US dollar rocked by Fed uncertainty, Euro volatile amid transatlantic trade tensions. Credit: Currencies Direct

Euro

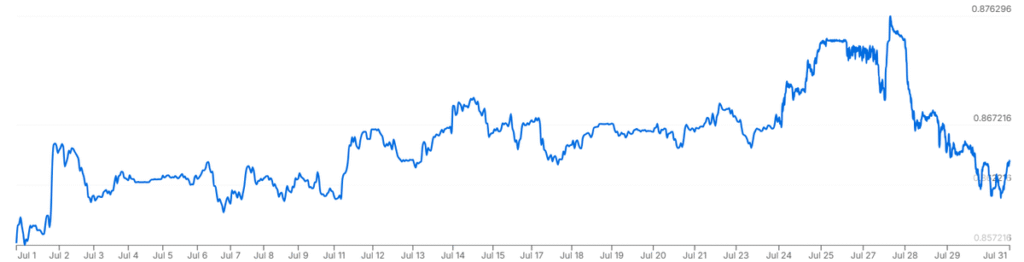

EUR/GBP: Up from £0.85 to £0.86

EUR/USD: Up from $1.16 to $1.17

The euro fluctuated over the past month. Initially being propelled to new multi-year highs, before slipping back to a two-week low.

This volatility in the euro was primarily linked to EU-US trade uncertainty. While an agreement was eventually reached, it sparked a wave of criticism from EU leaders, casting doubts on whether the deal will even be ratified.

The focus now turns to upcoming Eurozone data, with the initial highlight being the bloc’s latest consumer price index, where an expected slowdown in inflation in July may stoke European Central Bank (ECB) rate cut bets.

Pound

GBP/EUR: Down from €1.16 to €1.15

GBP/USD: Down from $1.36 to $1.35

The pound trended lower over the last four weeks, amid growing concern over the UK’s fiscal health, with a watering down of the government’s welfare bill stoking expectations of additional tax hikes in the Autumn.

Adding to the pressure on Sterling were some underwhelming UK data releases and mixed messaging from the Bank of England (BoE).

A key focus for GBP investors in August will be the BoE’s latest interest rate decision. Another rate cut is largely priced in, but Sterling could rally if the bank signals it might hold off from further cuts for the time being.

US Dollar

USD/GBP: Unchanged at £0.73

USD/EUR: Down from €0.86 to €0.85

Trade in the US dollar remained erratic in recent weeks, with US President Donald Trump’s repeated criticism of Federal Reserve Chair Jerome Powell acting as a significant source of volatility.

US trade uncertainty also contributed to USD volatility after Trump delayed his tariff deadline once again.

However, the ‘greenback’ was able to find some bullish momentum at the end of July, following the signing of several key trade deals, robust data and hawkish signals from the Fed.

The immediate focus now turns to the Fed’s upcoming rate decision. While the Fed is expected to leave its policy unchanged following its July meeting, USD investors will be looking for any clues as to whether a rate cut can be expected in September.

Currencies Direct have helped over 500,000 customers save on their currency transfers since 1996. Just pop into your local Currencies Direct branch or give us a call to find out more about how you can save money on your currency transfers.