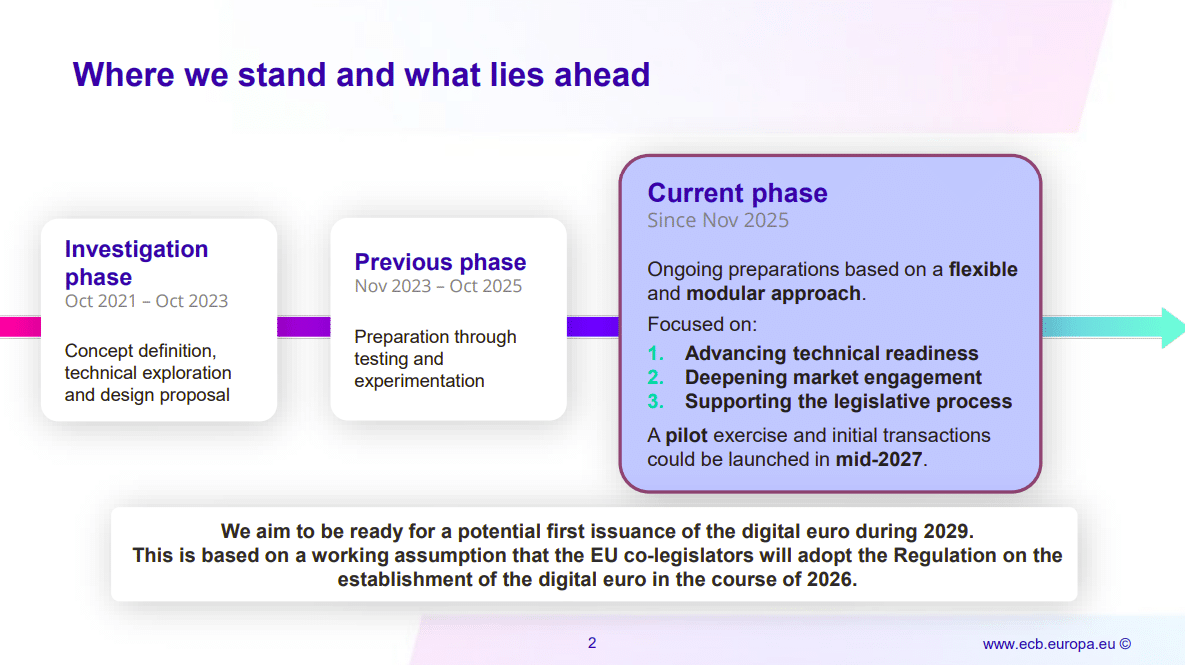

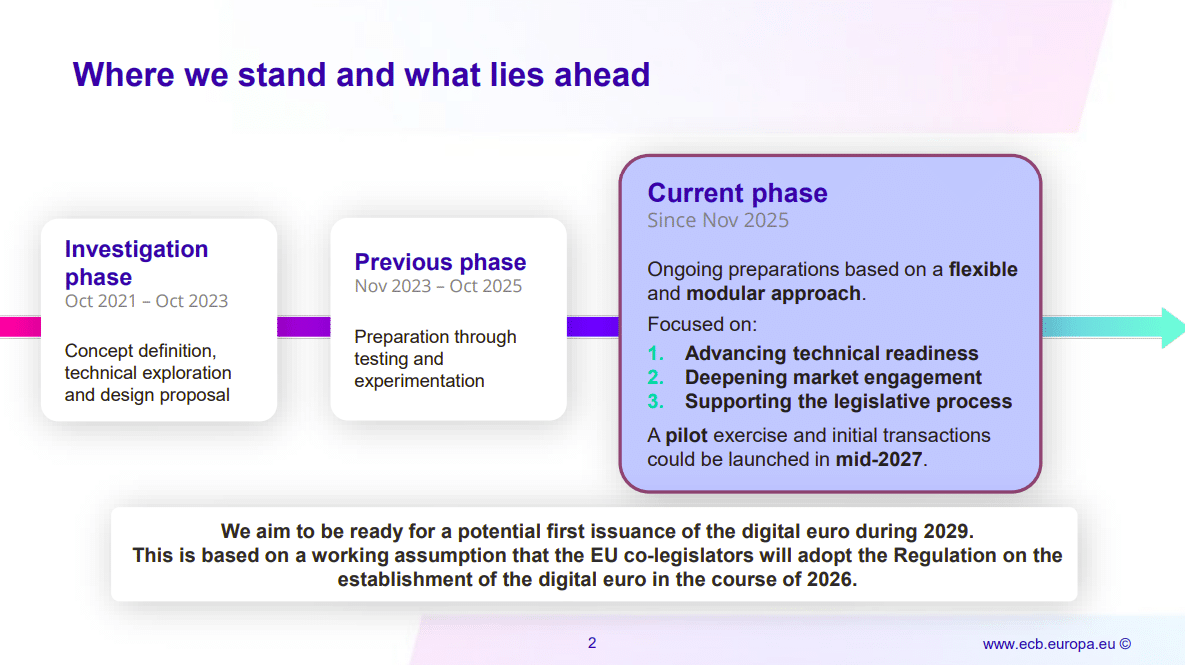

The European Central Bank (ECB) is aiming to begin pilot testing of the digital euro in mid-2027, with initial issuance targeted for 2029, according to Executive Board member Piero Cipollone speaking at an Italian Banking Association executive meeting today.

The ECB, which oversees monetary policy for the eurozone, entered its technical readiness phase in November 2025 after completing two years of preparatory work. The current stage focuses on building infrastructure, testing components, and engaging with payment providers and merchants.

A 12-month pilot involving selected banks, retailers, and central bank staff will test four specific transaction scenarios in a controlled setting.

The currency’s rollout hinges on European Union legislators finalizing regulations this year. The Council adopted its position in December 2025, with Parliament expected to finalize its stance around May.

The project preserves the role of traditional financial institutions. Users would access digital euros through accounts at licensed banks and payment providers, funding them from existing accounts and transacting via apps, cards, or other devices.

The ECB also announced a partnership with the ONCE Foundation to ensure the currency remains usable for people with disabilities, limited technical proficiency, or advanced age.

The digital euro would operate alongside physical cash on a centralized settlement platform managed by the Eurosystem, which would record and verify all transactions and holdings.

While not built on blockchain, it incorporates selected design principles inspired by distributed ledger technology to strengthen resilience, efficiency, and reliability within a secure multi-region infrastructure.

The ECB has emphasized the initiative as a safeguard for European monetary independence amid growing reliance on non-EU payment networks.