- EUR/USD rallies toward 1.1700 as softer U.S. CPI data boosts Fed rate-cut probability to 94.2%, pressuring the dollar.

- Technical structure remains bullish, with price holding above the 1.16556–1.16645 H4 Fair Value Gap and eyeing 1.175–1.18 targets.

- Bearish risks emerge if 1.1655 support fails, opening the path toward 1.1600 and potentially 1.1550.

The euro is building on its bullish footing against the U.S. dollar after a mixed but dovish-leaning U.S. CPI report reinforced expectations of a Federal Reserve rate cut in September. EUR/USD is now trading around.

While core CPI YoY came in slightly above forecast at 3.1%, the headline CPI YoY remained unchanged at 2.7%, missing estimates for 2.8%. Markets interpreted this as a sign that inflationary pressures are not re-accelerating, allowing the Fed more room to ease policy without reigniting price growth.

The euro, supported by steady Eurozone data and a technical structure that has respected key retracement zones, has benefited directly from the resulting dollar weakness.

US inflation results and EUR/USD reaction

|

Data |

Actual |

Forecast |

Previous |

Market Impact |

|---|---|---|---|---|

|

Inflation Rate YoY (Jul) |

2.7% |

2.8% |

2.7% |

Slight miss supported a dovish Fed outlook. |

|

Core Inflation Rate YoY (Jul) |

3.1% |

3.0% |

2.9% |

Small upside surprise but overshadowed by stable headline CPI. |

|

Inflation Rate MoM (Jul) |

0.2% |

0.2% |

0.3% |

On target, no hawkish shift. |

|

Core Inflation Rate MoM (Jul) |

0.3% |

0.3% |

0.2% |

Matched forecasts, keeping cut expectations alive. |

Traders largely dismissed the slight core CPI beat, focusing instead on the fact that headline CPI YoY remains anchored at 2.7%. This reinforced a dovish Fed bias and triggered a USD sell-off, giving EUR/USD the momentum to push toward the top of its range.

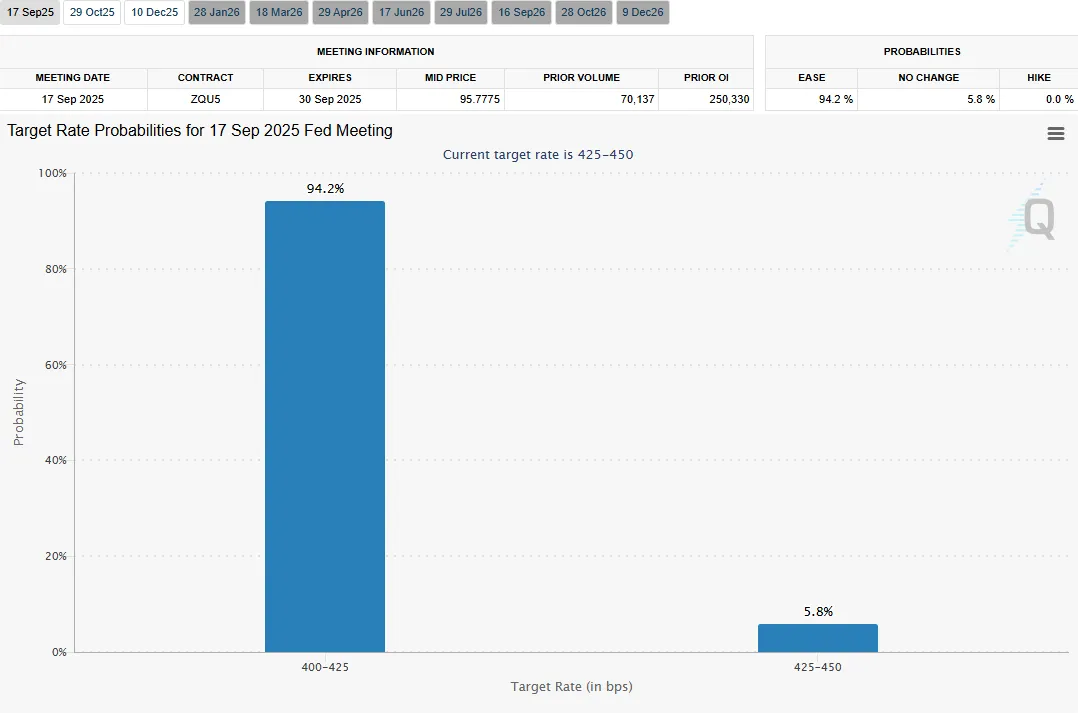

Rate cut probability surges to 94.2%

The CME FedWatch tool now shows a 94.2% probability of a 25 bps cut at the September 17 FOMC meeting—up sharply from 84.5% in our August 12 forecast.

This jump reflects market conviction that the Fed will take action, as YoY inflation has stabilized and risks of re-acceleration appear limited. The pricing shift further undercuts

How the bullish bias materialized

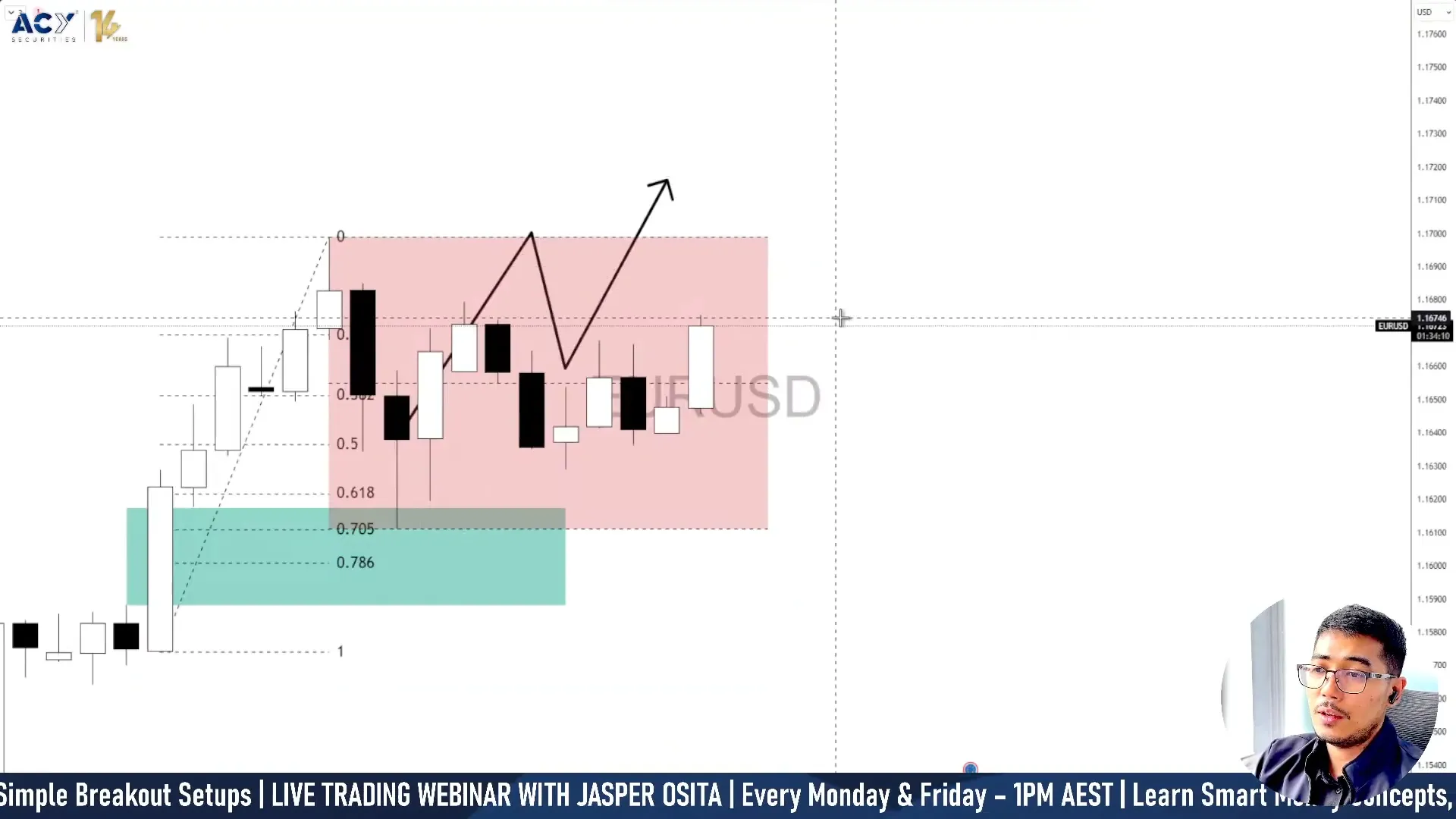

In the previous webinar, our bullish projection outlined:

- EUR/USD holding the 0.705–0.786 retracement zone as a demand base.

- Another round of price run towards the lows of the discount/retracement level, gearing towards upside ahead of CPI release.

- Liquidity targets above 1.1700 as the next milestone.

Following the inflation release, the market followed this blueprint precisely—rejecting deeper downside, reclaiming the upper range, and moving toward breakout territory.

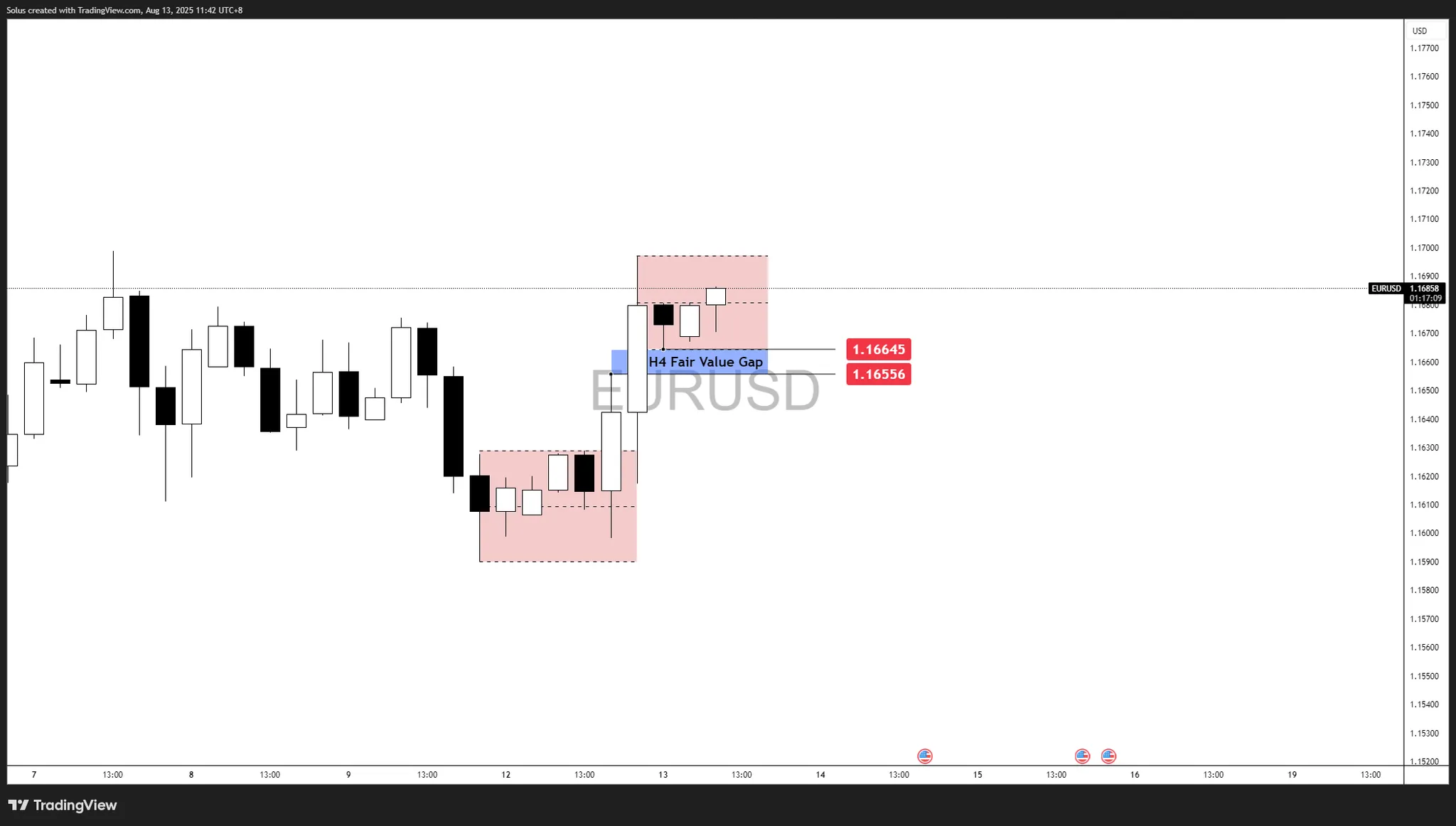

Technical outlook: EUR/USD retains bullish control above four-hour fair value gap

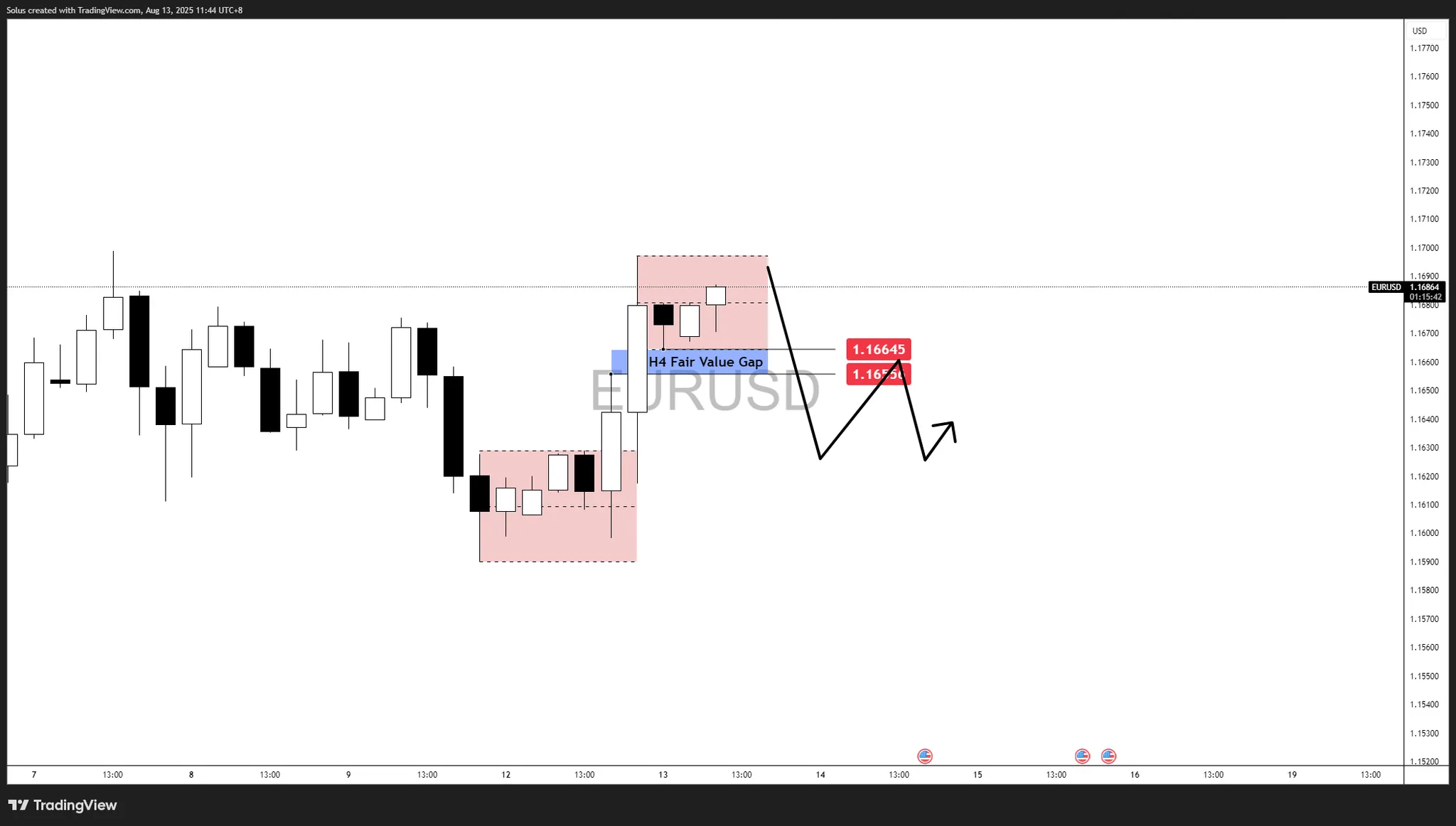

The recent EUR/USD price action confirms a bullish market structure, with price breaking higher from the earlier consolidation zone and now leaving the H4 Fair Value Gap (FVG) between 1.16556 – 1.16645 untouched as potential fresh intraday support for pullback opportunity.

The rally from the August 12 low was impulsive, sweeping prior liquidity and leaving behind a clean demand imbalance that aligns with our prior bullish roadmap. Current price action shows a modest consolidation just below 1.1700, a key breakout level.

Bullish scenario: Breakout or retest continuation

EUR/USD is currently consolidating just under the 1.1700 breakout level after a sharp rally from the August 12 lows. Price is holding above the H4 Fair Value Gap (1.16556 – 1.16645), which is acting as a key intraday support zone.

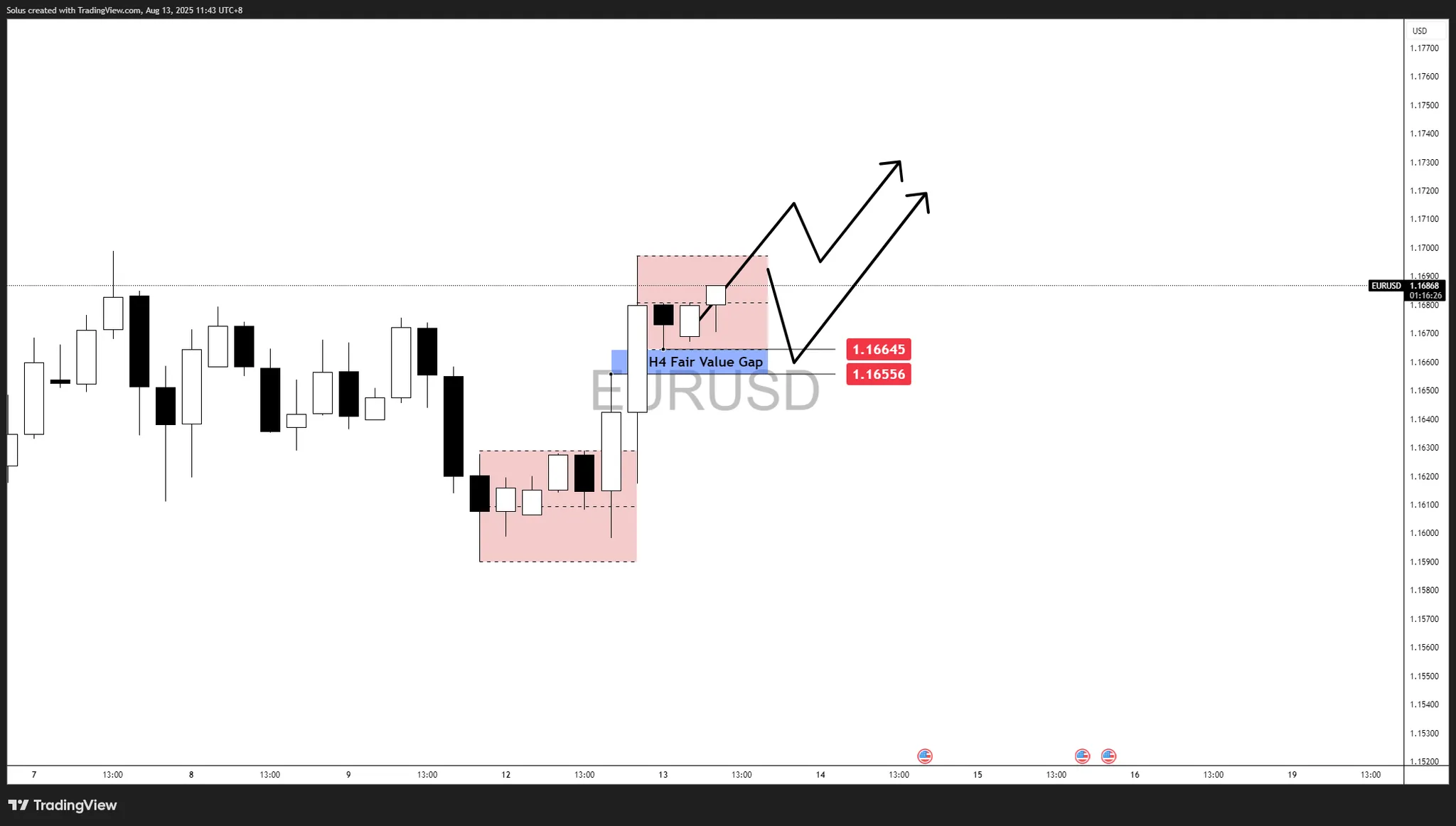

From here, there are two bullish pathways:

Immediate breakout:

- A clean break above 1.1700 could open a fast move toward 1.175, with extended upside targeting the liquidity pool at 1.18.

- Momentum traders may look for a continuation entry on a confirmed candle close above 1.1700.

FVG retest before breakout:

- Price may retrace into the 1.16556 – 1.16645 H4 FVG for a deeper liquidity grab before resuming higher.

- This pullback would offer a high-probability long entry if bullish order flow is reasserted from the gap zone.

- Following the retest, the same upside targets remain: 1.175 (first target) and 1.18 (secondary target).

Bullish invalidations:

- A sustained break below 1.1655 would weaken the bullish structure and shift focus back to 1.1556 demand.

Bearish scenario: Rejection and deeper pullback

EUR/USD is showing signs of stalling just below the 1.1700 breakout level, with the potential for a rejection that sends price back toward the H4 Fair Value Gap (1.16556 – 1.16645).

If the gap fails to hold as support, bearish pressure could accelerate toward the 1.1600 psychological level which marks the prior accumulation base and key liquidity pool before the CPI momentum.

Bearish pathway:

- Price rejects from 1.1700 and drops into the 1.16556 – 1.16645 FVG..

- Weak reaction or a clean break below this zone signals a loss of short-term bullish structure.

- Downside targets:

-

- Target 1: 1.1600 – minor support / psychological level.

- A break below 1.1600 exposes a deeper slide toward 1.1550.

Bearish invalidation:

- A sustained rally and close above 1.1700 would negate this short-term bearish outlook and put buyers back in control.