The Pound Sterling (GBP) trades lower against its major currency peers, outperforming North American peers on Monday. The British currency steadies after a sharp rally on Friday, which was prompted by strong United Kingdom (UK) S&P Global Purchasing Managers’ Index (PMI) preliminary data for January and upbeat Retail Sales data for December.

The data released on Friday showed that UK private business activity expanded at a faster pace due to strong manufacturing and services PMI. The UK Composite PMI came in at 53.9 in January, higher than estimates of 51.7 and the prior release of 51.4.

Meanwhile, the UK Office for National Statistics (ONS) reported that Retail Sales returned to growth in December after declining in the previous two months. Retail Sales rose by 0.4%, while it was expected to have declined 0.1% again.

This week, the UK economic calendar will be light; therefore, market sentiment and speculation ahead of the Bank of England’s (BoE) monetary policy meeting in February will be key drivers for the Pound Sterling.

In the December policy meeting, the BoE guided that monetary policy will remain on a “gradual downward path”. Meanwhile, BoE Monetary Policy Committee (MPC) member Megan Greene stated on Friday that the UK central bank should avoid reducing interest rates, like the Federal Reserve, citing upside wage growth expectations.

“I will be watching household and business inflation expectations over the next few months to see if they come down in line with lower inflation outturns. Even more concerning, in my view, are the forward indicators for wage growth,” Greene said, Reuters reported.

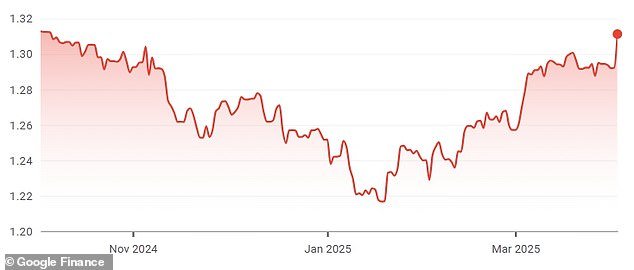

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.33% | -0.24% | -1.43% | -0.13% | -0.38% | -0.39% | -0.60% | |

| EUR | 0.33% | 0.09% | -1.13% | 0.21% | -0.06% | -0.07% | -0.28% | |

| GBP | 0.24% | -0.09% | -1.20% | 0.11% | -0.15% | -0.16% | -0.37% | |

| JPY | 1.43% | 1.13% | 1.20% | 1.34% | 1.07% | 1.07% | 0.85% | |

| CAD | 0.13% | -0.21% | -0.11% | -1.34% | -0.26% | -0.26% | -0.48% | |

| AUD | 0.38% | 0.06% | 0.15% | -1.07% | 0.26% | -0.00% | -0.20% | |

| NZD | 0.39% | 0.07% | 0.16% | -1.07% | 0.26% | 0.00% | -0.20% | |

| CHF | 0.60% | 0.28% | 0.37% | -0.85% | 0.48% | 0.20% | 0.20% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily Digest Market Movers: Investors await Fed’s monetary policy outcome

- The Pound Sterling ticks marginally higher against the US Dollar during the European trading hours on Monday. The GBP/USD pair edges up as the US Dollar underperforms across the board, with the US Dollar Index (DXY) trading 0.3% lower near 97.15 as of writing. A slight uptick in the GBP/USD pair at times when the US Dollar is sharply lower signifies that the Pound Sterling is also weak.

- The US Dollar faces severe selling pressure on hopes that the White House could announce the name of the Fed’s next Chairman this week. United States (US) President Donald Trump said in December that he would announce the name of Fed Chair Jerome Powell’s successor sometime in January.

- According to recent comments from White House officials, National Economic Council Director Kevin Hassett, BlackRock executive Rick Rieder, current Fed Governors Christopher Waller and Michelle Bowman, and former Fed Governor Kevin Warsh are top contenders to replace Powell.

- Investors worry that the Fed would lose its independence after the appointment of a Trump candidate as Fed Chairman. In the past, Trump has criticized Powell for not lowering interest rates and has also imposed criminal charges for renovation cost overruns. Therefore, it is highly anticipated that decisions taken by the new Chairman will be biased towards Trump’s economic agenda.

- This week, investors will also focus on the Fed’s monetary policy announcement on Wednesday. According to the CME FedWatch tool, the Fed is expected to announce a pause after three consecutive interest rate cuts. In the last three policy meetings of 2025, the Fed reduced borrowing rates by 75 basis points (bps) to the 3.50%-3.75% range, citing labor market risks.

- In Monday’s session, investors will focus on US Durable Goods Orders data for November, which will be published at 13:30 GMT.

Technical Analysis: GBP/USD holds firmly above 20-day EMA

GBP/USD trades higher at around 1.3670 as of writing. Price action holds well above the rising 20-day Exponential Moving Average (EMA), which has advanced to 1.3474 and underpins the bullish structure. The average has turned higher in recent sessions, reinforcing a positive trend bias. The Relative Strength Index (RSI) at 71.11 (overbought) signals stretched momentum and warns of scope for consolidation.

While above the 20-day EMA, pullbacks could remain contained and the uptrend could extend. A dip in RSI back below 70 would indicate momentum cooling and increase the risk of a pause.

(The technical analysis of this story was written with the help of an AI tool.)

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Next release:

Wed Jan 28, 2026 19:00

Frequency:

Irregular

Consensus:

3.75%

Previous:

3.75%

Source:

Federal Reserve