DXY firmed Friday night:

AUD faded:

North Asia was strong:

Oil too:

Advertisement

Dead dirt bounce:

Miners too:

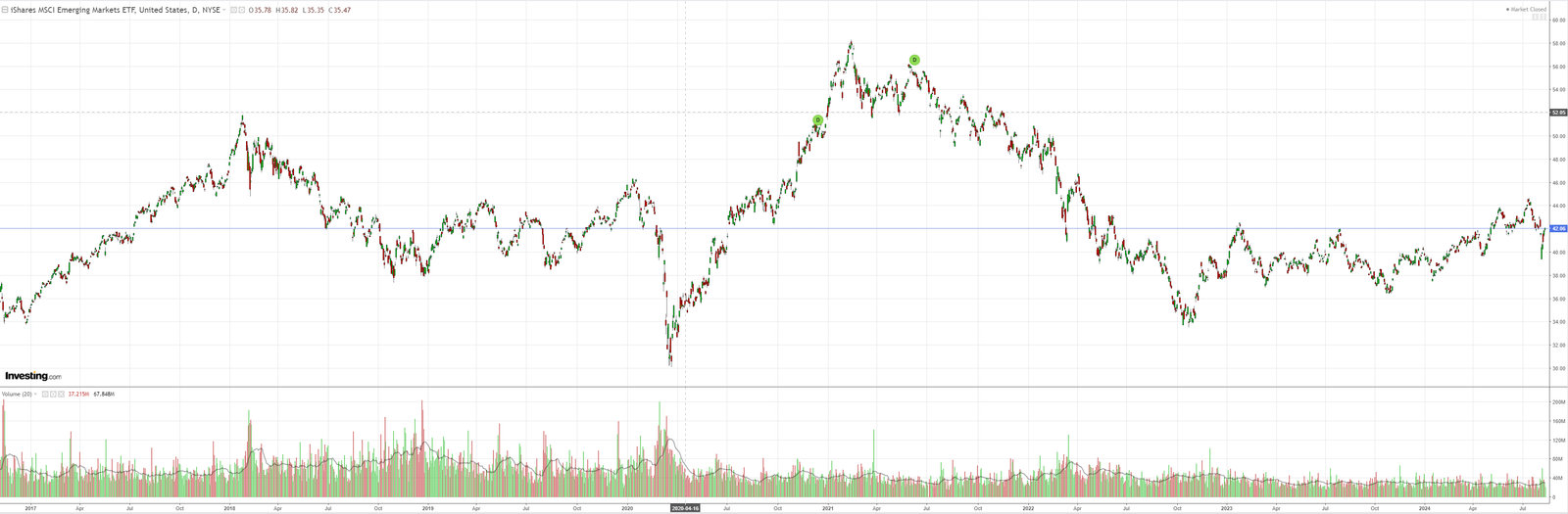

Schitzoid EM:

Advertisement

Junk is trying to base:

Yields rolled:

Stocks meh:

Advertisement

Goldman says the DXY falls are overdone:

Recent Dollar depreciation is understandable given the shifting recession odds in the US, building evidence that restrictive policy has helped soften the labor market, and that US real rates have plenty of room to adjust.

Relative to a few months ago, the US outlook is less unique, and that requires some shift in the risk distribution around the Dollar view.

That said, we think FX markets have already moved a long way, and further than the fundamentals can justify.

On the US side, data this week have helped to confirm that the July employment report probably overstated the decline in the underlying trend of job creation, layoffs are still low, and the bar for more aggressive Fed easing than what is already priced is high; our economists still think continued expansion is far more likely than recession.

And, just as importantly, the US situation is hardly unique—central banks everywhere are increasingly putting the emphasis on the need for a more balanced approach to policy rather than a singular focus on spot inflation.

This makes us more willing to take the other side of recent price action in FX.

Hmm, well, I’m afraid I have to disagree.

I still see US soft landing but there is more growth scare ahead, along with more Fed and White House turbulence.

This strikes me as an environment where DXY will fall, but the high-beta AUD will fall even further.

AUD is not out of the woods.

Advertisement