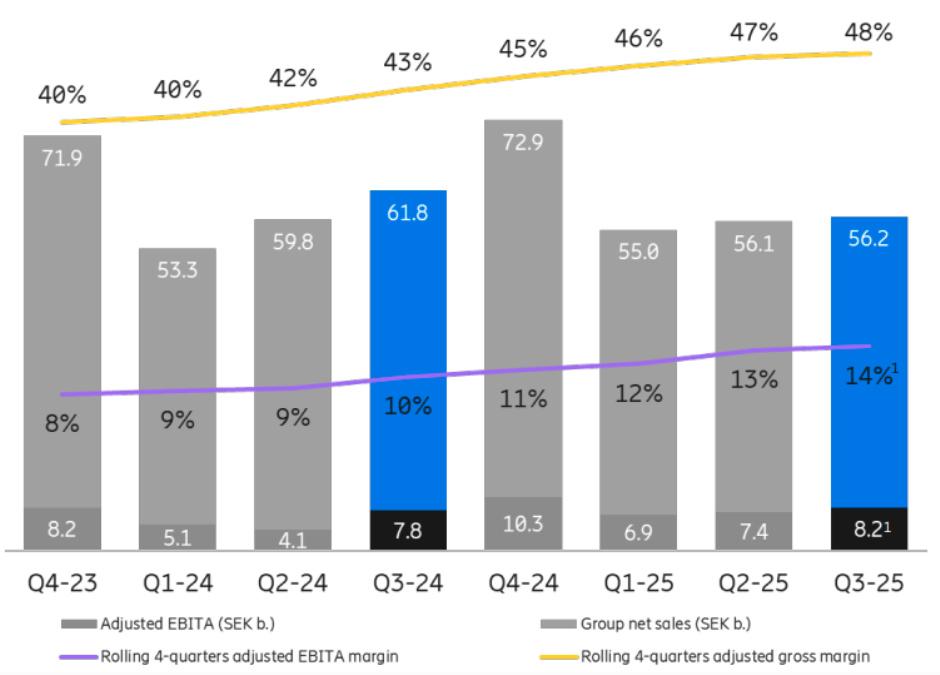

Ericsson reported a 9 percent decline in revenue to SEK 56.2 billion in the third quarter of 2025, compared to SEK 61.8 billion in Q3 2024. The Swedish telecom equipment maker attributed the fall primarily to adverse currency effects and lower network investments in key markets such as India.

“Gartner and Omdia reconfirmed our 5G solutions are industry leading. Our Open RAN-ready portfolio includes an AI native, future proof software architecture which is hardware agnostic. The portfolio integrates with third-party radios and supports Ericsson silicon and third-party CPU/GPUs,” Ericsson CEO Borje Ekholm said.

Sales in Networks, Ericsson’s largest business segment, dropped 11 percent to SEK 35.4 billion. While growth was recorded in Europe, the Middle East, Africa, and North East Asia, it was offset by sharp declines in other regions, particularly India, where telecom operators continued to scale back on network investments.

Cloud Software and Services revenue increased 3 percent to SEK 15.3 billion, supported by growth across three of the four market areas. The Enterprise segment, however, saw a steep 20 percent drop to SEK 5.1 billion, impacted by the divestment of iconectiv during the quarter and lower sales in the Global Communications Platform business.

Ericsson’s IPR licensing revenues decreased to SEK 3.1 billion from SEK 3.5 billion a year earlier, as Q3 2024 had benefited from retroactive revenue for unlicensed periods. Around 82 percent of IPR revenues came from the Networks segment, with the rest from Cloud Software and Services.

Regionally, Ericsson generated SEK 19.8 billion in sales from the Americas, SEK 16.7 billion from Europe, the Middle East and Africa, SEK 7.1 billion from South East Asia, Oceania and India, SEK 3.8 billion from North East Asia, and SEK 8.8 billion from Others.

In North America, network sales declined after a strong Q3 2024 driven by new contract ramp-ups. Latin America recorded a significant drop due to fierce competition and lower customer spending. However, Cloud Software and Services posted growth in core networks tied to a major modernization project.

In Africa, Ericsson reported strong growth in Networks driven by 4G upgrades and new 5G launches in Egypt and Morocco.

In contrast, sales in Europe declined following the completion of modernization projects and cautious customer investment. The Middle East also saw lower sales due to project timing.

Sales in South East Asia, Oceania, and India were affected by reduced investment levels in India and heightened competition in South East Asia, although Cloud Software and Services saw gains from project milestones. In North East Asia, Networks sales increased, particularly in Japan, while Cloud Software and Services remained stable.

Ericsson’s workforce stood at 89,898 employees as of September 30, 2025, down from 91,937 at the end of June 2025 and 95,984 a year earlier, reflecting ongoing restructuring and efficiency measures.

Despite the decline in quarterly revenue, Ericsson continues to strengthen its position in 5G network modernization and software-driven services, focusing on cost control and long-term profitability in a challenging global telecom market.

Baburajan Kizhakedath