- The Pound Sterling broke its consolidation to the upside against the US Dollar, testing 1.3200.

- Global trade war fears and US inflation data to drive the GBP/USD price action.

- The daily technical set up points to ‘buy-dips’ trades in the pair.

The Pound Sterling (GBP) broke out of its consolidative phase to the upside against the US Dollar (USD), sending the GBP/USD pair to its highest level in six months.

Pound Sterling capitalized on the US Dollar’s demise

The USD accelerated its decline from the previous week against its major currency rivals, reaching levels not seen since October 2024. The Greenback’s downward spiral provided a fresh zest to Pound Sterling buyers, driving GBP/USD briefly above 1.3200.

The primary reason behind the King Dollar’s demise was increased risks of a recession in the United States (US), courtesy of President Donald Trump’s aggressive tariff policies.

Following months of speculation surrounding the scope and extent of Trump’s ‘reciprocal tariffs,’ announced on April 2, the so-called ‘Liberation Day’ finally arrived, only exacerbating the USD’s pain.

“US President Donald Trump unveiled a 10% baseline tariff on most goods imported to the US, with much higher duties on products from dozens of countries. Chinese imports will be hit with a 34% tariff, in addition to the 20% levies Trump previously imposed, bringing the total new levy to 54%, according to Reuters. The European Union (EU) faces a 20% tariff, while Japan is targeted for a 24% rate.

Investors worried about potential retaliation from United States’ (US) major trading partners, including China and the European Union (EU), which could ultimately escalate into a severe global trade war and tip the global economy into recession.

Mounting economic concerns prompted markets to lift their expectations of US Federal Reserve (Fed) interest rate cuts this year. Interest rate futures are pricing about four rate cuts over 2025 as opposed to the Fed’s median March forecast of two cuts.

The benchmark US 10-year Treasury bond yield briefly breached the 4% key level, marking a six-month low.

On the other hand, markets are expecting a limited impact on the UK economy from Trump’s 10% reciprocal tariffs. Therefore, the Bank of England (BoE) is likely to stick to fewer rate cuts this year. The growing expectations of the Fed-BoE policy divergence also remained supportive of the pair.

Heading into the weekend, GBP/USD corrected sharply as the US Dollar benefited from the upbeat employment report. The US Bureau of Labor Statistics announced on Friday that Nonfarm Payrolls (NFP) rose by 228,000 in March. This reading followed the 117,000 increase (revised from 151,000) reported in February and came in much better than the market expectation of 135,000.

Fed Chairman Jerome Powell said late Friday that US President Donald Trump’s tariffs are bigger than expected, and they risk higher inflation and slower growth. These comments helped the USD hold its ground and didn’t allow GBP/USD to shake off the bearish pressure.

Trump’s tariffs and US employment data are set to steal the show

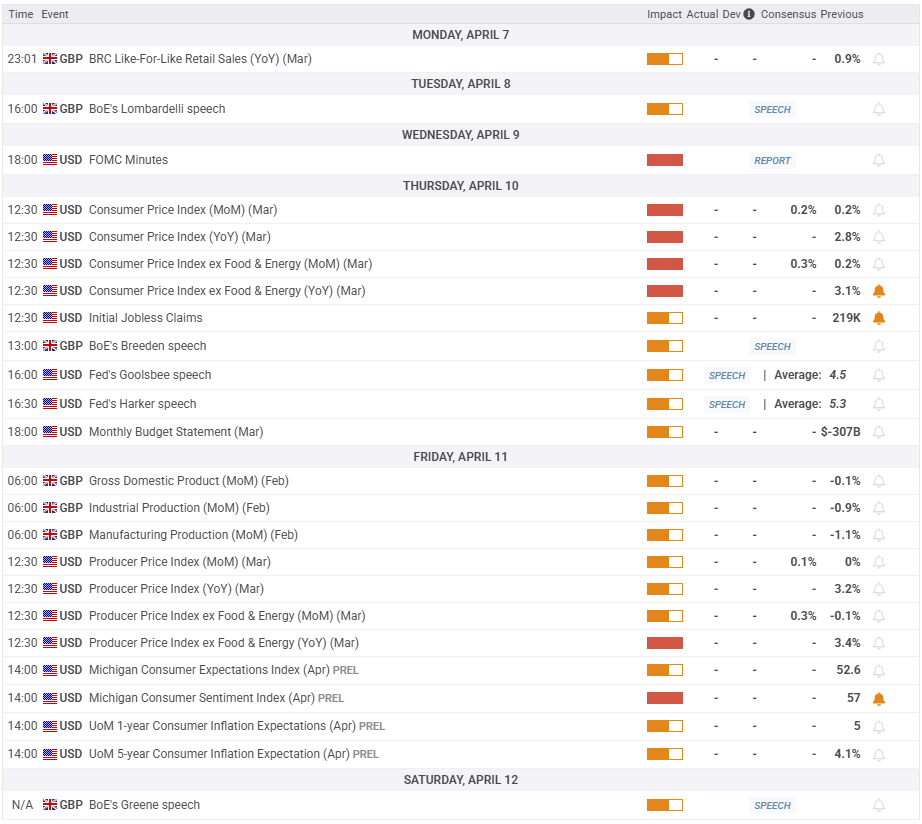

Following a volatile week, marked by Trump’s ‘reciprocal tariffs’ and the US NFP report, the upcoming week appears relatively calm until midweek.

Monday and Tuesday are devoid of any top-tier economic data releases from both sides of the Atlantic.

Therefore, all eyes remain on Wednesday’s Minutes of Fed’s March meeting for a fresh trading impulse, ahead of the BoE quarterly Bulletin release.

On Thursday, the US Consumer Price Index (CPI) inflation data will stand out amid the release of the weekly Jobless Claims report. Chinese inflation data to be released earlier that day will also likely have a significant impact on risk sentiment as US-Sino trade war risks mount.

Friday will feature the UK growth and industrial numbers for February. Later in the day, the US Producer Price Index (PPI) and the preliminary Michigan Consumer Sentiment and Inflation Expectations data will be published.

Apart from the economic data, speeches from Fed policymakers, global trade war fears and the Middle East’s geopolitical tensions will also likely emerge as significant market drivers.

GBP/USD: Technical Outlook

Despite the swift pullback from six-month highs of 1.3207, the GBP/USD uptrend appears uninterrupted in the near term.

The 14-day Relative Strength Index (RSI) currently reads 60, having eased from a heavily overbought zone, which suggests that dip-buying is likely to emerge.

The pair needs to close the week above the 1.3100 barrier to retest the half-yearly high of 1.3207.

Acceptance above the latter will open the door toward the 1.3300 threshold.

In case the correction continues, sellers could take action while the pair stays below the 21-day Simple Moving Average (SMA) at 1.2961.

The 200-day SMA at 1.2813 will rescue buyers if the selling pressure intensifies.

A sustained break below the latter will likely trigger a fresh downtrend toward the 50-day SMA at 1.2731, followed by the 100-day SMA at 1.2629.

British Pound PRICE This year

The table below shows the percentage change of British Pound (GBP) against listed major currencies this year. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -5.67% | -3.58% | -7.25% | -1.62% | -0.08% | -1.62% | -5.72% | |

| EUR | 5.67% | 2.28% | -1.57% | 4.38% | 5.95% | 4.38% | 0.04% | |

| GBP | 3.58% | -2.28% | -3.79% | 2.07% | 3.59% | 2.05% | -2.22% | |

| JPY | 7.25% | 1.57% | 3.79% | 6.10% | 7.76% | 6.11% | 1.69% | |

| CAD | 1.62% | -4.38% | -2.07% | -6.10% | 1.45% | -0.01% | -4.20% | |

| AUD | 0.08% | -5.95% | -3.59% | -7.76% | -1.45% | -1.47% | -5.59% | |

| NZD | 1.62% | -4.38% | -2.05% | -6.11% | 0.01% | 1.47% | -4.19% | |

| CHF | 5.72% | -0.04% | 2.22% | -1.69% | 4.20% | 5.59% | 4.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).