Gold price was sharply up on Friday, gaining around 1.5% after US labor data soured the sentiment and sparked fresh migration into safety.

Much weaker than expected job growth in July and strong downward revision of previous month’s numbers, as well as higher unemployment, point to moderation in the labor market and add to hopes of Fed rate cuts.

On the other hand, fresh wave of higher tariffs that President Trump imposed on a number of countries just ahead of the deadline, has deepened uncertainty and boosted safe haven demand that also contributed to fresh bullish acceleration.

Traders, however, remain cautious and keep an eye on tariffs, which may lift inflation again and dent current positive view.

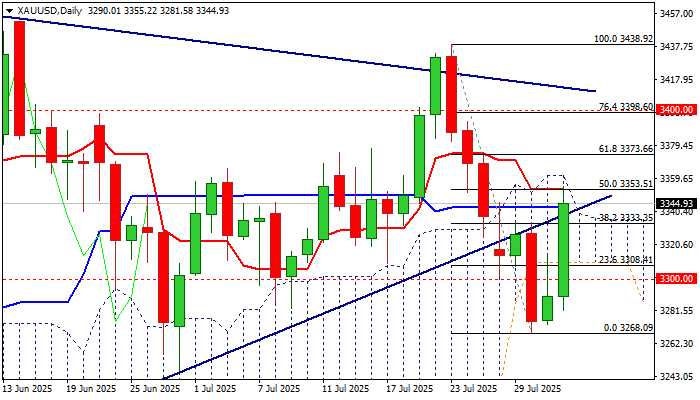

Fresh rally has fully reversed Wednesday’s sharp drop (down 1.6%) and improved near-term picture on penetration of daily cloud and return above the lower boundary of larger triangle, but bulls faced headwinds and were so far unable to emerge above daily cloud (also near 50% retracement of $3438/$3268 bear-leg) that is needed to confirm reversal.

According to the current situation on daily chart, the downside would remain vulnerable (14- momentum is at the centreline / the price is still below daily Tenkan/Kijun-sen), particularly if today’s rally fails to close at least within the triangle.

Repeated long upper shadows of hourly candles contribute to developing negative signals, however, near-term bias should remain with bulls while the price holds above broken Fibo 38.2% ($3325).

The picture will be more clear after the markets fully digest today’s data and complete the picture after several significant economic releases this week.

Res: 3353; 3361; 3373; 3398

Sup: 3340; 3325; 3308; 3300