Good morning and welcome back to FirstFT Asia. In today’s newsletter:

-

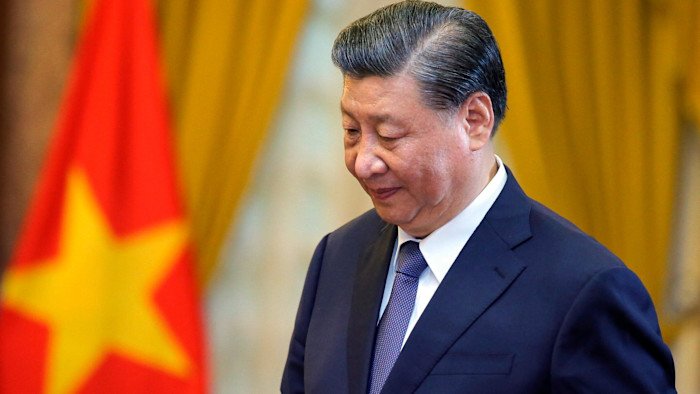

Xi’s global ambitions for the renminbi

-

How China’s “genius plan” is paying off

-

Singapore’s public housing model faces scrutiny

Xi Jinping has called for the renminbi to become a global reserve currency, in some of his clearest comments on his ambition for China’s legal tender to play a greater role in the international monetary system.

What to know: In commentary published on Saturday in Qiushi, the ruling Communist party’s ideology journal, China’s president said the country needed to build a “powerful currency” that could be “widely used in international trade, investment and foreign exchange markets, and attain reserve currency status”. China’s leadership has long sought to promote the internationalisation of the renminbi. However, the comments marked Xi’s clearest definition yet of his goal of a “strong currency”, as well as the broader financial foundations Beijing will need to build to support it.

A shifting global order: The publication of Xi’s comments comes amid heightened uncertainty in global markets as a weaker US dollar — which President Donald Trump last week called a “great” development — a change in leadership of the Federal Reserve and geopolitical and trade tensions have prompted central banks to rethink their exposure to dollar assets. “China senses the change of the global order more real than before,” said Kelvin Lam, senior China+ economist at Pantheon Macroeconomics.

Read more about Xi’s vision for the renminbi.

Here’s what else we’re keeping tabs on today:

-

Economic data: Indonesia and Pakistan publish January inflation data. Manufacturing PMIs are due for countries across Asia, including China, India and Japan.

-

China-Latin America ties: Uruguayan President Yamandú Orsi continues a seven-day state visit to China.

-

Monetary policy: The Bank of Japan publishes the summary of opinions from its January meeting, when it held the policy rate steady at 0.75 per cent.

-

Results: Mizuho, Central Japan Railway and East Japan Railway report earnings.

Five more top stories

1. India has pledged to raise investment in manufacturing and semiconductors, boost infrastructure spending and offer incentives for data centres as Prime Minister Narendra Modi’s government seeks to sustain economic momentum in the face of trade tensions with the US. Here’s what to know about India’s budget for the 2026-27 fiscal year.

2. Lord Peter Mandelson told Jeffrey Epstein in 2009 that the boss of JPMorgan should “mildly threaten” Britain’s chancellor over a tax on banker bonuses proposed by the government in which Mandelson was serving as business secretary, according to newly released documents.

3. The price of Bitcoin has dropped to its lowest level since last year’s tariffs shock as its reputation for being the digital equivalent of gold unravels. The move comes despite a breakneck rally in the price of bullion and other precious metals as investors seek safety in the face of rising geopolitical tensions. Here’s more on Bitcoin’s tumble.

4. A crypto venture linked to Trump accepted a half-billion-dollar investment backed by an Abu Dhabi royal days before the US president’s inauguration. The Trump family’s World Liberty Financial signed the deal with a group of investors backed by Sheikh Tahnoon bin Zayed al-Nahyan, the UAE’s national security adviser. The investment raises more questions about the fusion of politics and business during Trump’s second term.

5. Artificial intelligence researchers are grappling with how to stop “AI slop” from damaging confidence in the industry’s scientific work. AI conferences have rushed to restrict the use of large language models for writing and reviewing papers in recent months after being flooded with a wave of poor AI-written content.

FT Magazine

A year ago, when DeepSeek’s AI breakthrough shocked the world, many western observers wondered how a small team of Chinese researchers could be in a position to challenge American tech supremacy. A big part of the answer is China’s “genius classes”, an ultra-competitive high school talent pool that has been producing leaders of the country’s science and tech sectors for decades. Zijing Wu reports how China’s “genius plan” is paying off.

We’re also reading . . .

-

Diamond District dispatch: The ongoing volatility of gold and silver presents risks and big rewards for Manhattan’s no-nonsense jewellers.

-

Forever young: The idea of immortality is no longer confined to science fiction, writes Jemima Kelly about society’s obsession with longevity.

-

Corporate jargon: After five days at Davos, Pilita Clark writes about what she learned at the epicentre of global business-speak.

Chart of the day

In the eyes of many Liu Thai Ker, who died last month aged 87, was the “architect of modern Singapore”, the man who designed the state-subsidised housing that has underpinned the growth of the former British colony. Yet while Liu’s death was greeted with plaudits for his work, it also raised questions about whether the city-state’s public housing model is still fit for purpose.

Take a break from the news . . .

Oscar winner Riz Ahmed ate Lunch with the FT and discussed the liberating power of film, what Hollywood still has to offer — and realising his 20-year ambition to produce and star in his own Hamlet.