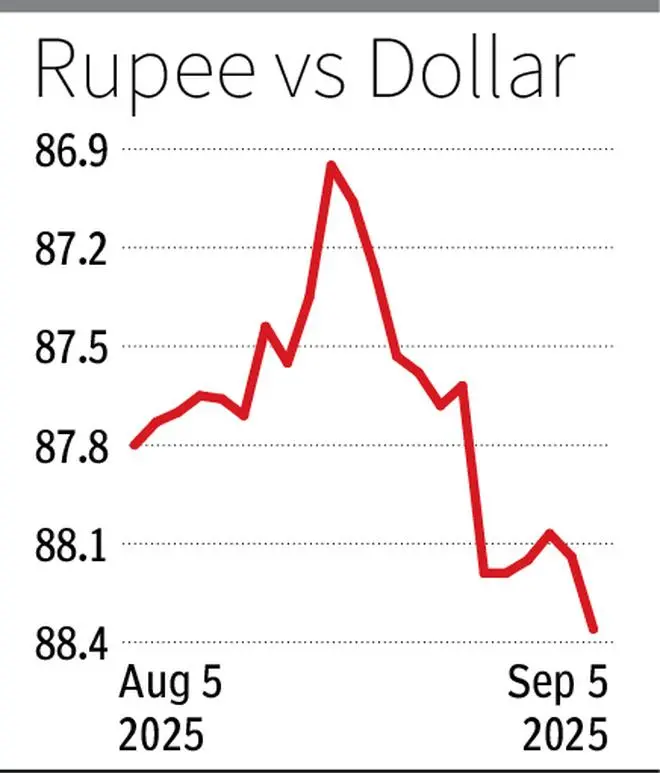

The Indian rupee slid to yet another all-time low on Friday, touching 88.36 mark against the US dollar. The depreciation came on the back of persistent foreign portfolio outflows and growing unease over the resurgence of global trade frictions.

“After already slapping steep tariffs on Indian goods, fresh buzz in the market suggested that the US could be mulling curbs on IT services, outsourced processes, and remote work. While unconfirmed, such speculation rattled traders, given the crucial role of services exports in cushioning India’s current account,” says Amit Pabari, MD at CR Forex. Adding fuel to the fire, US President Donald Trump’s latest tariff threats on semiconductor imports have only clouded the global trade outlook further, dragging down sentiment across risk assets.

Overall dollar demand remains elevated, as consistent equity and debt market outflows continue to weigh on sentiment. Any fresh development on the tariff front will likely carry outsized weight in driving its trajectory. Until clarity emerges, the bias for the rupee stays tilted towards depreciation. From a technical perspective, resistance is now seen in the 88.80–89 zone, while strong support remains at 87.50, according to Pabari.

The Reserve Bank of India (RBI) frequently intervenes in the forex market, including selling dollars, to manage liquidity and curb sharp volatility in the rupee. Kunal Sodhani, head of treasury at Shinhan Bank, says the RBI at this juncture may not intervene aggressively to maintain export competitiveness against China in the backdrop of tariffs. The central bank doesn’t eye any level but may intervene in case of any excessive volatility.

“Weak US jobs data reinforced the expectations of a September rate cut by the Federal Reserve. 20-day Exponential Moving Average (EMA) trades near 87.73 acts as a major support while 88.70 levels can be tested,” he said.

Published on September 5, 2025