Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

People really really REALLY don’t like the dollar at the moment. It’s approaching the point where we can call it the Manchester United of currencies. Just check out this MainFT story from yesterday:

Fund managers are taking the most bearish stance on the dollar in more than a decade, as the currency bears the brunt of the damage from unpredictable US policymaking.

The dollar is down 1.3 per cent this year against a basket of peers including the euro and the pound — on top of a 9 per cent drop in 2025 — and is hovering close to a four-year low.

A Bank of America survey published on Friday said fund managers’ exposure to the dollar had dropped below last April’s nadir, when President Donald Trump spooked the world with sweeping tariffs. The survey found that the managers’ positioning in the dollar was the most negative since at least 2012, the earliest year for which it had data.

The CFTC’s “Commitment of Traders” report on futures positioning also indicates a pretty glum view of the dollar’s prospects. Positioning data from State Street shows a sizeable underweight on the part of foreign asset managers. And Alphaville’s inbox is bursting with bearish takes, from banks, asset managers, economic consultancies in Asia, Europe and the US too.

On the other hand . . .

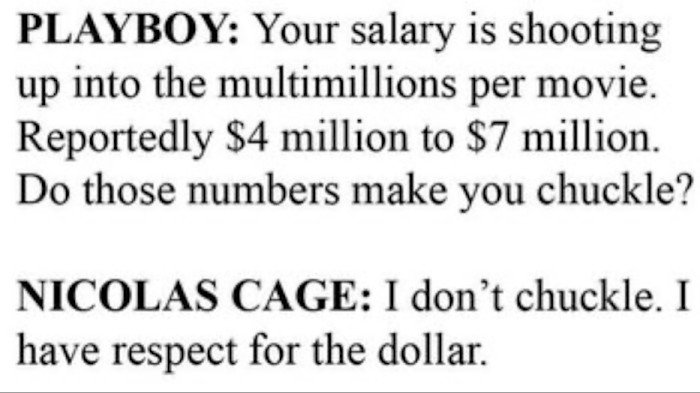

Look, performative contrarianism is incredibly tedious — and nothing Alphaville writes is ever investment advice — but it does feel like people are so unbelievably negative on the dollar that a big turnaround now seems more probable than another leg down. Maybe we should take a leaf out of Nic Cage’s playbook and show it a little more respect?

Let’s take a step back. As we’ve banged on about for a while now, there are two related but distinct questions surrounding the dollar:

1) Can it retain its status as the pre-eminent currency for international trade, business and finance?

2) Will the dollar weaken or strengthen against its biggest counterparties?

These two are often conflated, but they are actually very different questions. The dollar has weakened sharply during periods where its position as the global reserve currency has become even more pronounced (viz, the mid-1980s through the 1990s), and strengthened when the US system appears to be failing (the GFC).

On the first question, Alphaville has been a longtime sceptic of dollar doomerism. There’s an almost visceral desire among a wide variety of people for the dollar to lose its lustre, but aside from a glacial decline in its share in global central bank FX reserves there’s little evidence that it has, or even will.

About 54 per cent of all export invoices are still denominated in dollars. In finance the greenback’s reign is even more supreme. Roughly 60 per cent of all international loans and deposits are in dollars, and 70 per cent of international bond issuance. Turning to FX markets, 88 per cent of all transactions involve the dollar. Almost half of the more than $2tn worth of US bank notes in issue are held by foreigners. And despite a gradual decline dollar still accounts for almost 57 per cent of the world’s official foreign currency reserves (and much more of unofficial reserves).

Sure, its dominance might wax and wane a little in relative terms, but there’s simply no real viable alternative to the dollar either. Despite the Trump administration’s incoherent and chaotic policymaking, even talk of a “multi-polar” reserve system seems wildly fanciful at the moment.

On the second question — on whether the dollar will weaken further — who knows. As the old joke goes, God invented FX strategists to make economists seem accurate.

Even before Trump came to power you could argue that the dollar was “grossly overvalued”. The post-Trump rush to pare back exposure to the US currency (if not US assets) made a lot of sense, given everything that has happened. Given how slowly most institutional investors move, this could continue for a few years.

But just think, over the past year we’ve had talk of “user fees” for foreign buyers of Treasuries; another debt-gorged government budget; a frontal assault on the Federal Reserve’s independence; the evisceration of entire government agencies; the mass flaunting of legal norms; masked government security officials rounding up people on the streets; the abduction of an overseas president; a flirtation with a selective default; and even overt threats to invade Nato allies.

And the dollar has fallen . . . roughly 7 per cent since Trump was elected.

Sure, if the US actually invades Greenland, arrests the entire FOMC or declares that some Treasuries “don’t count” then the dollar will fall a lot further. State Street’s aggregate positioning data has been had larger absolute underweights in 2006, 2014, and 2020 so it’s not like asset managers haven’t any got more dollars to sell. More realistically, if the AI trade continues to implode then the foreign inflows into US equities that have helped support the dollar could reverse course and send it lower.

But right now it feels like so many people are so gloomy about the dollar that Alphaville wouldn’t be surprised to see a bounce. All we now need is some kind of celebrity asking to be paid in euros to mark its nadir.