- AUD/USD alternated gains with losses below 0.6600 on an apathetic Monday.

- The US Dollar gave away part of its recent multi-day advance post-Fed.

- The advanced S&P Global PMIs will grab all the attention in Oz on Tuesday.

The Australian Dollar (AUD) slipped again on Monday, with AUD/USD dropping back under the 0.6600 support level. That move came after last week’s failure to hold above the 0.6700 mark, which had been the highest in months.

Interestingly, the retreat happened even as the US Dollar (USD) lost a bit of momentum. The US Dollar Index (DXY) gave back some ground after a three-day rally, unwinding part of the reaction to the September 17 Federal Open Market Committee (FOMC) meeting.

Stubborn inflation keeps the RBA cautious

Australia’s inflation story remains sticky. July’s Monthly CPI (Weighted Mean) accelerated to 2.8% from 1.9% in June, while Q2 CPI rose 0.7% QoQ and 2.1% YoY.

That explains why the Reserve Bank of Australia (RBA) isn’t in a rush to cut. Policymakers are cautiously supporting growth to prevent another price flare-up, as inflation remains higher than they would prefer.

Domestic economy holding up better than feared

Despite global uncertainty, the Australian economy has shown surprising resilience. August’s Manufacturing PMI came in at 53.0, while Services hit 55.8, both firmly in expansion territory.

Retail Sales climbed 1.2% in June, the July trade surplus widened to A$7.3 billion, and business investment ticked up in Q2. GDP also surprised on the upside, rising 0.6% QoQ and 1.8% YoY.

The labour market is a little more mixed. Unemployment held steady at 4.2% in August, but total employment fell by 5.4K.

RBA sticks to data-driven path

Earlier this month, the RBA trimmed the Official Cash Rate (OCR) by 25 basis points to 3.60% and pared back its 2025 growth forecast. Governor Michele Bullock has since made clear that deeper cuts aren’t on the table for now, stressing that policy decisions will depend on the data.

The minutes echoed that stance: if the labour market shows fresh signs of weakness, the RBA could move faster, but if growth holds steady, changes will be more gradual.

Appearing before a House economics committee, Governor Bullock also emphasised that growth and inflation remain in a “good place”, signalling there’s no pressing need to cut rates.

Heading into next week’s policy meeting, markets broadly expect the RBA to stay on hold, with implied pricing pointing to about 26 basis points of easing by year-end.

China still the swing factor

China continues to heavily influence Australia’s outlook. Q2 GDP there grew 5.2% YoY, but August retail sales disappointed at 3.4%.

PMIs are also mixed: manufacturing slipped back into contraction at 49.4, while services barely held above 50 at 50.3. On top of that, deflation risks linger, with CPI down 0.4% in the year to August.

The People’s Bank of China (PBoC) kept its Loan Prime Rates unchanged in September: 3.00% for the One-Year and 3.50% for the Five-Year, just as markets expected.

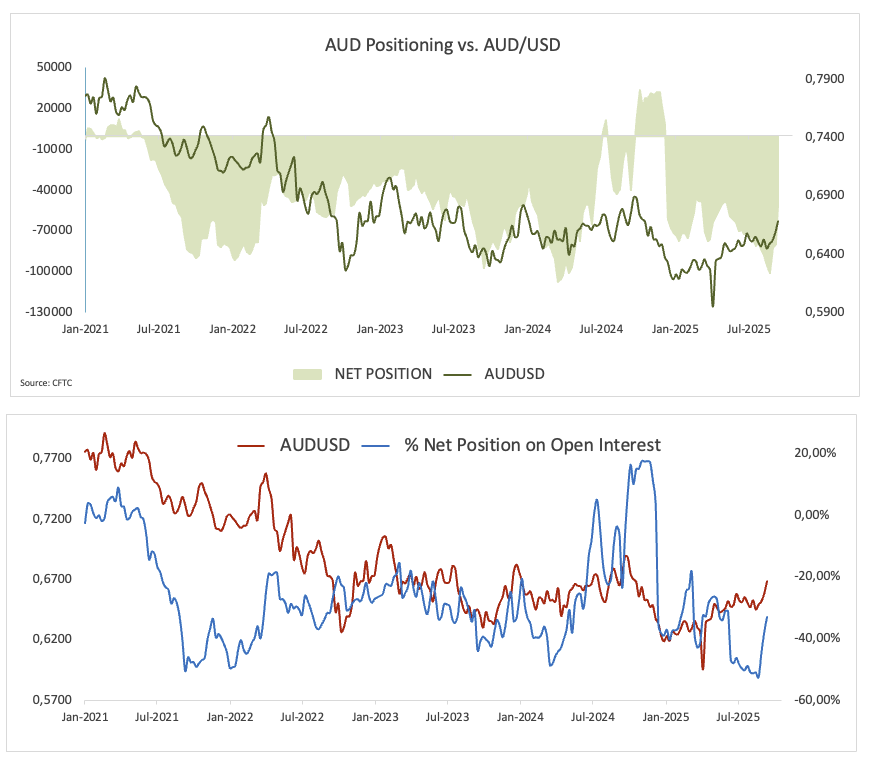

Speculators remain sellers of the AUD

According to the Commodity Futures Trading Commission (CFTC) data for the week ending September 16, speculators trimmed their bearish bets on the AUD, with net shorts falling to around 51.2K contracts, the lowest since May. Of note, however, is that open interest decreased sharply to nearly 154K contracts.

Technical landscape

From a technical standpoint, if buyers regain control, AUD/USD could retest its 2025 ceiling at 0.6707 (September 17). A clean break higher would expose last year’s peak at 0.6942 (September 30), just shy of the 0.7000 round level.

On the downside, provisional support sits at the 55-day and 100-day Simple Moving Averages (SMAs) at 0.6535 and 0.6510, respectively. A breach below this region could bring the August floor at 0.6414 (August 21) back into focus, seconded by the 200-day SMA at 0.6396, and then the June valley at 0.6372 (June 23).

Furthermore, momentum indicators show a softer tone but still point to a constructive outlook:The Relative Strength Index (RSI) has eased to around 52, pointing to waning bullish momentum, while the Average Directional Index (ADX) near 20 suggests the broader trend is only gradually strengthening.

AUD/USD daily chart

Short-term view

AUD/USD’s recent push through the 0.6400–0.6600 range still looks shaky. For a more convincing breakout, markets may need a bigger catalyst, whether that’s stronger data out of China, a dovish pivot from the Federal Reserve (Fed), or the RBA maintaining a more firm stance.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.