The GBP/USD pair dropped to 1.3252, its lowest level since 11 May 2025, as a resurgent US dollar and disappointing UK economic data weighed on the pound.

Market sentiment has shifted from concerns about inflation to fears of an economic slowdown, while optimism surrounding new trade agreements has bolstered the dollar.

Although warmer weather boosted food sales, the broader economic outlook remains fragile after worse-than-expected PMI figures. This has reinforced expectations that the Bank of England (BoE) could cut interest rates by 25 basis points as early as August, with another potential reduction before year-end to stimulate growth.

Meanwhile, the dollar gained strength following the announcement of a US-EU trade deal, which imposes 15% tariffs on most European exports, including cars. The agreement has averted a further escalation in trade tensions, providing additional support for the greenback.

However, not all European leaders view the deal as favourable. Many argue that the terms disproportionately disadvantage the EU. While the UK maintains its separate agreements, the broader economic ripple effects are still being felt, given the interconnected nature of global markets.

Technical analysis: GBP/USD

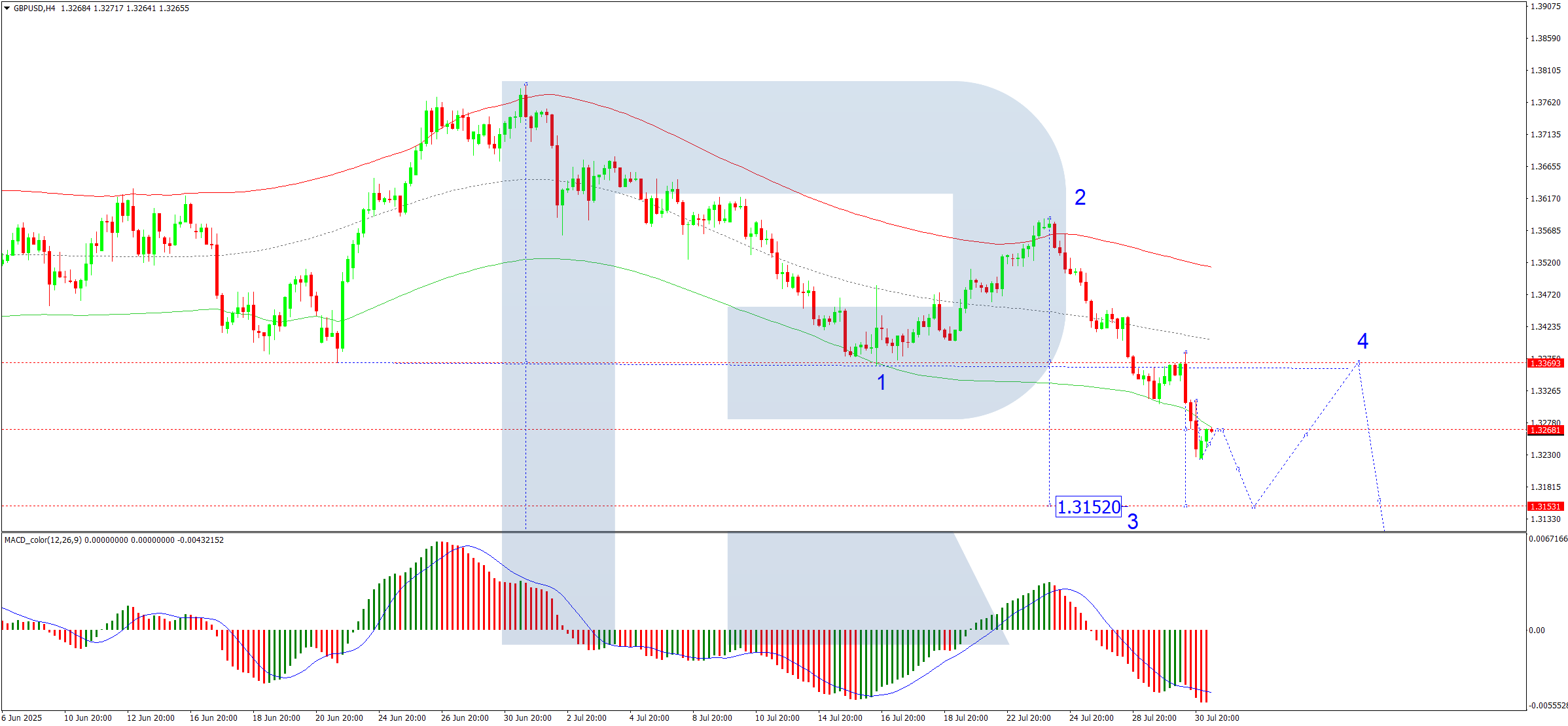

Four-hour chart

On the 4-hour chart, GBP/USD continues its downward trajectory towards 1.3152, with a consolidation range currently forming around 1.3268. A downside breakout from this range could see the pair extend losses towards 1.3152, followed by a potential corrective rebound to 1.3370. This scenario is supported by the MACD indicator, where the signal line remains below zero and points sharply downward.

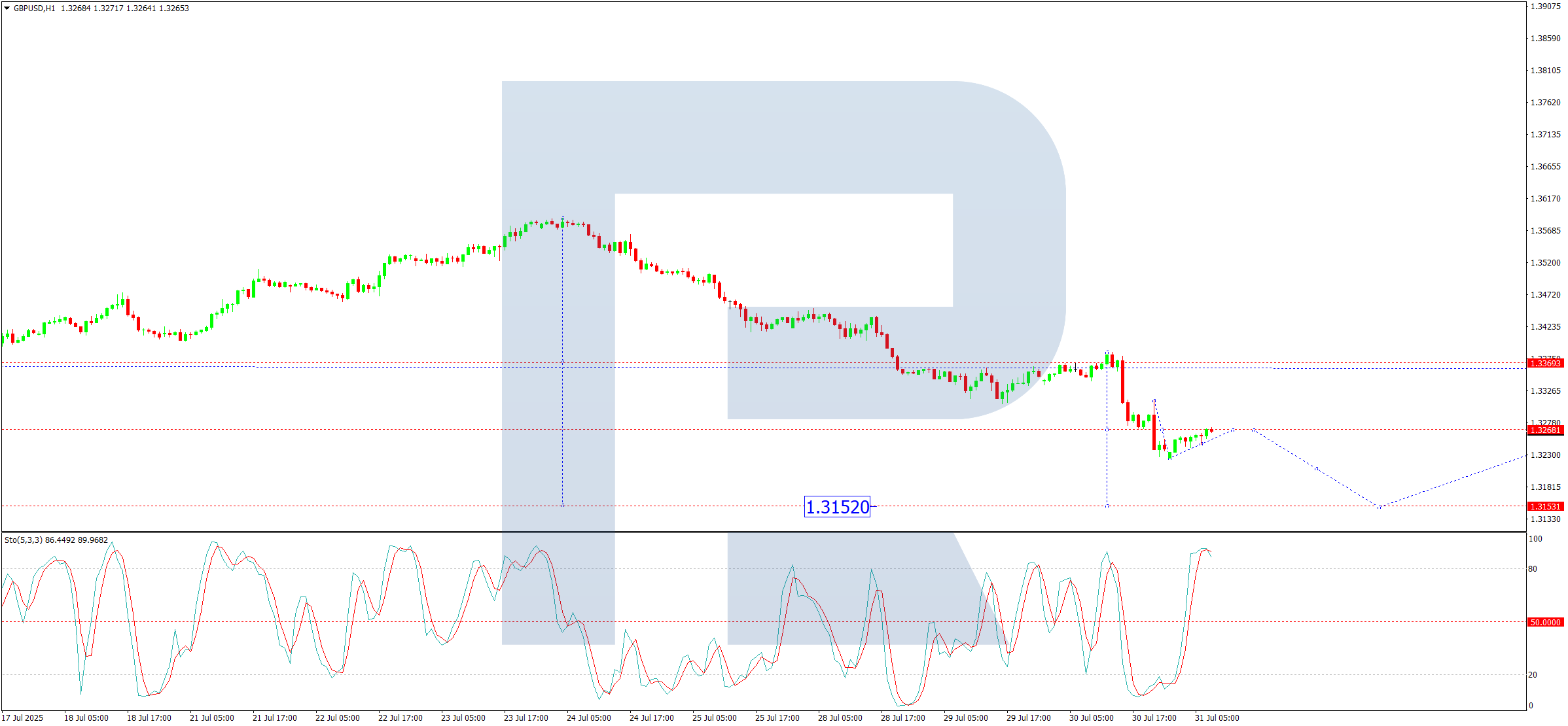

One-hour chart

On the hourly chart, the pair declined to 1.3225 before correcting to 1.3270. Further downside movement towards 1.3152 is anticipated today, with the Stochastic oscillator confirming this outlook: its signal line has crossed below 80 and is trending downward towards 20.

Conclusion

The pound remains under pressure amid a stronger dollar and a lacklustre UK economic performance. With rate cut expectations mounting and global trade dynamics shifting, further volatility in GBP/USD is likely. Traders will be watching key technical levels for confirmation of the next directional move.