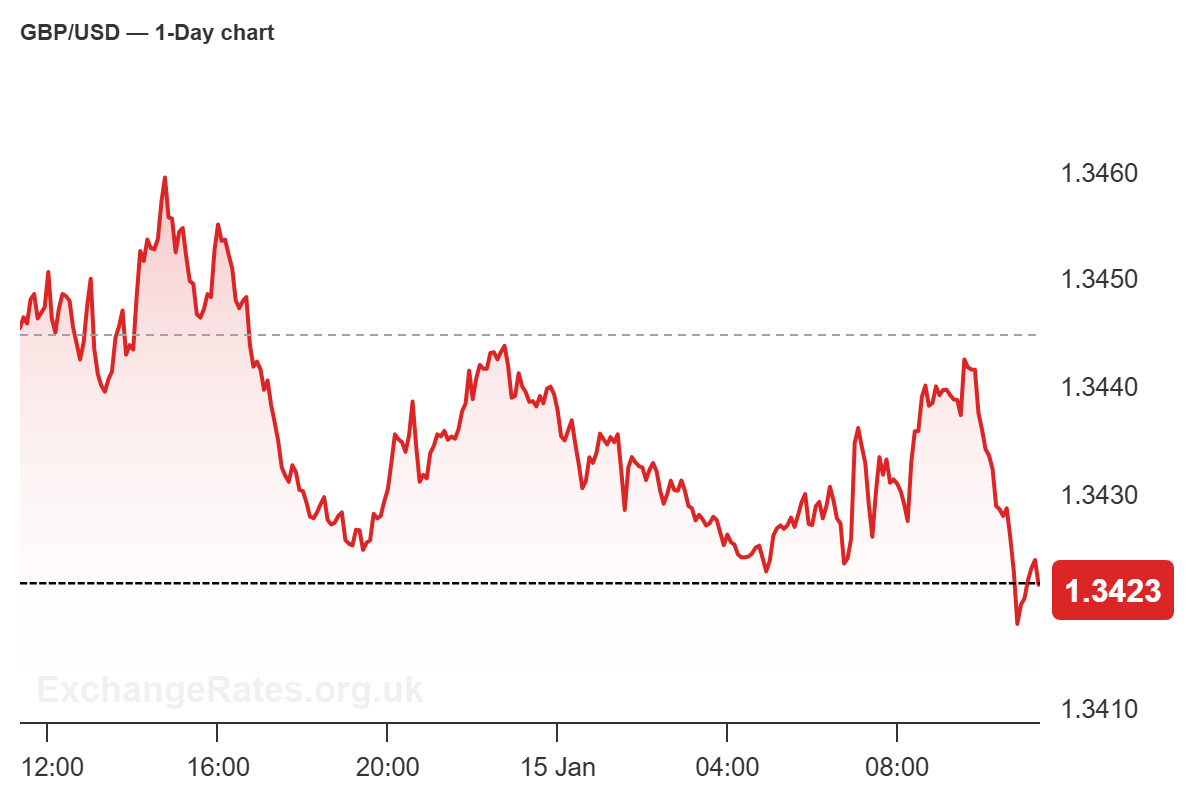

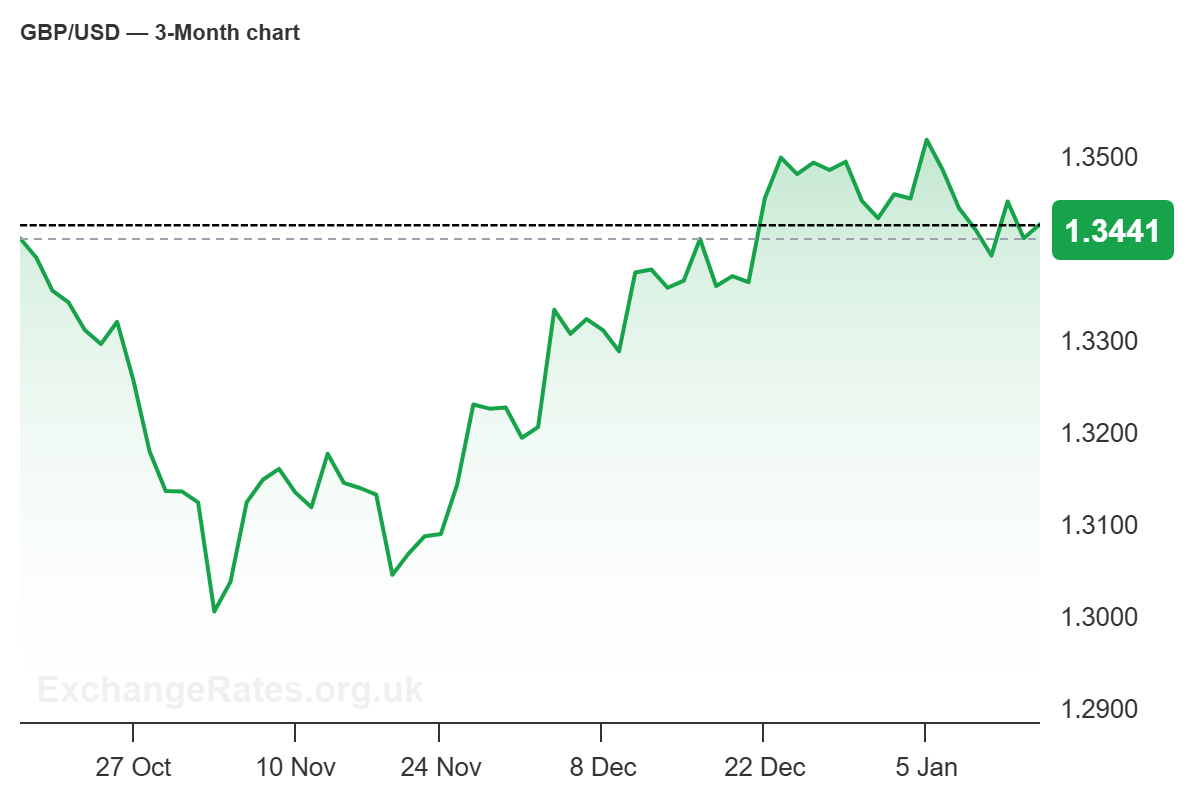

The Pound to Dollar (GBP/USD) exchange rate is trading near 1.3423, easing back after a choppy start to January that has seen the pair struggle to build on December’s rally.

Sterling remains modestly lower on the week after briefly pushing above 1.35, while the dollar has been influenced by swings in energy prices and shifting expectations for US monetary policy.

According to MUFG, recent swings in oil prices have become an important cross-market driver for the dollar.

The bank notes that the sharp pullback in crude, after earlier fears of supply disruption linked to US action in Venezuela and tensions with Iran, reinforces its broader view that lower energy prices will remain a drag on the US dollar in 2026.

MUFG argues that falling oil prices tend to improve growth and terms-of-trade conditions outside the US, particularly in Europe, while also giving the Federal Reserve more scope to continue easing policy.

Against that backdrop, the dollar’s recent resilience looks fragile unless energy prices spike again in a sustained way.

For sterling, MUFG acknowledges some near-term support from the UK’s stronger-than-expected November GDP print, which showed growth of 0.3% month-on-month despite ongoing budget uncertainty.

However, the bank stresses that this upside surprise is unlikely to change the bigger picture.

UK yields continue to drift lower, and MUFG still expects further Bank of England rate cuts this year, leaving the pound vulnerable against both the euro and the dollar over time.

In MUFG’s view, GBP/USD may see intermittent support from data surprises, but the balance of risks still points to a softer pound as monetary easing in the UK and US plays out through 2026.