind if you are in fact trying to trade it.

Ready to trade our daily Forex forecast? Here’s some of the best forex broker UK reviews to check out.