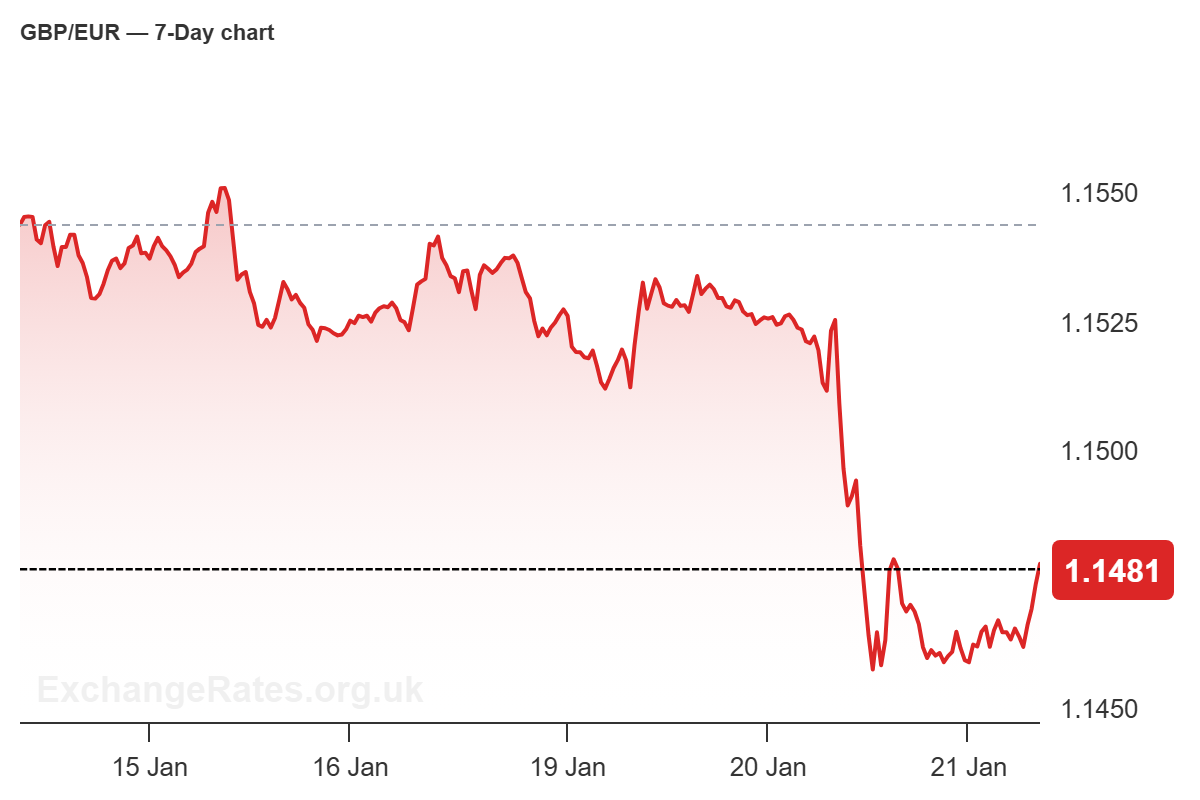

The pound to euro exchange rate (GBP/EUR) is trading at 1.1471, modestly higher on the day but still close to its lowest levels of the month (and 2026) following last week’s sharp selloff.

Pound Sterling remains on the back foot after the exchange rate fell almost 0.6% on 20 January, the largest daily decline since November, pulling GBP/EUR back towards the lower end of its January range and erasing what little upside momentum had built earlier in the year.

From our perspective, the move has left the pair vulnerable.

GBP/EUR is struggling to recover after repeated failures in the 1.1550-1.1570 area, and the latest pullback reinforces the broader picture of a fading recovery following the slide from mid-2025 highs above 1.18.

Risk sentiment and global flows in focus

While softer UK labour market data helped trigger the initial decline, we do not think domestic data alone can explain the scale of sterling’s weakness.

Recent price action has coincided with renewed pressure in global equity markets – a backdrop that has historically favoured the euro over the pound during periods of rising risk aversion.

Currency strategists at Nomura argue that the balance of risks has shifted further against sterling as investors reassess global capital flows amid rising geopolitical tensions.

“The latest intensification of geopolitical tensions by US President Trump on Greenland is more likely to result in a return to the ‘Sell America’ theme seen in April 2025,” says Dominic Bunning, Head of G10 Strategy at Nomura.

Such a shift, he argues, would benefit the euro area as “one of the few genuine alternative destinations for investments in terms of size and liquidity.”

Nomura sees the euro as a likely beneficiary of any rotation away from U.S. assets, given the euro area’s large and liquid capital markets and its significant share of U.S. external liabilities.

Euro resilience contrasts with UK headwinds

The bank also points to increasingly supportive euro area flow dynamics, with foreign demand for eurozone equities and bonds remaining firm into late 2025, while overseas investment by euro area residents has slowed.

By contrast, the UK side of the cross offers fewer positives.

Recent labour market data point to cooling wage momentum, easing concerns among some policymakers that inflation pressures could re-intensify.

“Today’s UK labour market data showed continued soft momentum in wage growth,” Nomura notes, a backdrop that leaves the risk skewed towards further easing by the Bank of England rather than a hawkish reassessment.

GBP/EUR Outlook: Bearish bias remains below resistance

Taken together, the combination of fragile risk sentiment, supportive euro inflows and a softening UK domestic backdrop leaves Nomura wary of further downside in GBP/EUR.

The bank targets a move in EUR/GBP to 0.8950, implying a fall in the pound-to-euro exchange rate (GBP/EUR) towards 1.12.

For now, we think the near-term bias in the pound to euro rate remains skewed to the downside unless sterling can find a stronger domestic catalyst or a sustained improvement in global risk sentiment.