US dollar exchange rates rebounded sharply against major currencies after Kevin Warsh was nominated as the next Federal Reserve Chair, triggering a violent reversal in gold and silver and raising doubts over the longevity of the dollar debasement trade.

Precious Metals Bubble Pops as Trump Picks New Fed Chair

Gold and silver uptrends went parabolic last week but finally popped on Thursday as Kevin Warsh was nominated as the next Fed Chair.

Warsh is a dove, but not as likely to make aggressive cuts like the previous favourite for the job, Kevin Hasset.

The dollar debasement trade may now be over and the USD has recovered from 4-year lows. Precious metals remain at risk, as does oil.

The nomination of Kevin Warsh to succeed Jerome Powell as Chair of the Federal Reserve marks a major shift in global monetary expectations, sparking a “regime change” trade that could fundamentally alter the trajectory of the U.S. dollar and precious metals.

The Trump administration initially signaled a preference for aggressive “doves” like Kevin Hassett to drive rapid rate cuts, triggering the “dollar debasement” trade and sparking a rapid rally in precious metals.

However, the selection of Warsh, a figure synonymous with institutional credibility and fiscal discipline, has forced markets to price in a “higher-for-longer” interest rate environment that favours greenback strength over non-yielding assets like silver and gold.

Precious metals dropped again on Monday, with gold down 10% and silver down 16%> this follows on from Friday’s huge falls, the largest on record, which saw silver down 35% at one point.

Warsh’s history as a “hawk” during his previous tenure on the Federal Reserve Board of Governors suggests a leader who is unlikely to cut as aggressively as the likes of Hasset.

However, at face value, it hasn’t changed much as Warsh has promoted a dovish view and will still try to deliver at least two cuts this year.

The problem with that is he only has one vote in the Fed, and there are a total of 12 voting members.

The other uber-dove, Miran, will step down at the same time Warsh takes over from Powell as he was only filling in for the unexpired term of Kugler.

Furthermore, other members may not be as dovish as they once were now that Warsh has been confirmed. Waller was only putting on a dovish front as he wanted the position.

So without devout doves, Warsh may struggle to build consensus. Besides, the conditions in the economy do not seem to merit more than 1-2 more cuts, and if the economy and labour market heat up, then it would be hard to justify any at all.

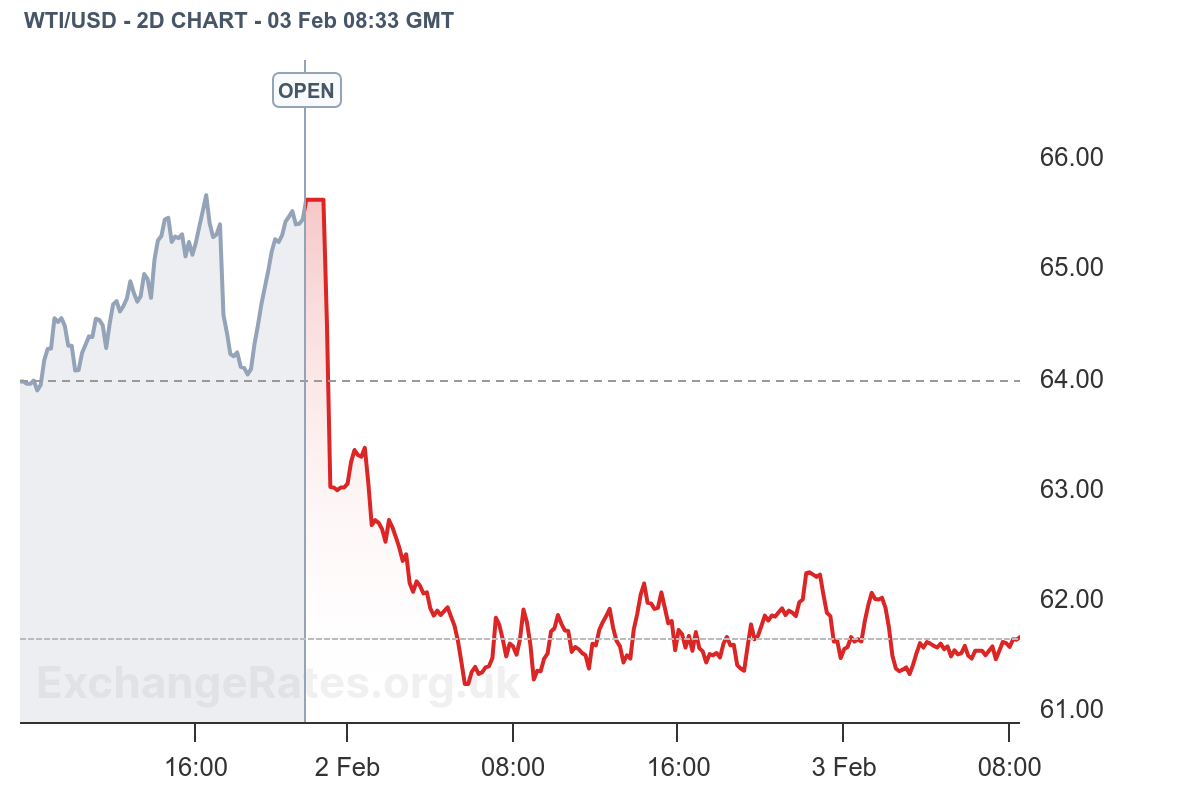

Oil and Gas Drop

While dollar strength may be a headwind for all commodities priced in USD, Monday’s drop in oil and gas were not directly linked to the appointment of Warsh as Fed Chair.

Gas prices are heavily influenced by weather, and oil dropped as a US strike on Iran did not happen over the weekend despite an “armada” building up in the Arabian sea.

Here’s ING:

“Oil prices came under renewed pressure this morning, with both ICE Brent and NYMEX WTI dropping more than 5% in early trading. The selloff follows reports of fresh US-Iran negotiations, raising the possibility of a deal and easing geopolitical risk premium. A broader correction across financial markets has added to the downward momentum.”

Oil prices were significantly higher in January but may now retrace some of those gains.

There are several central bank meetings due later this week, with the RBA, BoE and ECB all due to meet.

Only the RBA is likely to adjust rates, and a hike is expected due to sticky inflation.

Friday’s main release is the all-important US jobs report, which will be closely watched for signs of stabilization. A strong report could further the USD recovery.