Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

CNY at new lows as PBoC steps back

Asian FX markets remained pressured on Thursday with the Chinese yuan leading losses even as People’s Bank of China kept interest rates – the loan prime rates – on hold.

The People’s Bank of China set yesterday’s daily fix at the lowest level since November as the central bank allowed the CNY to gradually decline further. The USD/CNH gained 0.2% and hit seven-month highs.

Financial markets expect the PBoC to loosen policy further as growth slows and inflation remains below target. The Shanghai Composite is down 6.0% over the last month after earlier seeing a strong rally for most of 2024.

Potential changes in how the PBoC manage their economy – possibly engaging in open market operations along the line of other large economies – might also impact the Chinese yuan

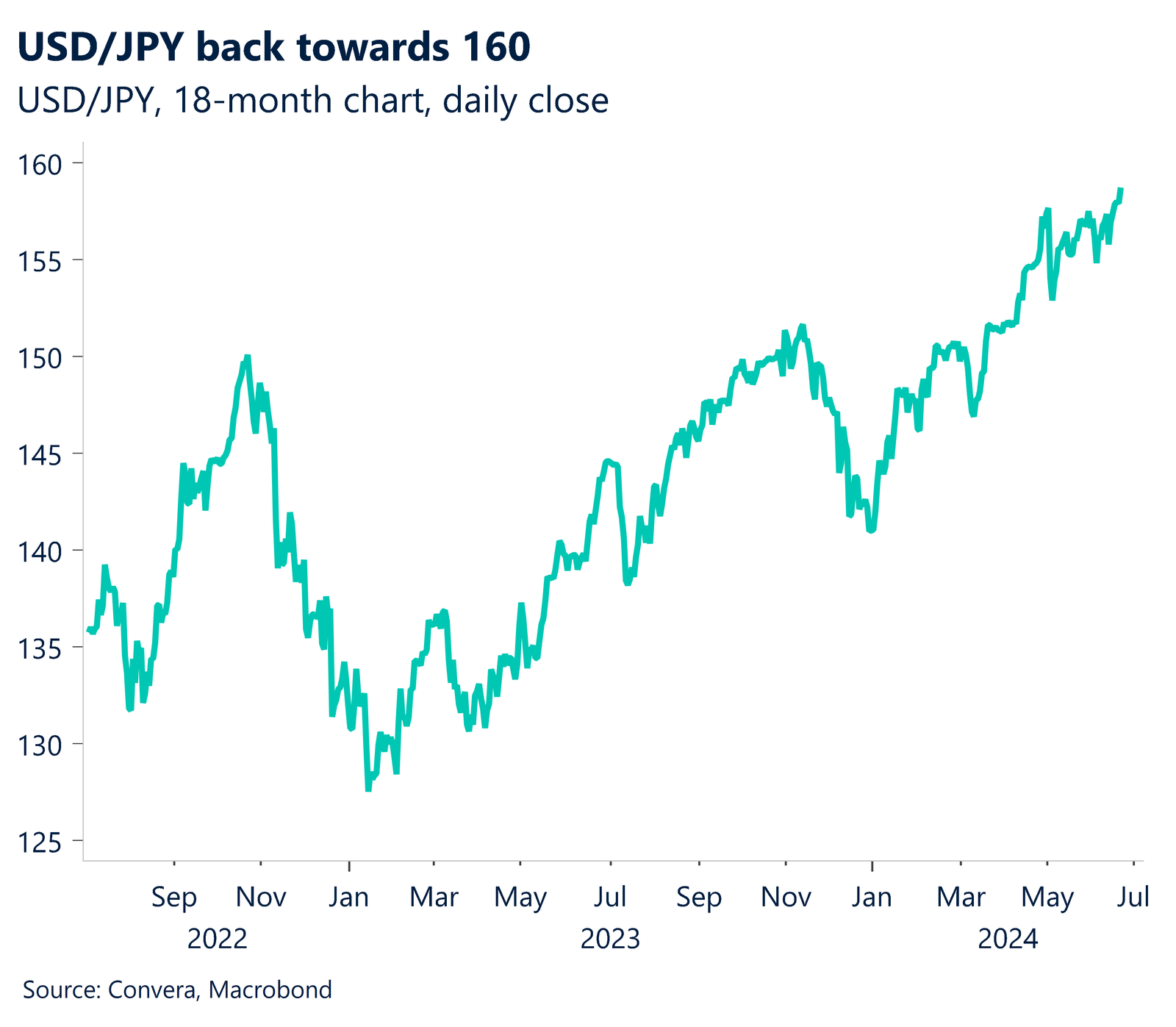

Other Asian markets were also weaker, with USD/JPY up 0.5% and back near key levels at 160.00 at which Japanese authorities have previously intervened. USD/SGD retuned to five-week highs at 1.3550.

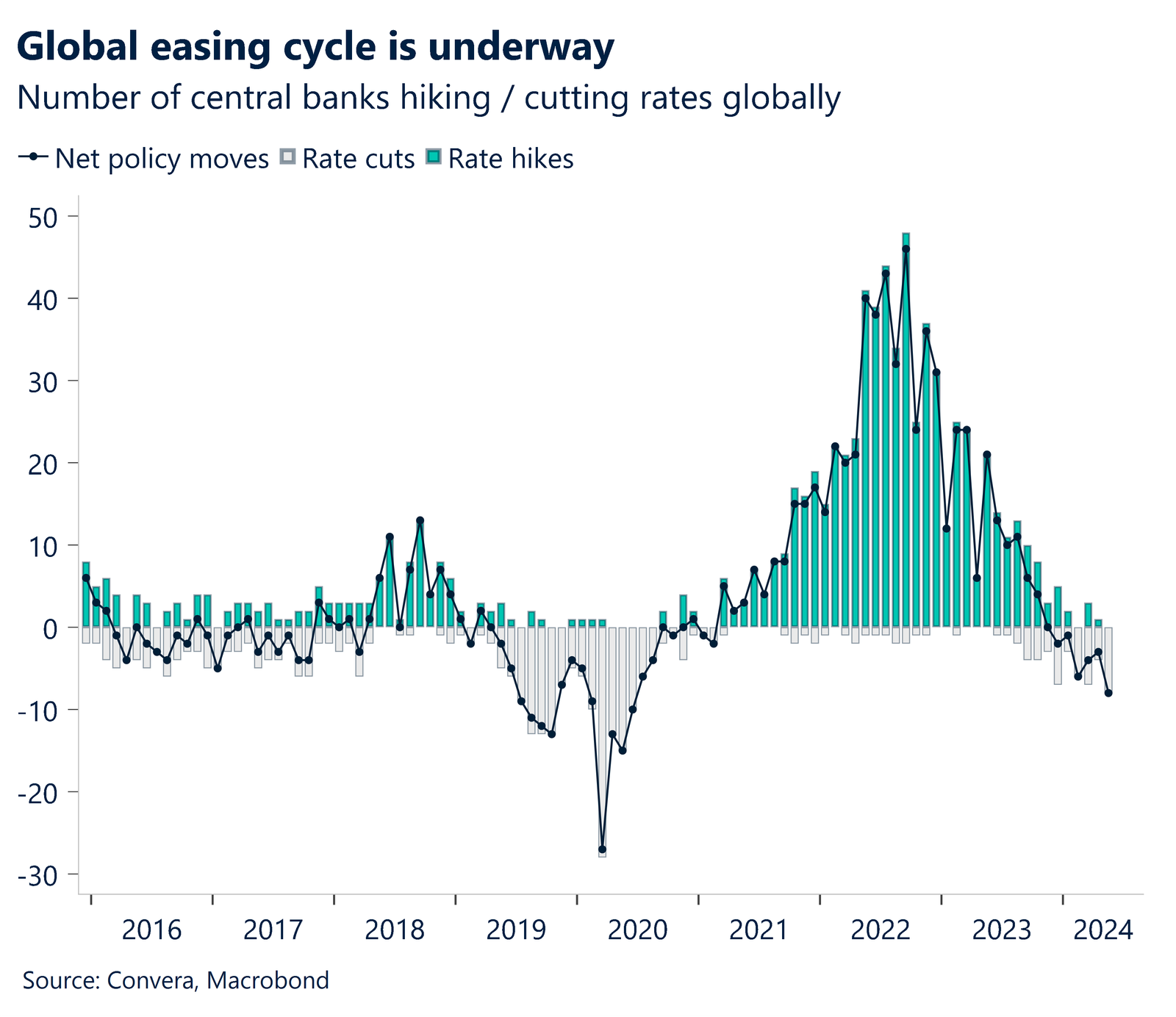

SNB cuts again

In Europe, all eyes were on central bank decisions with the Swiss National Bank cutting rates by 25bps to 1.25%, while the Bank of England and Norway’s Norges Bank kept rates on hold. The SNB’s was the second cut this year for the Swiss central bank.

The Swiss franc, recently boosted by safe-haven flows as investors fret about upcoming French parliamentary elections, fell from recent highs. The euro and pound were also mostly weaker.

The Aussie and kiwi eased overnight, with AUD/USD and NZD/USD lower, but both currencies gained well versus European currencies.

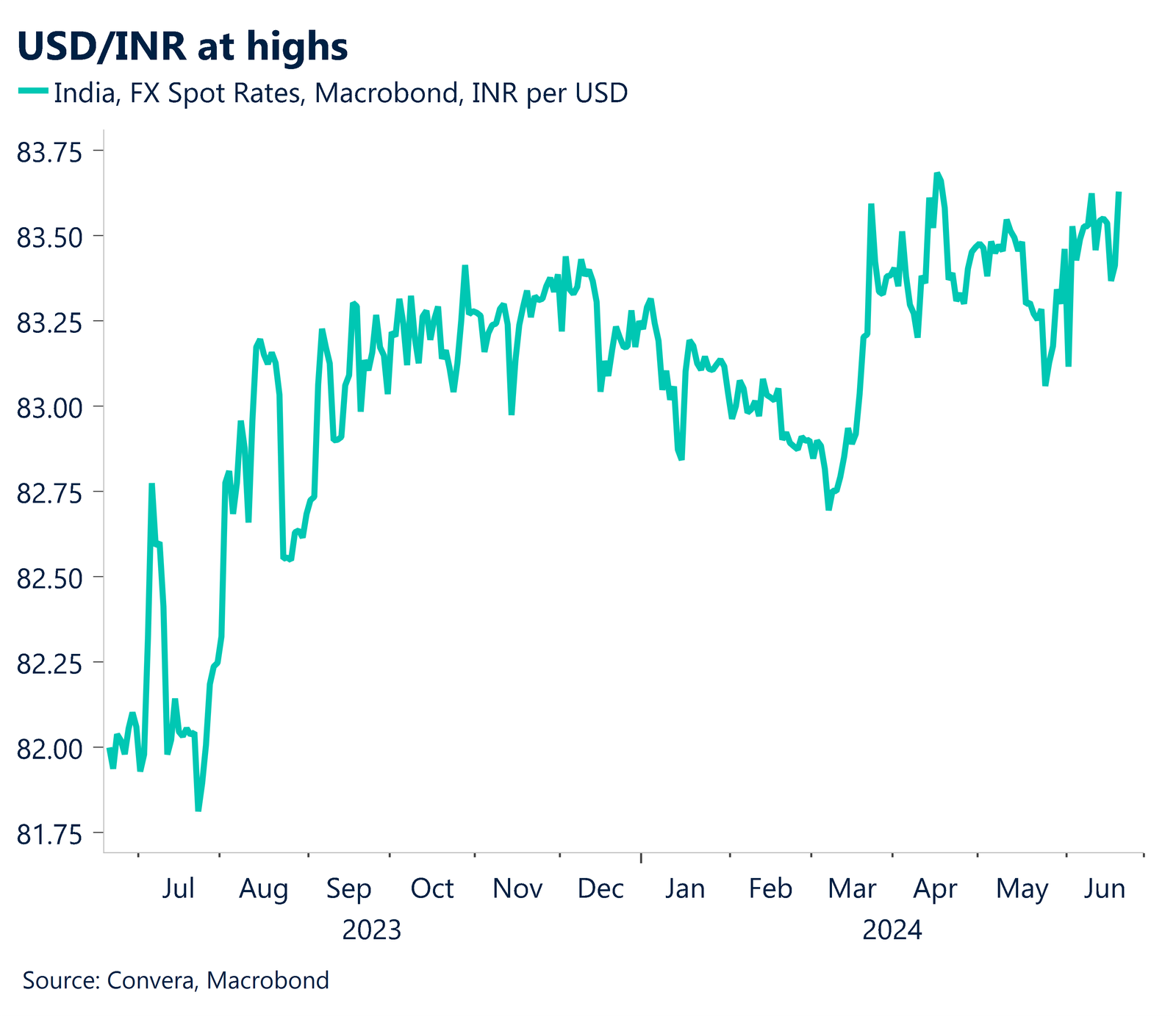

INR nears all-time lows ahead of minutes

Across markets, the Chinese yuan wasn’t the only key mover. The Indian rupee traded near all-time lows and closed at the third-lowest level in its history.

Coming up, the minutes of the Reserve Bank of India’s (RBI) June MPC meeting should reveal the reasoning behind the MPC’s vote to leave policy unchanged, while the vote split shifted from 5-1 to 4-2, with two external members now dissenting in favour of a cut.

Despite this, the overall tone of the minutes should be neutral, as dovish commentary from the dissenters is likely to be matched by hawkish views among the others, particularly RBI members, who are likely to flag increased optimism on growth and the need for continued caution on inflation.

Markets will be monitoring the minutes to ascertain what triggers could prompt the hawks in the MPC to vote for policy easing.

USD/CNY at top of the range

Table: seven-day rolling currency trends and trading ranges

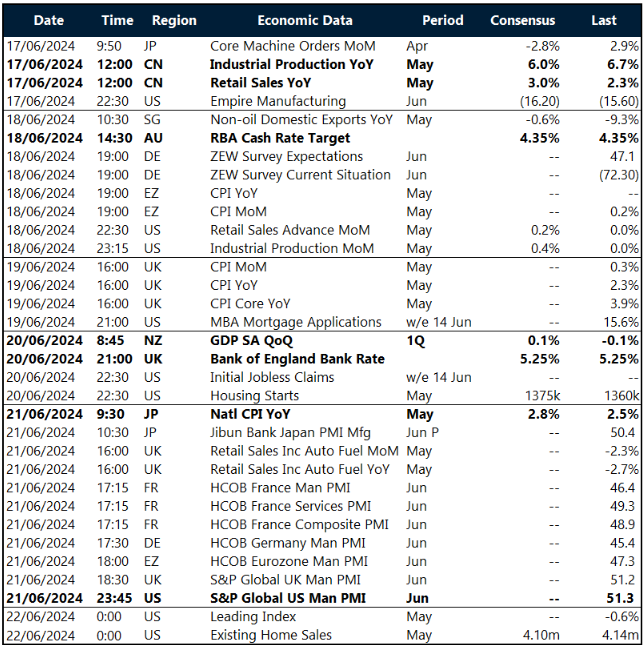

Key global risk events

Calendar: 17 – 22 June

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]