China’s economy is being rocked by enormous headwinds – excess leverage, local government debt, housing sector woes, de/disinflation, contracting manufacturing and weak service sector growth. The authorities have announced measures to reduce interest rates, spur housing and boost equity prices. However, the fiscal pronouncements made over the past weekend – though apparently not directly aimed at boosting consumption –were lacking in details, terms and amounts.

Together, these efforts, while helping to limit downside risks to the economy, are so far unlikely to restore confidence and significantly strengthen activity. Amid weak domestic demand and low confidence, how then might Chinese authorities view the renminbi?

Many in the US focus on the renminbi in terms of the dollar. But for China’s authorities, the calculus is more complex.

The authorities manage the renminbi in an opaque manner. They seem to keep an eye on two exchange rates – the trade-weighted renminbi and the renminbi-dollar. When the dollar falls, the renminbi can rise against the dollar while still gaining competitiveness vis-à-vis China’s trading partners and competitors, whose currencies may rise even faster against the dollar. When the dollar rises, even tempering the renminbi’s decline against the dollar may still cause China to lose trade-weighted competitiveness.

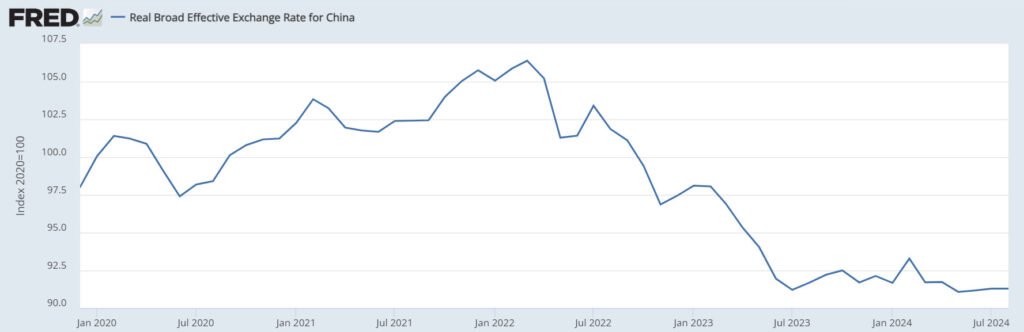

On a trade-weighted basis, the real renminbi appears highly competitive. Between March 2022 and July 2023, the real renminbi fell by roughly 15% and has remained broadly stable since then, according to the Bank for International Settlements (Figure 1).

Figure 1. Trade-weighted real renminbi is highly competitive

Source: Bank for International Settlements

The competitiveness of the renminbi is one reason for China’s strong trade and current account surpluses, along with other factors including the country’s extraordinarily high savings rates. The International Monetary Fund estimates China’s 2024 current account surplus to be around 1.5% of gross domestic product and its trade surplus around 3.5%. Analysts have persuasively noted that these estimates are understated and the surpluses could be one percentage point higher. One startling statistic is that China’s manufacturing trade surplus is over 10% of GDP.

External demand is an important prop for Chinese GDP growth amid the weak domestic economy.

The authorities also closely watch the renminbi-dollar exchange rate, which has critical implications for financial flows and the capital account. In 2015-16, when the market decided renminbi appreciation was no longer a one-way bet and domestic economic turbulence emerged, a massive self-reinforcing wave of dollar selling ensued, prompting the authorities to spend $1tn in reserves to staunch renminbi depreciation. An analogous wave of renminbi selling is an experience they do not wish to see replicated. Further, the authorities are mindful that a weak and falling renminbi-dollar exchange rate can be a trigger for more trade tensions with China.

Figure 2. Renminbi has come off recent lows against dollar, but remains weak

Source: tradingview.com

Notwithstanding China’s large trade and current account surpluses, the renminbi has been weak against the dollar this year on large capital outflow, reflecting the lack of confidence in the Chinese economy and its management (Figure 2).

The renminbi-dollar exchange rate is importantly influenced by relative US-China economic developments and interest differentials. In contrast with China’s doldrums, continued US outperformance may curb the fall in US rates and support larger interest differentials relative to China, as well as the European Central Bank, than previously anticipated. On balance, the dollar could remain broadly firm in the near term.

In July, the renminbi approached 7.3 per dollar. Subsequently, improved US inflation data and anticipation of the Federal Reserve starting a cutting cycle helped move the renminbi somewhat off its lows.

The modest renminbi-dollar appreciation in the past months has helped reduce fears of a massive wave of renminbi selling and yet has not impacted the currency’s trade-weighted competitiveness. Absent concrete plans for major fiscal stimulus, animal spirits will remain moribund.

On balance, the renminbi’s weak performance against the dollar is a barometer for China’s economic sluggishness. It may also pose a dilemma. The authorities are wary of protectionist pressures against China and may not wish to see the renminbi decline anew against the dollar for fear of sparking capital outflow. But they also may not wish to see significant erosion in the renminbi’s substantial competitive edge, mindful that external demand is one support for the economy’s anaemic growth and can help China achieve this year’s 5% growth target.

Regardless, Europe has increasingly turned hawkish towards Chinese exports. The US will remain so no matter who wins the presidency in November and concerns about China exporting its overcapacity in key sectors will exacerbate tensions. Global trade may slow. There is evidence of reshoring away from China. In 2019, the Donald Trump administration ill-advisedly designated China for currency manipulation in a fit of pique and developed a misguided regulation allowing countervailing duties for currency undervaluation. Trump’s tariff threats hang in the air.

What lurks around the corner, especially after US elections, may be the next minefield for the renminbi.

Mark Sobel is US Chair of OMFIF.