WOOL prices retracted at auctions this week, heavily influenced by a stronger Australian dollar against the United States currency.

WOOL prices retracted at auctions this week, heavily influenced by a stronger Australian dollar against the United States currency.

The Australian Wool Exchange reported the wool market as unable to maintain its sharp upward trajectory of recent weeks.

“There was a total of 43,582 bales (85 more) available to the trade.

“Of this quantity 40,932 bales were sold, meaning despite the weaker market, there was just 6 percent passed in, showing that most sellers were willing to accept the prices on offer.”

AWEX said buyers were predicting a softer market, based purely on the strengthening of the Australian dollar compared to the US dollar.

“On Wednesday the AUD pushed past US70 cents briefly, the highest the AUD had been since February 2023.”

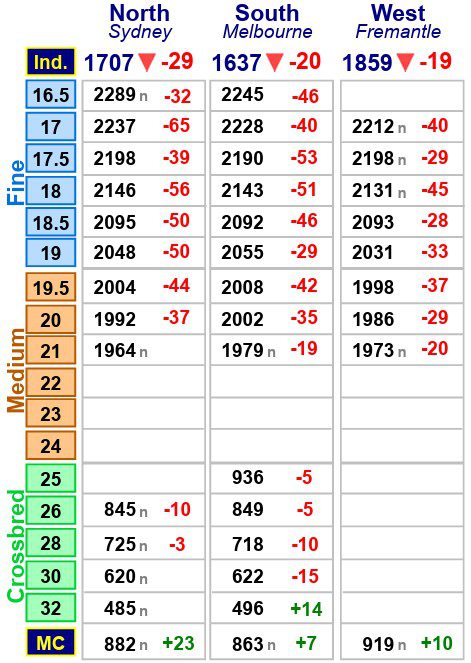

AWEX said on the opening selling day, in the merino fleece sector the Micron Price Guides (MPGs) fell by between 7 and 74 cents.

AWEX said on the opening selling day, in the merino fleece sector the Micron Price Guides (MPGs) fell by between 7 and 74 cents.

“The skirtings followed a similar path to the fleece, while the oddments defied the trend recording modest gains.”

Awex said the benchmark Eastern Market Indicator dropped by 27 cents/kg clean.

“This was the largest daily fall of the EMI since the 14th of October last year.

“The currency movement was so influential, that when viewed in USD terms the market had a healthy rise, the EMI gained US25 cents for the day, pushing the USD EMI up to 1162 cents.”

AWEX said this was the highest the EMI has been In USD terms since 11 July, 2019.

“Although there was further strengthening of the AUD before the second day, (the AUD broke through the 70-cent barrier again), on day two the market generally settled.

“The EMI gained 3 cents for the day, closing the week 24 cents lower.”

In USD terms the market recorded further gains, adding another US15 cents, closing the week US40 cents higher at US1177c/kg, a weekly increase of 3.5pc, AWEX said.

Next week the offering is expected to fall marginally, there is currently 40,480 bales on offer in Sydney, Melbourne and Fremantle.

Underlying offshore demand is supportive – AWI

Australian Wool Innovation said while the market weakened, importantly, while prices fell in Australian dollar terms, USD-based prices continued to strengthen, indicating that the softer AUD EMI outcome was currency-driven rather than the result of weakening offshore demand.

“Currency movements were a key influence on market results this week, with the Australian dollar strengthening against the US dollar.

“The firmer AUD was supported by rising expectations that the Reserve Bank of Australia may lift interest rates at its upcoming meeting, following stronger-than-expected inflation and labour market data,” AWI said.

“At the same time, the US dollar eased as markets digested recent Federal Reserve policy decisions.”

AWI said from a broader perspective, the divergence between AUD and USD wool prices indicates that underlying offshore demand remains supportive, with the recent easing in local prices largely currency-driven.

“Should the Australian dollar stabilise or weaken, current USD price strength suggests the potential for improved AUD returns.

“Despite the reduction in AUD returns, relatively high clearance rates reflected firm seller sentiment, with most willing to accept the prices on offer in the sale rooms.”

Sources – AWEX, AWI.