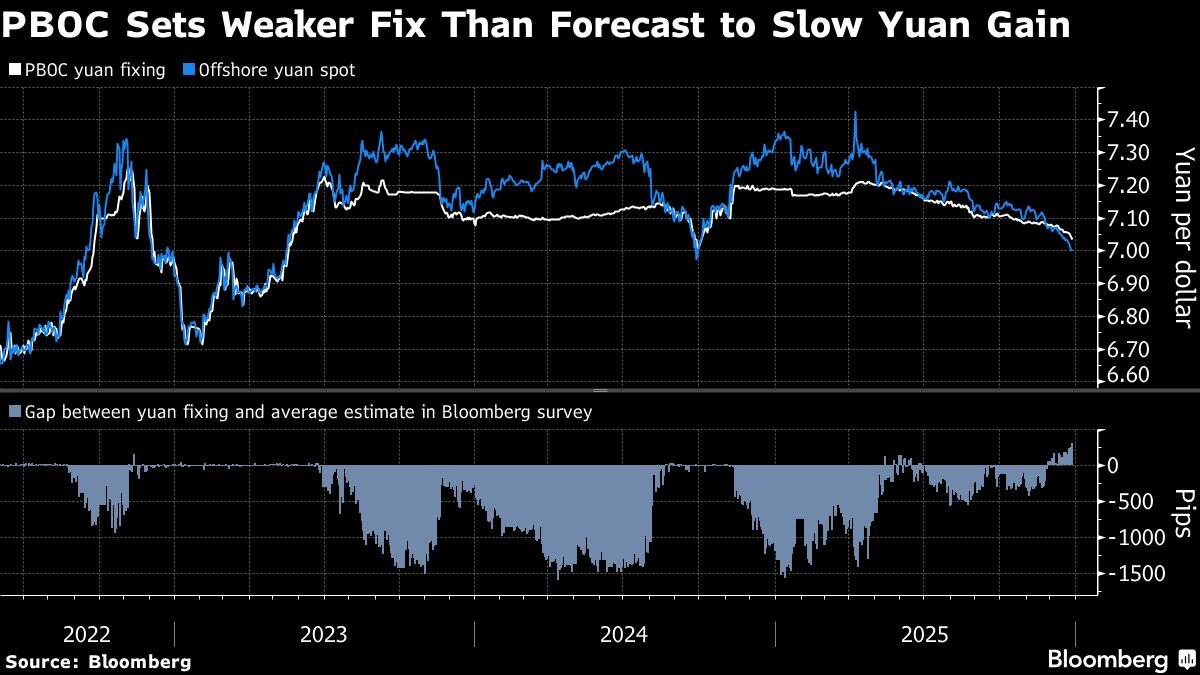

SHANGHAI: China’s yuan slipped on Tuesday, retreating from a 14-month peak against the dollar hit in the previous session, as the central bank again used its official guidance rate to signal caution over a recent spike in the Chinese currency.

Market participants closely watch the People’s Bank of China’s (PBOC) daily midpoint fixing for any subtle signals about the official stance on the foreign exchange market. The central bank has been generally setting the midpoint firmer than market expectations since last November.

However, the official fix came in weaker than market projections for the fourth straight session on Tuesday, the longest such streak since last September, a move traders interpreted as an effort to slow the pace of yuan rises.

Prior to market opening, the PBOC set the midpoint rate at 7.0794 per dollar, its weakest since November 26, and 48 pips weaker than a Reuters estimate of 7.0746. The spot yuan is allowed to trade a maximum of 2% either side of the fixed midpoint each day.

“It appears aimed at arresting the recent rapid declines in the dollar/yuan pair,” said a trader at a foreign bank. The onshore yuan traded at 7.0745 per dollar as of 0412 GMT, down from a 14-month high of 7.0650 hit a day earlier. Its offshore counterpart stood at 7.0709.

Apart from the broad dollar weakness, recent strength in the yuan also comes as companies have higher seasonal demand for yuan towards the year-end, when many exporters settle their foreign exchange receipts for various administrative requirements and for their employees.

“Exports have shown overall strength this year … leading to a concentrated demand for foreign exchange settlement among enterprises,” analysts at GF Securities said in a note.

“Some companies might have anticipated potential dollar volatility if the Federal Reserve lowers rates in December. Consequently, they are inclined to settle foreign exchange promptly during the current favorable period to lock in their income in yuan.”

The yuan has gained about 3.2% versus the dollar year-to-date and looked set for the biggest annual rise since 2020.

Rapid one-way moves on either side of the currency are never ideal for policymakers as they could trigger a herd effect and lead to a market stampede, currency traders said.

Guan Tao, global chief economist at BOC International and a former senior official with the country’s foreign exchange regulator, also warned “against betting on one-sided FX market movements.” – Reuters