- GBP/USD sank following the Fed’s latest rate call, slipping below 1.3250.

- Fed Chair Jerome Powell tempered rate cut hopes, sending the US Dollar higher.

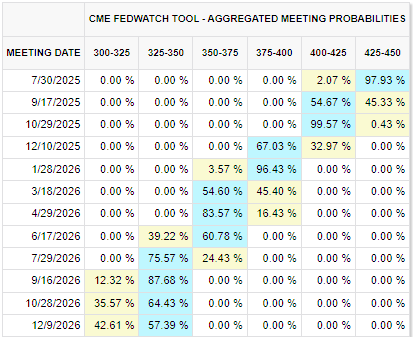

- Odds of a second rate cut in October fell off the bottom of the charts as Fed awaits tariff impacts.

GBP/USD sank after the Federal Reserve’s (Fed) latest interest rate call. The Fed held interest rates steady on Wednesday, as expected by the markets. However, a cautious Fed Chair Jerome Powell noted that inflation risks continue to hang over policymakers, and the Fed remains concerned that inflationary impacts still loom ahead, crimping odds of extra rate cuts through the remainder of this year.

Fed Chair Powell tamped down on expectations of immediate rate cuts, noting that despite the progress the Fed has made on inflation thus far, sticky price issues still remain. Fed policymakers are poised to wait for two additional rounds of both inflation and labor data before making a final decision to cut interest rates in September, cooling market hopes for a near-term rate cut.

Read more Fed rate call news: Powell says we have made no decisions about September

GBP/USD 5-minute chart