Global markets rose after the US and China slashed tariffs for 90 days in a significant de-escalation of the trade war.

The US will cut the additional tariffs imposed on Chinese goods during Trump’s second term to 30 per cent from 145 per cent while Chinese retaliatory duties on US imports imposed since April 2 will fall to 10 per cent from 125 per cent, the two countries announced on Monday.

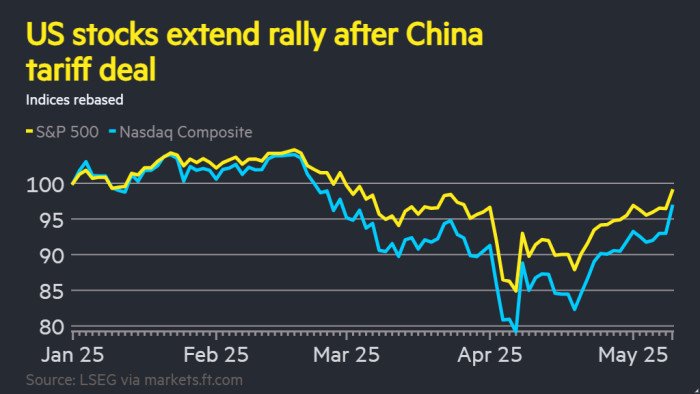

S&P 500 and Nasdaq futures rose 3.2 per cent and 4.1 per cent respectively. The US dollar rose 1.3 per cent against a basket of its peers and the renminbi strengthened. Gold fell 2.9 per cent. Brent crude oil gained 3.7 per cent to $66.25 a barrel.

Shares in shipping company Maersk were up 13 per cent as individual trade-exposed stocks surged. Apple rose 6.4 per cent in pre-market trading, while Amazon, which sources many of its marketplace’s products from China, climbed 9 per cent ahead of the New York open.

“These were earlier and larger concessions on tariffs than the market had been expecting,” said Chris Turner, global head of markets research at ING.

Consultancy Capital Economics calculated that, because of duties that predated Trump’s return to power, total US tariffs on China would come down to about 40 per cent after the agreement, while Chinese tariffs on the US would be about 25 per cent.