- GBP/JPY has fuel to stay on the upside as the Japanese government’s high spending plans compromise the yen’s safe haven status

- The Bank of Japan just kept interest rates unchanged at 0.75% while the UK’s resilient economy means the BoE could become hawkish

- BoE could move to hike rates if the labour market signals weakness

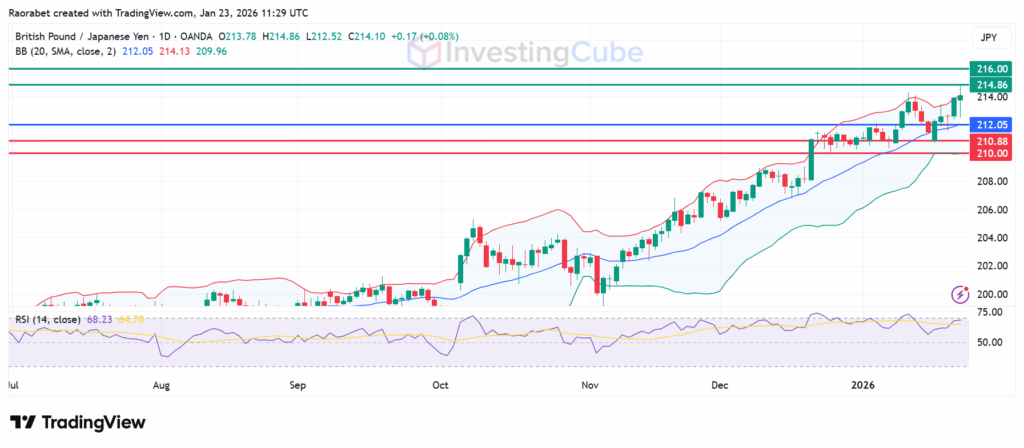

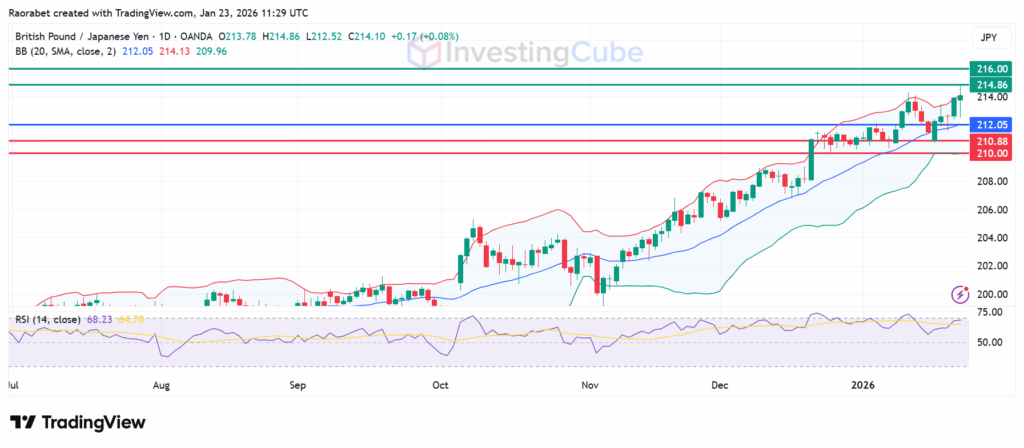

The GBP/JPY pair, has shot up in early 2026 to levels not seen since the 2008 financial crisis. As of this writing, it has risen to highs of 214.86 in the intraday session.We discuss the underlying forces propelling this movement and the elements that could influence its direction through 2026.

What’s Fueling the Pound Sterling’s Rise Against the Yen?

The main reason behind GBP/JPY’s rise is a weak yen, made worse by uncertainty in Japan. Prime Minister Sanae Takaichi’s upcoming snap elections in February and plans for big spending, like tax cuts without a clear way to pay for them, aren’t helping.

Even though the Bank of Japan (BoJ) kept rates at 0.75% at its January 23 meeting, the Yen hasn’t recovered. Prime Minister Sanae Takaichi’s government has suggested a huge ¥20 trillion spending package, which raises worries about Japan’s ability to pay its debts. This has hurt the yen’s reputation as a safe investment.

Meanwhile, the UK economy has been surprisingly strong. The Office for National Statistics (ONS) says UK inflation is still sticky at 2.8%, so the Bank of England (BoE) has to keep its base rate at 3.75% longer than expected.

GBP/JPY 2026 Outlook

Looking ahead, the road for GBP/JPY is paved with both opportunity and significant risks. The Japanese government’s big spending plans could keep the yen weak. The market is also watching the February 8 election in Japan, which could be a turning point. If the ruling party wins big, the yen could fall even further.

The pound has been supported by strong UK data. Despite some mixed signals, like lower GDP numbers, the Bank of England is expected to cut rates less than other central banks, which has helped the pound. But JPMorgan analysts warn that if the UK labour market weakens, the BoE could change its mind by mid-2026.

Potential Risks

In the past, when GBP/JPY has risen this much, the BoJ has stepped in to buy Yen, which is a risk for those betting on the pound. Any big rally has risks. The Ministry of Finance in Japan has already started talking about intervention, with Finance Minister Satsuki Katayama .

GBP/JPY Forecast

The GBP/USD pair recently cleared the major psychological resistance at 210.00. The RSI is currently at 68, flirting with the overbought threshold. The immediate target for bulls is 214.86, with a clear breach potentially exposing the 216.00 level. If a pullback occurs, the first line of defense is the 20-day Simple Moving Average (SMA) at 212.05, followed by the January low near 210.00.

GBP/JPY daily chart with key support and resistance levels on January 23, 2026. Created on TradingView

The surge is driven by the Bank of England keeping interest rates at 3.75% due to sticky inflation, contrasted with the Bank of Japan’s much lower 0.75% rate and Japan’s new, fiscally expansionary political agenda.

The potential risks include yen interventions, pullbacks from being overbought, faster BoE cuts due to UK fiscal concerns, or global risk-off events, which could cause reversals if support levels are broken.

Yes. Japanese authorities have intervened in the past to stabilize the yen. Since the pair is at 18-year highs, the risk of an intervention is considered high by analysts.