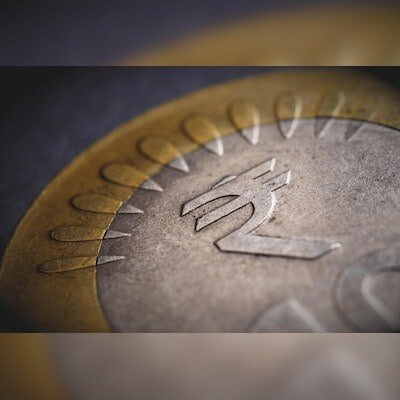

This move could also have an impact on the rupee, which may depreciate further.

Indian bonds and currency markets may feel the heat as JP Morgan Chase & Co is reportedly considering cutting the weight of the largest bond issuers in its flagship emerging-market index — including China and India.

Indian bonds (or Government Securities/G-Secs) were included in JPMorgan’s Global Bond Index – Emerging Markets (GBI-EM) only last year, with effect from June 28, 2024.

Financial market players caution that if India’s weight in the aforementioned index is cut from 10 per cent to 9 per cent, there could be selling pressure in G-Secs, leading to hardening of the yields.

This could also have an impact on the rupee, which may depreciate further.

K Arvind, Head – Treasury, Tamilnad Mercantile Bank, said: “Everybody was gung-ho about the inclusion of our G-Secs in the JPMorgan Index and the Bloomberg Index. Now, if JPMorgan plans to cut the India’s weight in its index, it will be negative for our markets. I think our bond yields will jump… It will have a ripple effect on the Rupee too.”

Tariff tussle

Market players said that the US seems to be opening up another front in its tariff tussle with India and China via possible recalibration of country risk weights in JPMorgan’s GBI-EM.

Bloomberg, in a report, said JPMorgan Chase & Co will cut the weight of the largest bond issuers in its flagship emerging-market index, diverting investor flows from the likes of China and India toward smaller nations.

The Wall Street bank will gradually lower the issuer cap on its GBI-EM Global Diversified Index in the first half of 2026, according to a client notice seen by Bloomberg.

The limit will fall to 9 per cent from 10 per cent currently, with the implementation to be phased over a period of several months, the documents dated Friday said.

Edelweiss Mutual Fund, in a September 2023, report said that a 10 per cent weight for G-Secs would attract $21 billion (about ₹1.7 lakh crore) worth of investments in the bonds by March 31, 2025 assuming investors have zero weight as of now and would like to be index neutral.

Published on September 15, 2025