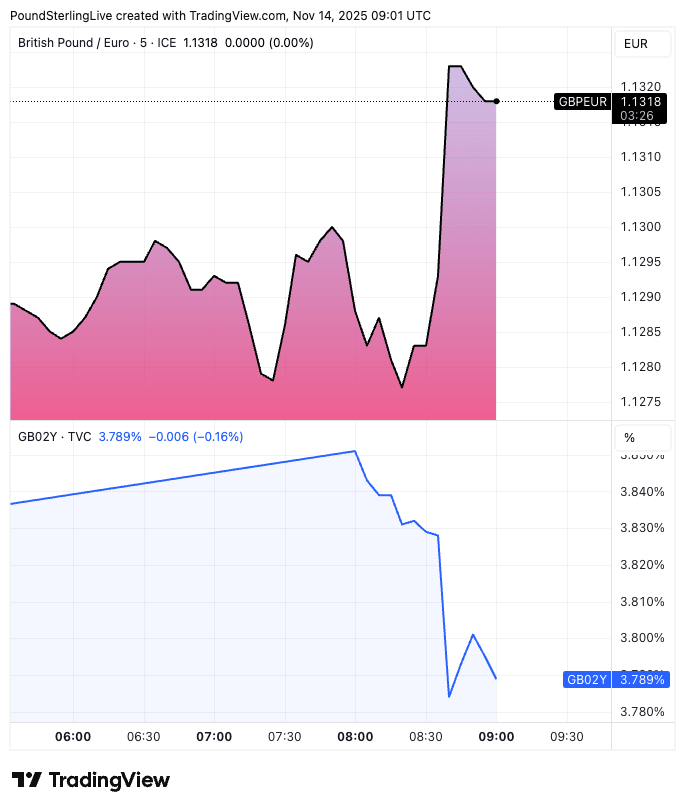

Above: GBP/EUR recovered as bond yields fell, suggesting markets won’t be panicked by overnight news.

Pound sterling fell on news that the government would abandon plans to raise income taxes, but is now off the lows.

Here’s a potential explanation.

The pound to euro exchange rate (GBP/EUR) has recovered from fresh two-year lows after UK bond markets opened for trade and revealed a relatively sanguine investor mood.

UK bonds initially fell and their yield rose as markets tried to make sense of news that the government was abandoning plans to raise income taxes, raising fears the UK’s debt outlook would deteriorate.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£25.00

Compare Rates from Leading Providers →

Free • No obligation • Takes 2 minutes

However, those initial moves are being pared, perhaps as it is realised that the spirit of the government’s plans to steady the finances is unchanged.

What we know is the government won’t be raising income tax rates, according to a Treasury submission to the Office for Budget Responsibility made on Wednesday.

But, what might now happen is that the income tax brackets are lowered in order to drag more people into paying more taxes.

So either way, tax increases are set to be substantial.

This is important in that the message remains the same: the tax intake should increase by enough to fill the government’s stark £30BN black hole.

An initial spike in UK bond yields was soon faded, and the pound recovered:

📉 Two-year bond yields – the most relevant for the pound – rose to as high as 3.90% in initial London market trade, before fading back to 3.80%, which puts them back where they were on Monday.

📈 The pound to euro conversion dropped to 1.1285 in Asian trade but has since recovered to 1.1320 as bond yields give a cautious, albeit stable response to developments.

So, although the news is exciting, the market is staying cool.

Nevertheless, for the pound, the slow deflation looks entrenched and the grind lower isn’t over.

💬 “Signs of internal party dissent, potentially impacting Budget decisions and outcomes risks undermining GBP sentiment,” says Jeremy Stretch, an analyst at CIBC Capital Markets.

💬 “GBP/EUR is becoming the preferred vehicle for expressing bearish sterling views,” says George Vessey, analyst at Convera.

“Abandoning plans to raise headline income tax rates and other levies in the upcoming Budget… raises immediate questions over how the government will plug the revenue shortfall,” he explains.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£25.00

Compare Rates from Leading Providers →

Free • No obligation • Takes 2 minutes

The context to this morning’s FX action is a report in the FT that the Treasury told the Office for Budget Responsibility on Wednesday it would no longer pursue a plan to raise income taxes by 2p.

According to the report, Reeves will instead raise revenue by lowering the threshold at which people pay higher rates of income tax.

A “smorgasbord” of smaller measures is reportedly now under consideration, pointing to a messy, multi-pronged attack on earners and the productive sector at the November budget.

By targeting smaller tax sources, Reeves risks shifting taxpayer behaviour and actually receiving less revenue.

These taxes also risk hurting the economy, as did the national insurance tax increase in the previous budget, which has driven up unemployment in recent months.

For the pound, this is a reminder that November 26 is a high-risk event and further weakness is possible.