Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD at lows across Asia

The US dollar fell back to recent lows – with the USD index closing at the lowest level since 12 January – as markets looked ahead to key commentary from the US Federal Reserve this week.

The minutes of the Fed’s most recent policy meeting are due on Thursday morning while the Jackson Hole Symposium of central bankers will be held on Thursday and Friday evening (all times AEST).

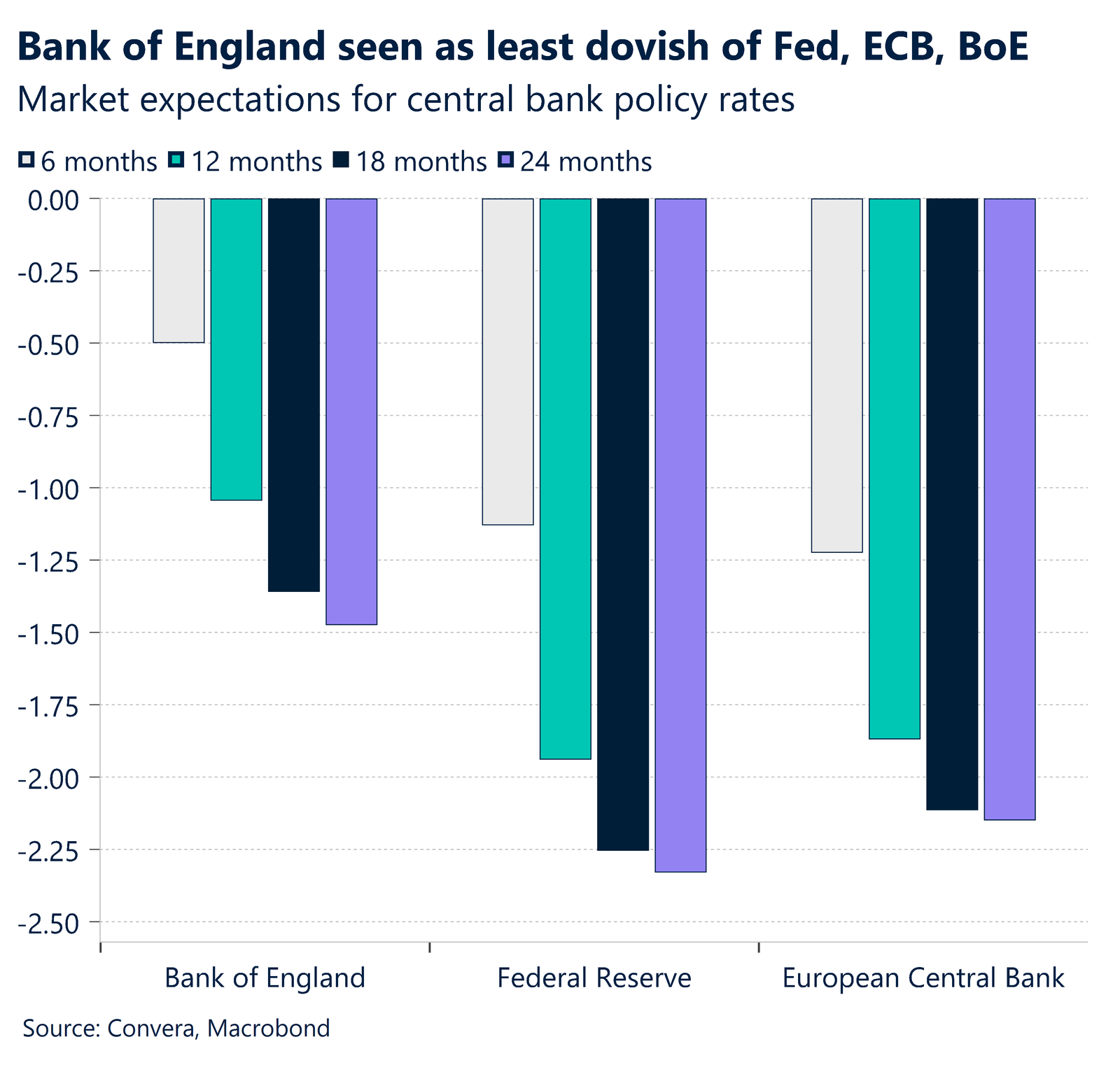

Financial markets will be looking for any clues about potential rate cuts from the Federal Reserve when it next meets in mid-September with markets seeing a 25bps cut as fully priced in with a 25% chance of a 50bps cut.

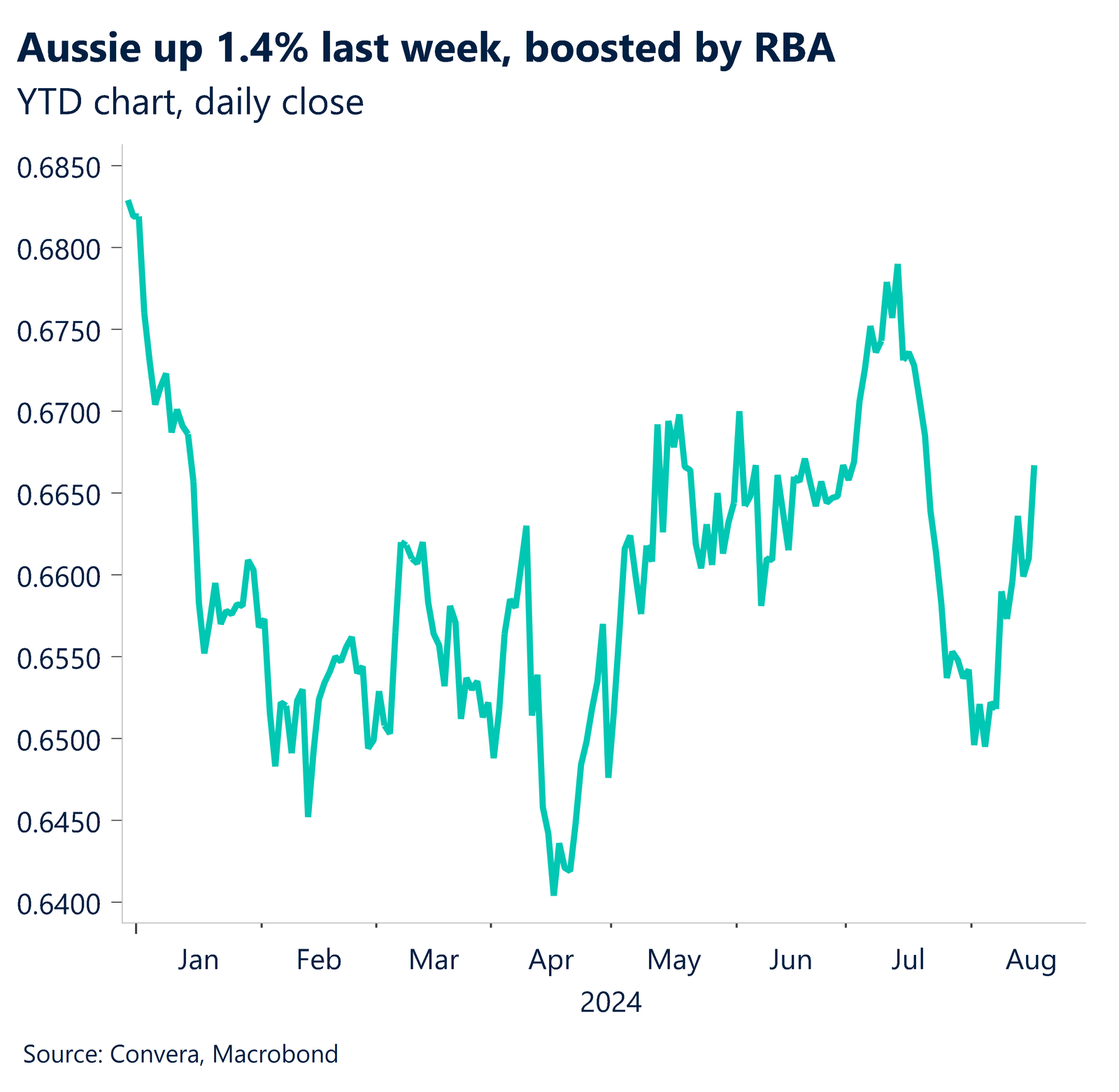

The Australian dollar had a strong week with the AUD/USD up 1.4% helped by more belligerent commentary from the Reserve Bank of Australia.

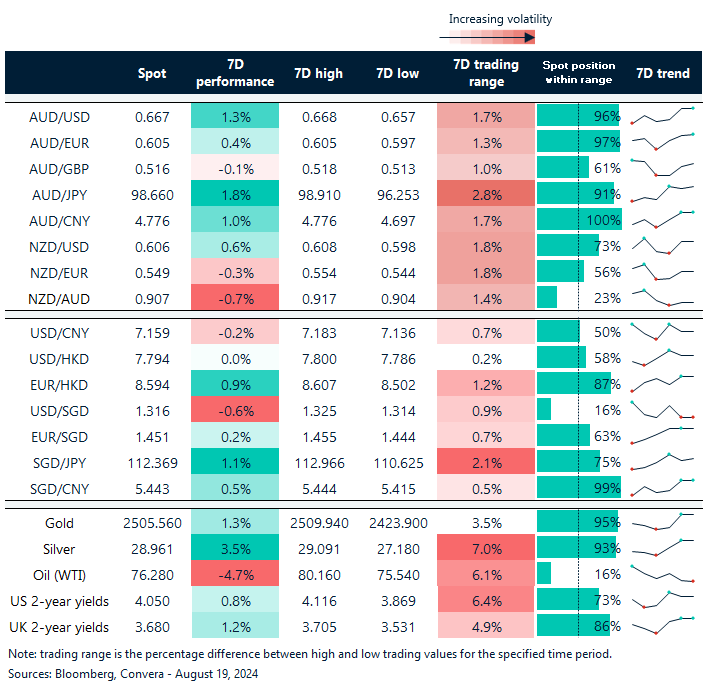

The kiwi was a surprise winner, up 1.1% last week, despite a 25bps rate cut from the Reserve Bank of New Zealand.

The USD/SGD closed at the lowest level since February 2023, down 0.6% over the week.

The USD/CNH was only moderately lower after some disappointing economic data kept the pressure on the Chinese yuan.

Greenback might see consolidation after weakness

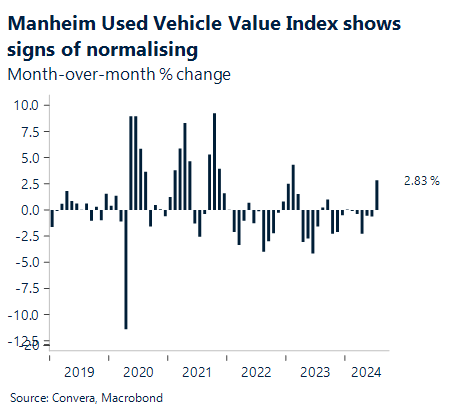

The recent US dollar weakness has been partly driven by an expectation of a slowdown in inflation – and upcoming used car data will be key.

In keeping with previous remarks from Black Book, we anticipate that the mid-month Manheim index will demonstrate that wholesale used car prices moderated in the first half of August.

In July, the index surprisingly rose 2.8% month over month after declining for five months in a row.

The US dollar’s recent move lower has seen some momentum measures turned stretched so a period of consolidation, or even rebound, cannot be ruled out.

Central banks in focus this week

Apart from the Federal Reserve, FX markets will likely be driven by other central bank news, with China’s loan prime rate and Reserve Bank of Australia minutes due on Tuesday.

Later, policy announcements are due from Sweden’s Riksbank, Bank of Thailand and Bank of Korea.

The Riksbank’s rate announcement on Tuesday will be closely watched as markets anticipate the repo rate to be held at 3.50%. This decision could impact the Swedish krona and potentially influence broader European currency movements.

Bank of Thailand’s monetary policy meeting on Wednesday and Bank of Korea’s monetary policy meeting on Thursday respectively, are both expected to maintain current rates, but any hints about future policy direction could affect the Thai Baht, Korean won and other Asian currencies.

US dollar at lows ahead of major Fed chat

Table: seven-day rolling currency trends and trading ranges

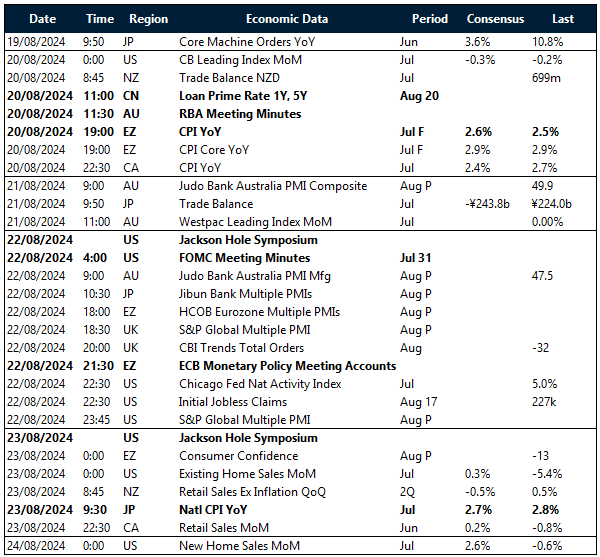

Key global risk events

Calendar: 19 – 24 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]