The US presidential campaigns have heated up the political scene. With Harris and Trump battling for the presidential seat, an array of promises have been made to support the US economy, with both candidates going far and beyond to woo its citizens.

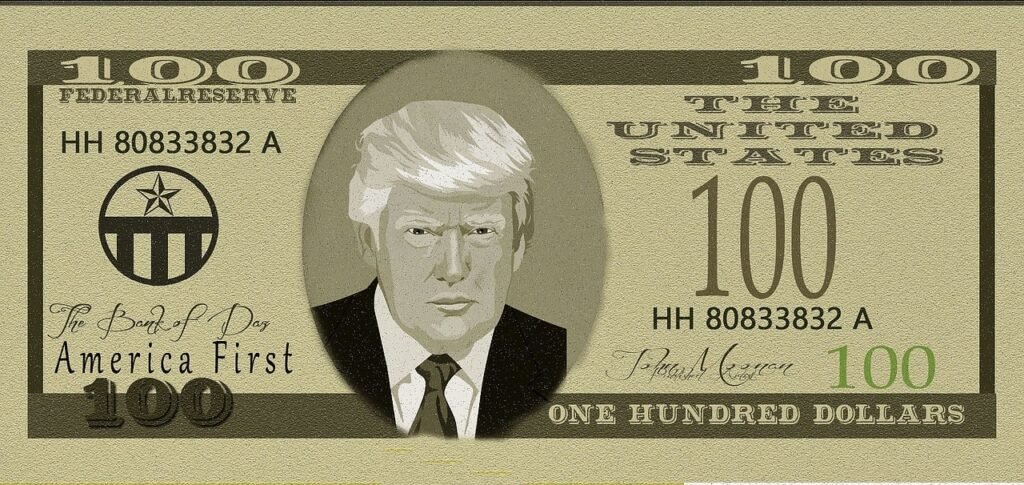

To derail the flowing narrative of de-dollarization, Trump is changing the currency dynamics by promising a 100% tariff on countries moving away from the dollar. This development bolsters the greenback up a notch, adding prestige to the USD.

Also Read: BONK & Dogecoin (Doge) Price Prediction For October End

What’s Happening Between Donald Trump and USD?

The US dollar is surprising the world markets by soaring to new highs. The greenback is on the verge of delivering fresh gains as speculators continue to bet on Trump winning the ultimate presidential title in the long haul.

As the US elections draw closer, Trump has recently commented about the US dollar and how he will work to curb the rampant de-dollarization drive. Trump was documented sharing how he will levy a 100% tariff on countries moving away from the USD.

“If a country tells me, sir, we like you very much. But we are going to no longer adhere to being in the reserve currency. We are not going to salute the dollar anymore. I’ll say that’s okay, and you’re going to pay a 100% tariff on everything you sell into the United States.”

Trump’s recent comments have strengthened the greenback a notch. At press time, the US dollar was at 103.62, up by 0.03% against major currencies.

In addition, the US elections often play a vital role in determining the pace of world financial markets. The dollar, which was earlier simmering due to the recent rate cut announcement by the Federal Reserve, is now in the queue to gain significant ground, provided Trump wins the US elections.

Traders are also associating Trump’s win with positive greenback sentiment, as his comments about the greenback have generally bolstered consumer sentiment.

Also Read: Jio Financial Shares: New Price Target Amid Market Correction

Trump’s Tariff Plan

Donald Trump is leaving no stone unturned to win the ongoing US elections. Trump’s recent tariff plans have been planned with great detail to restrict countries from moving away from the dollar. The step has been taken to curb de-dollarization-centric activities spurred by alliances like BRICS and ASEAN, which have long been promoting the use of local or alternate currencies on a global scale.

In addition, Trump’s tariff plan may have several implications. While attending the Bloomberg interview, the outlet’s editor, John Micklethwait, was quick to emphasize how the former president’s tariff plan may trigger a complete trade halt with China and disrupt trade flow with European nations.

“That is going to have a serious effect on the overall economy,” Micklethwait said.

Trump defended his plans, adding that they may prove lucrative for the dollar in the long run.

“It must be hard for you to spend 25 years talking about tariffs. As being negative and then have somebody explain to you that you’re totally wrong,” Donald Trump told Micklethwait.

Also Read: Netflix Stock Price Revisited: Analysts Weigh In Before Earnings