It’s a good time to pitch alternatives to the US dollar , but it pays to be specific. On Wednesday, People’s Bank of China Governor Pan Gongsheng told attendees of a financial forum in Shanghai that he expected the largely greenback-based global monetary system to become multipolar, ultimately helping to “better safeguard global financial stability”.

Pan had clearly read the room: just a day prior, European Central Bank President Christine Lagarde wrote in the Financial Times that a “global euro” moment had arrived as the dollar’s dominance is called into question, pointing to “protectionism, zero-sum thinking and bilateral power plays”.

It’s not difficult to imagine a scenario in which the dollar retreats as the euro increasingly dominates European finance and the yuan comes to dominate Asian finance. In reality, though, getting there is much harder.

Figures from the Bank for International Settlements show outstanding US government debt securities at roughly $31 trillion, while those of China and the euro area are both at about $11 trillion each. Combined, the latter two come closer to the dollar total, lending some credence to Pan’s scenario. But size alone is not enough.

China, for instance, offers a large, single pool of government debt denominated in its own currency with a common credit rating — key prerequisites for reserve currency status. However, its capital account is largely closed, currency hedging options are restricted and domestic banks controlled by the state buy up the lion’s share of government bonds issued and hold them to maturity. That saps market liquidity.

Meanwhile the euro area has an open capital account and proper hedging tools, but is comprised of 20 member states with individual credit ratings and differing appetites for bond issuance.

For both the euro and yuan to pose a serious challenge to the dollar, then, requires two major changes: China needs to open its capital account and substantially change the investment behaviour of its banks; and the eurozone needs most of its member states to sufficiently improve their credit ratings while also spurring enough issuance.

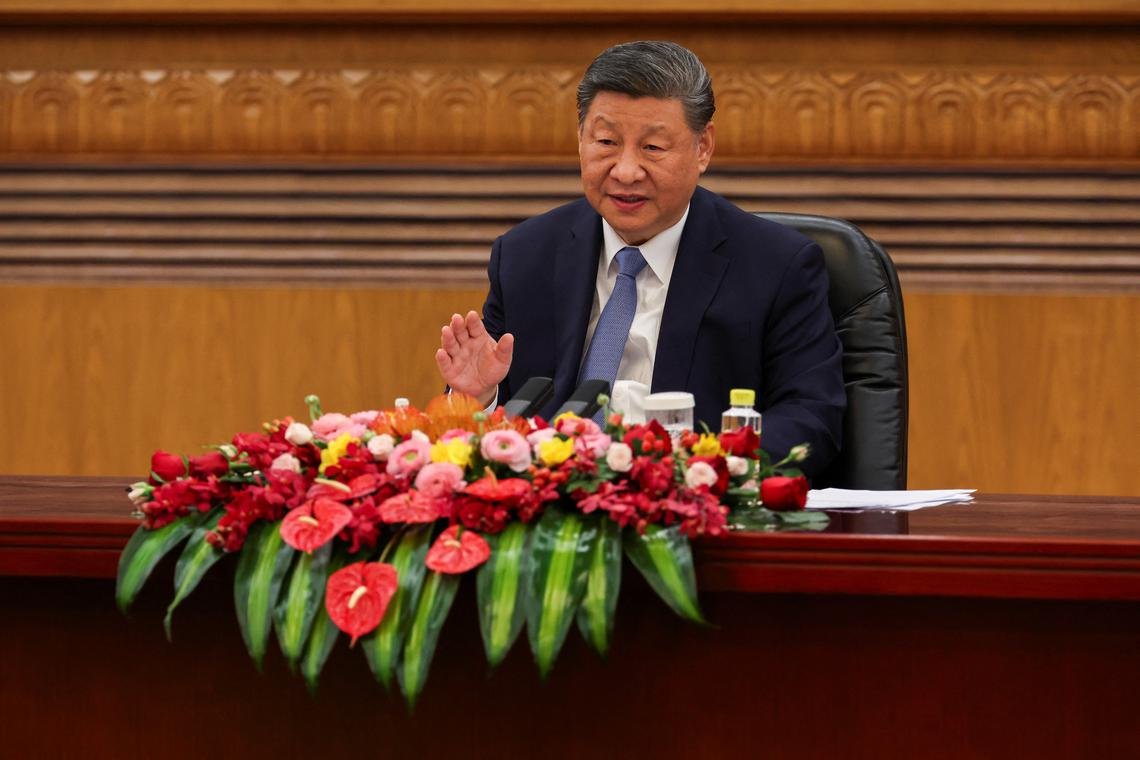

From this perspective, a multi-pronged assault on US dollar hegemony looks like a long shot – especially given that the new measures Pan flagged this week to boost yuan internationalisation were marginal at best, in line with President Xi Jinping’s stated desire for a firm exchange rate. The ECB may well take a crack at dethroning the greenback, which Beijing will cheer. But for as long as it keeps its capital account cloister-tight, China won’t be ramping up its own efforts.

Pan Gongsheng, governor of China’s central bank, said at a financial forum in Shanghai on June 18 that he expected the largely US dollar-based global monetary system to become multipolar, ultimately helping to “better safeguard global financial stability”.

Pan’s comments came a day after European Central Bank President Christine Lagarde wrote in the Financial Times that a “global euro” moment had arrived as the dollar’s dominance is called into question, pointing to “protectionism, zero-sum thinking and bilateral power plays”.

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.