- The Pound Sterling scaled a four-month high against the US Dollar and hung near 1.3000.

- GBP/USD looks for a fresh upside as the Fed and BoE policy decisions loom.

- The pair hovers near the overbought zone while price remains above key daily moving averages.

The Pound Sterling (GBP) almost tested the critical 1.3000 level against the US Dollar (USD) in the past week, driving the GBP/USD pair to its highest level in four months.

Pound Sterling stood tall amid tariff wars, USD rebound

GBP/USD stretched its previous week’s positive momentum and reached four-month highs just shy of the 1.3000 threshold on Wednesday before entering an upside consolidative phase in the remainder of the week.

US President Donald Trump’s tariff uncertainty, easing fears over a potential recession and aversion to the US government shutdown emerged as key factors lifting the sentiment around the US Dollar. Trump’s 25% global tariffs on imported steel and aluminium came into effect on Wednesday, topping the previously announced tariffs on China and certain Canadian and Mexican products.

Amid an escalating trade war, the EU responded to blanket US tariffs on steel and aluminium by imposing a 50% tax on American whiskey exports, prompting Trump to threaten a 200% tariff on imports of European wines and spirits.

Meanwhile, the US-Canada tariff war took a positive turn after Ontario Premier Doug Ford said on Thursday there will be another meeting next week between Canadian and American trade officials, following his ‘productive conversations’ with US Commerce Secretary Howard Lutnick.

On Wednesday, the US Consumer Price Index (CPI) rose less than expected across the time horizons, easing US economic slowdown concerns spurred by Trump’s tariffs. The US annual headline CPI rose 2.8% in February versus January’s 3% and the expected 2.9% figure. The monthly CPI and core CPI increased by 0.2% in the same period.

The US Dollar tracked the US Treasury bond yields higher heading into the weekend as risk sentiment improved on an aversion to the US government shutdown and hopes of a US-Canada trade truce.

The Pound Sterling struggled to keep the upper hand on the US Dollar re-emergence, courtesy of the divergent monetary policy expectations between the Bank of England (BoE) and the Fed. The US inflation cooldown doubled on the bets that the Fed will resume its rate-cutting cycle starting in June. On the other hand, the BoE has stuck to its cautious rhetoric, hinting at fewer rate cuts amid uncertainty on the inflation outlook.

An unexpected contraction in the UK economy in January also limited the Cable’s upside. The UK Gross Domestic Product (GDP) fell 0.1% after increasing 0.4% in December, according to the latest data published by the Office for National Statistics (ONS) on Friday. Markets projected a 0.1% growth in the reported period. Later in the day, the data from the US showed that the University of Michigan’s Consumer Sentiment Index declined to 57.9 in March’s flash estimate from 64.7 in February. This data made it difficult for the USD to gather strength and helped GBP/USD hold its ground heading into the weekend.

Week ahead: Fed and BoE policy verdicts to stand out

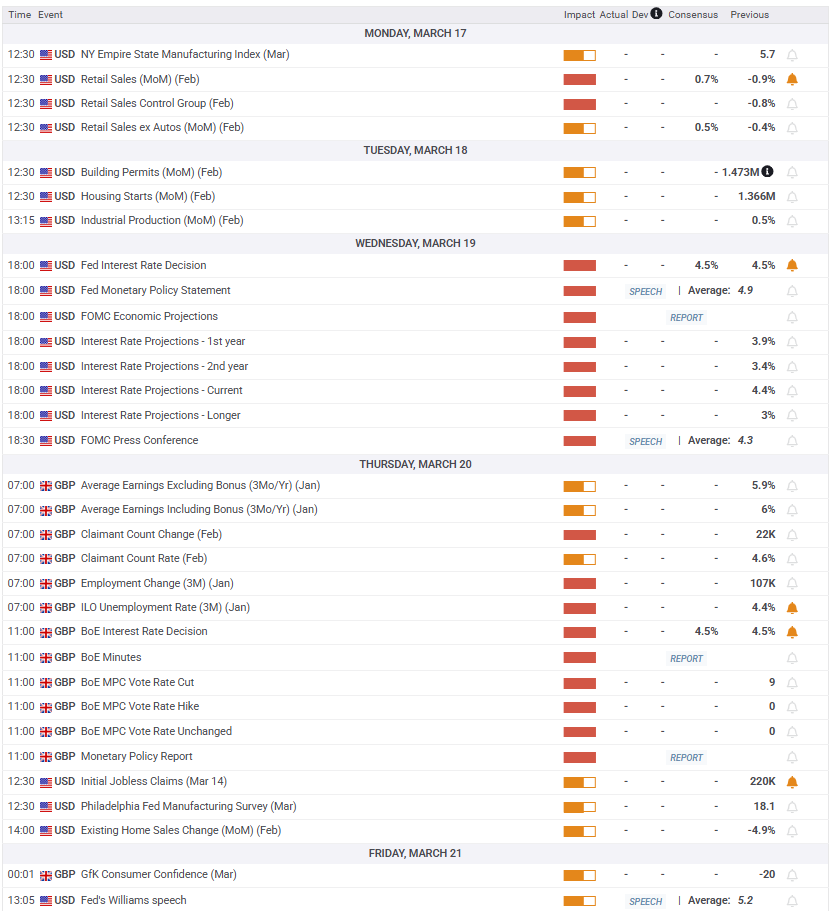

It’s a busy week from the word go, with the US Retail Sales data due on the cards on Monday.

Tuesday will feature the mid-tier US housing and the Industrial Production data as the UK data docket remains dry.

All eyes will be on the Fed policy announcements on Wednesday, accompanied by the Statement of Economic Projections (SEP), the so-called Dot Plot chart. The Fed’s outlook on inflation and interest rates will drive the direction of the US Dollar, significantly impacting the GBP/USD pair.

On Thursday, the UK labor market data will be reported before the BoE policy decision. The BoE’s hints on the timing and the scope of further rate cuts will be closely scrutinized for a clear directional impetus on the Pound Sterling.

There are no top-tier US and UK statistics due on Friday, and hence, the focus will remain on the speeches from Fed policymakers as they return to the rostrum after the ‘blackout’ period.

Apart from the economic data and Fedspeak, tariff headlines will continue to drive markets.

GBP/USD: Technical Outlook

The daily chart shows that GBP/USD needs acceptance above the November 6, 2024, high of 1.3048 to extend the uptrend if buyers take out the 1.3000 barrier.

The door would then open up for a test of the 1.3150 – 1.3200 resistance area.

The 14-day Relative Strength Index (RSI) has eased off the overbought region to trade around 68.50 at the moment. The leading indicator suggests that more upside remains in the offing.

The 21-day Simple Moving Average (SMA) is looking to pierce the 200-day SMA from below, which will validate a Bull Cross if it happens on a daily closing basis.

Adding credence to the bullish potential, the pair trades well above the major daily SMAs.

Should a correction unfold, the immediate downside target is the weekly low of 1.2862.

The 200-day SMA at 1.2792 could come into play on additional declines, exposing the 21-day SMA support at 1.2750.

A sustained break below the latter will likely trigger a fresh downtrend toward the 100-day SMA at 1.2615.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.